The Banking Battleground 2022: Finding the Opportunities

The last two years created an incredible agility within the banking industry that it had long struggled to achieve. And now, with 2022 underway, institutions are being challenged to take that agility and think about how it can be applied to all facets of their business. This is a very interesting place to be because it means opportunity is everywhere. The field is green. So, then, the question becomes, “Where do we go exactly?”

This second edition of The Banking Battleground presents the findings of CCG Catalyst’s 2022 US Banking Study and attempts to shed some light on where the industry is headed from here. Building on last year’s report, we asked C-level bank executives in the US about their attitudes and priorities as we look toward the future. As in 2021’s installment, this report focuses on the differences in perspectives between more forward-thinking institutions and those that have generally taken a traditional approach. The following is meant to serve as a tool for banking providers that may be lagging behind on certain areas as well as those simply interested in better understanding where their peers are directing their efforts.

Methodology and purpose

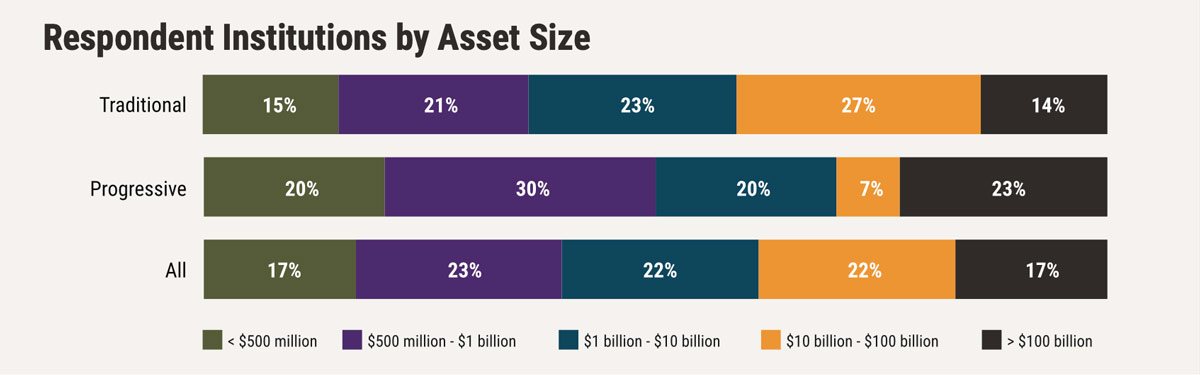

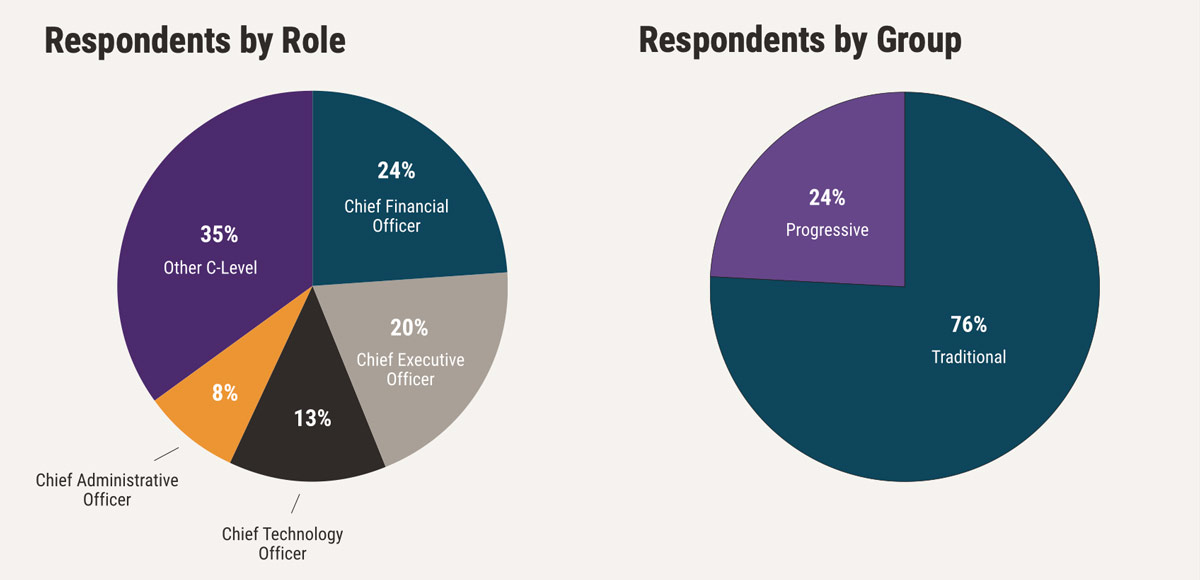

CCG Catalyst surveyed 127 C-level bank executives between November 2021 and February 2022 to gauge their attitudes and perspectives on their business and the market. Using the same criteria as last year, we’ve grouped respondents into two categories: traditional and progressive. To be included in the progressive group, a respondent had to report acquiring less than 50% of their technology from a single vendor, working with fintech companies as an integral part of their strategy, and making at least one fintech investment. Based on this segmentation, we conducted an analysis to determine how the different groups approach the market and how prepared each is for the future. Our focus this year included three core areas: business trends and priorities, technology and innovation, and new frontiers. The survey data is unweighted, and the analysis that follows is based on our sample.

Business trends and priorities

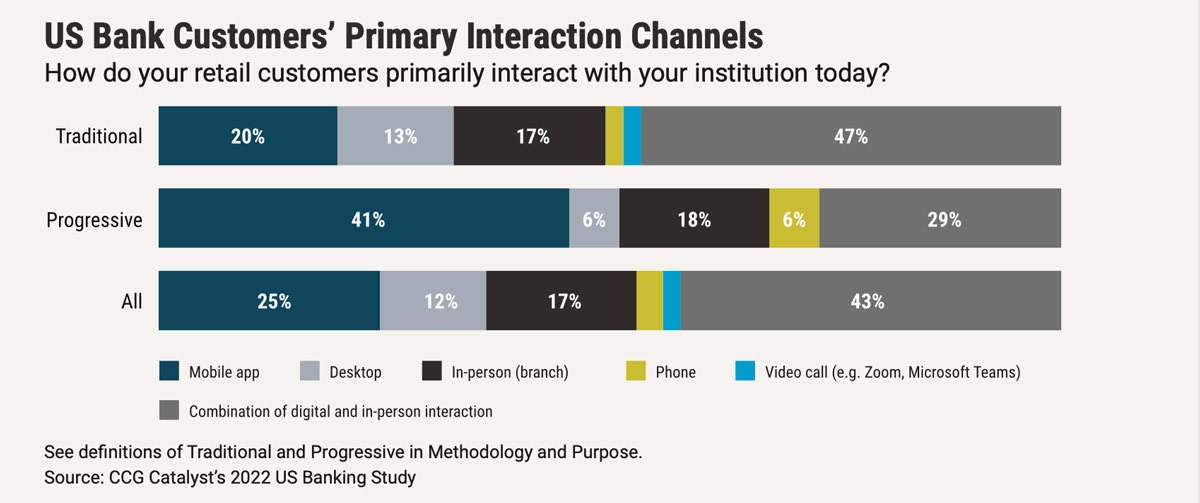

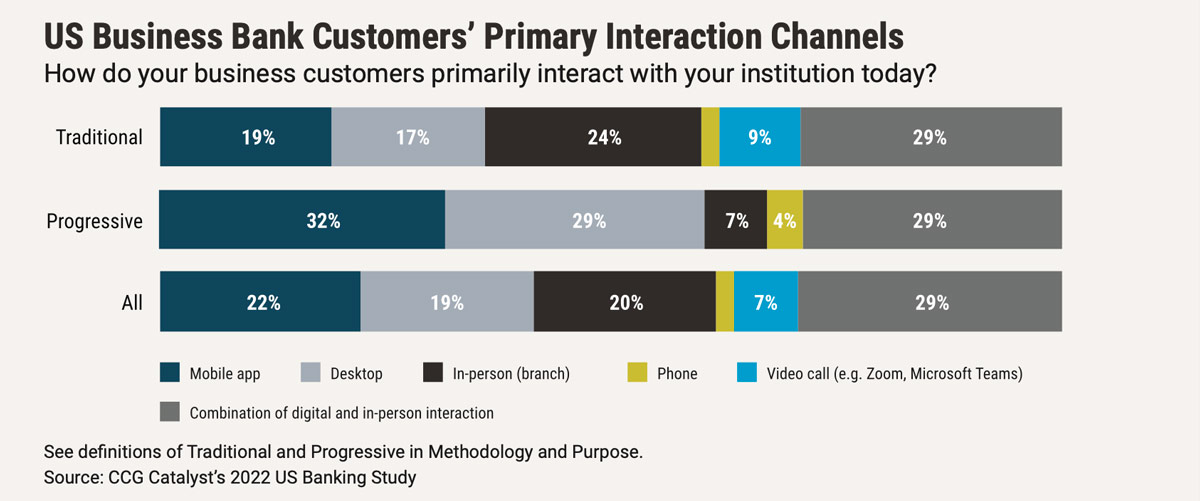

The way customers interact with their bank changed over the last couple of years, and things are now beginning to solidify and indicate long-term direction. For example, between last year and this year, progressive institutions were able to move more of their customers (both in retail and commercial banking) to digital channels, even as in-person interaction became an option again. In particular, progressives saw their retail clients further embrace mobile, with 41% of executives saying that’s how customers currently primarily interact with their bank, up from 33% in 2021’s study. Meanwhile, on the commercial side, customers are flocking to both mobile and desktop in greater numbers: 32% and 29% of respondents, respectively, say these represent business clients’ primary interaction channels, compared with 26% and 6% last year.

Traditionalists, on the other hand, are still seeing a real mix of digital and analog interactions across categories. And, like last year, even when it comes to digital usage, their customers are not necessarily leveraging the same channels as progressives’. For example, traditionalists’ retail clients remain more likely to use desktop or online banking than customers at progressive banks. This, coupled with the growing preference for mobile we saw with the latter group this time around, suggests that traditionalists may not be putting adequate focus on new frontiers for engagement. While this may not be terribly problematic for many of them now (especially if their client bases skew older or tend to prefer desktop for other reasons), it’s important to consider what both existing and new customers will want down the line, as well.

Traditionalists are clearly lagging behind the curve here, but it’s not too late to catch up. In looking to do so, we continue to stress that institutions should be thinking about how to create device-agnostic experiences that can support new and different interfaces in the future. Or put another way, put less emphasis on the channel itself and focus on supplying a uniform experience through any delivery mechanism. That way, you future-proof your experience as customers adopt new devices and options.

Looking at how customers are interacting with their bank is an important way to discern where we are and where we are going from a digital standpoint. Based on our data, it’s clear that not only are customers continuing to embrace digital channels, but they’re also evolving in how they are using digital and different interfaces. Understanding this evolution will be critical to ensuring banks can meet customers where they are and continue to promote loyalty and satisfaction. Meanwhile, as this overall drive to digital channels accelerates, it is manifesting in a variety of ways across retail and commercial banking, with notable differences in how traditional and progressive institutions are approaching each area. Below, we take a closer look at each category:

Retail-specific trends

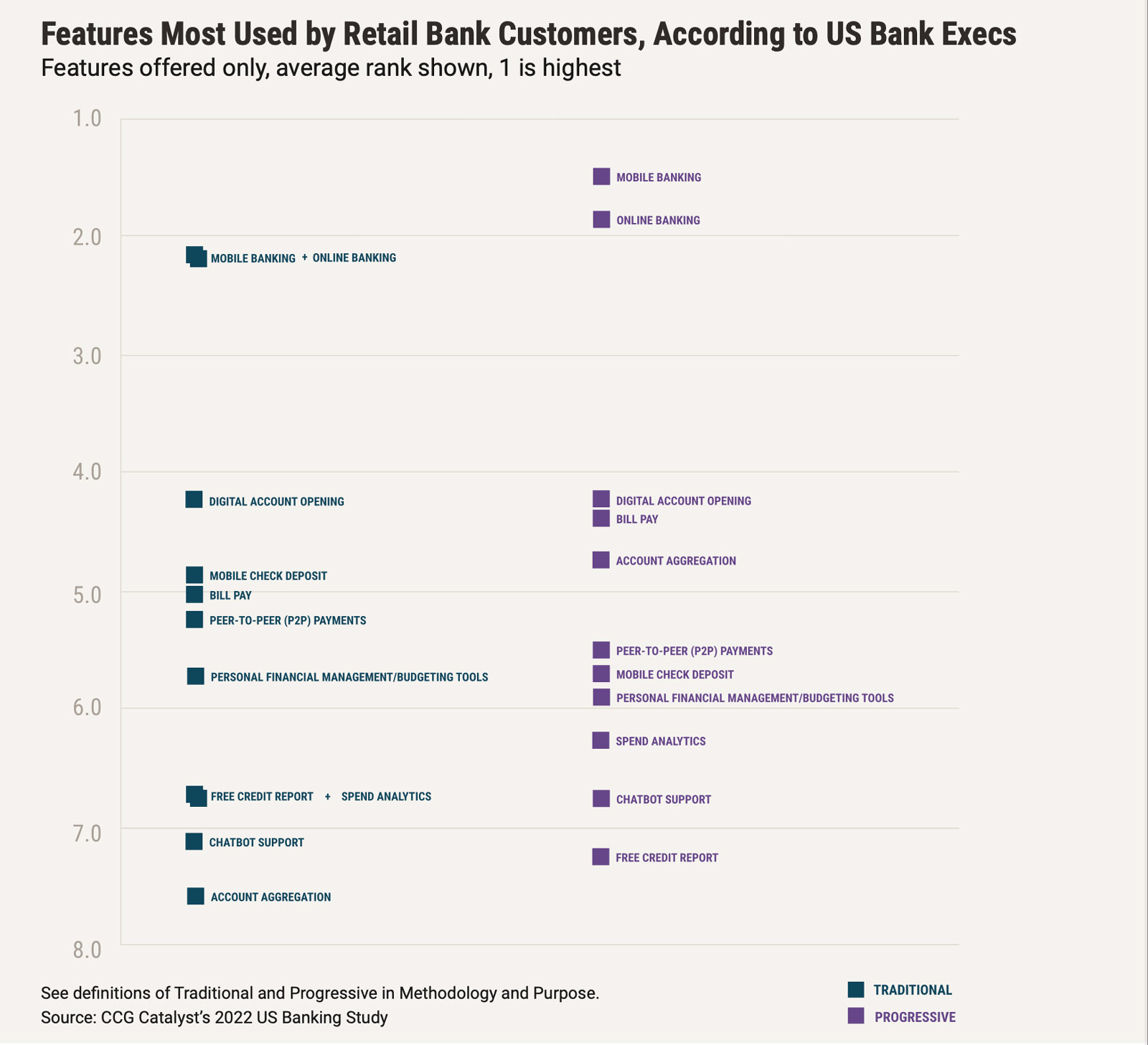

Beyond interactions on the retail side, there are important differences at the feature level between progressive and traditional institutions. For example, customers at progressive institutions are more likely to be using advanced tools like account aggregation, which enables users to see multiple accounts across providers in one place to capture a full picture of their finances, when they are available. This could be down to a few things including awareness of such tools, demographic, or even education. For example, younger, tech-savvy users may be more inclined to adoption.

However, a large part of this is likely also how the roll out of such features and their value are communicated. Progressive institutions are not necessarily more likely to offer all of these tools, but when they do, their customers use them more often. This is an important point because it indicates that, when progressive institutions introduce a new capability, they are doing so thoughtfully and with intent to drive engagement. Account aggregation, in particular, (or at least the idea behind it) is an attractive proposition to consumers broadly — in fact, a whopping 91% of respondents to an MX survey said the ability to see all of their accounts in one app would be somewhat or very valuable 1 — so it’s quite probable that the lag in adoption here on the traditional side is tied at least in some way to communication.

Customers at traditional institutions, on the other hand, are making greater use of capabilities like mobile check deposit, which is essentially a digital version of an analog process. This suggests that, while progressives are looking to find ways to help customers better manage their financial lives, traditionalists are more focused on bringing existing offerings into the digital channel. The intent here is good, but it misses the mark a little bit. Institutions generally should be thinking about the next phase of banking and what that looks like, asking questions like, “How do we serve new needs?”

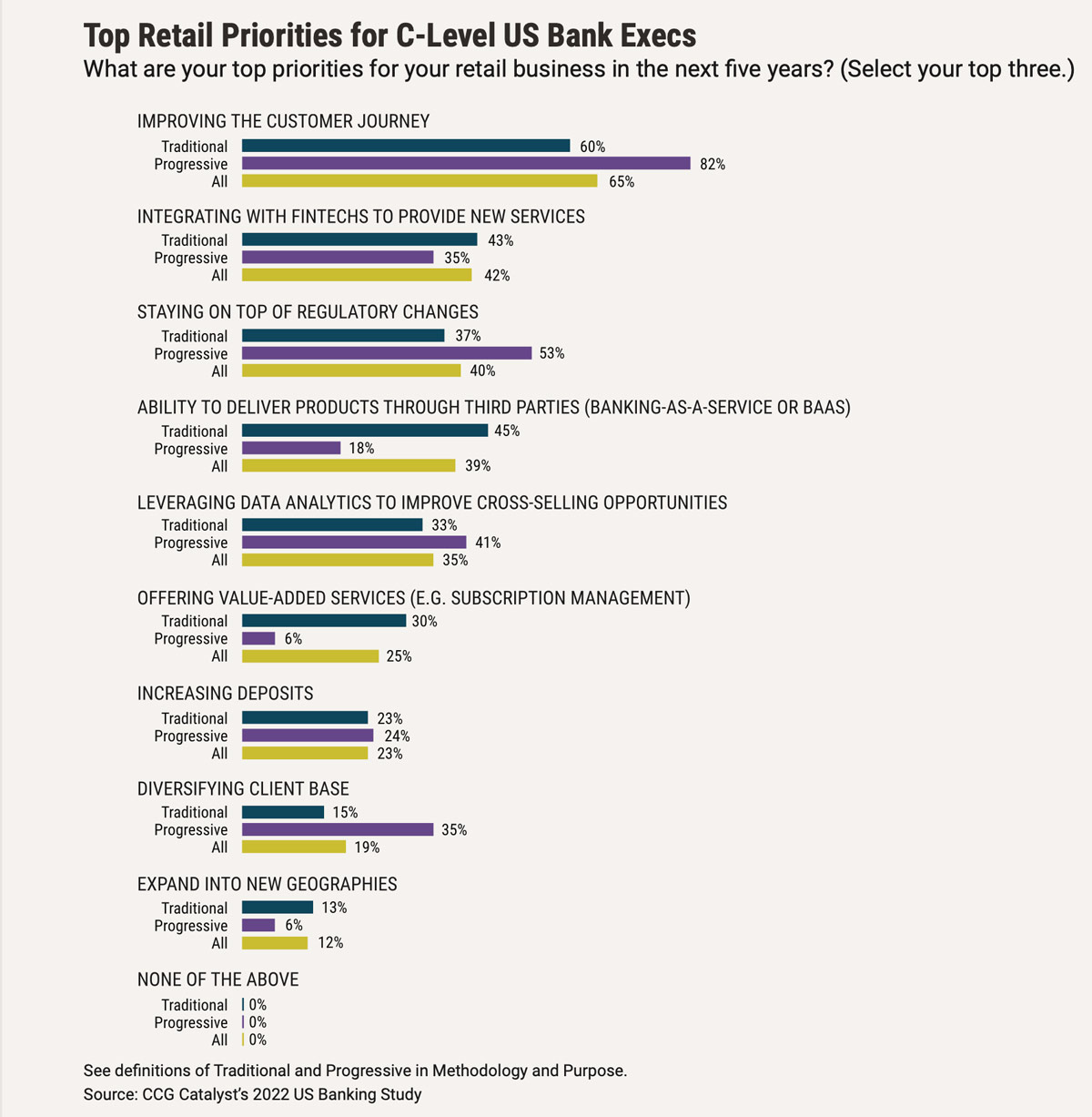

It does seem, however, that traditionalists are at least waking up to new opportunities in the retail realm. While both groups are still prioritizing the customer journey overall for the next five years, traditionalists put greater weight on buzzworthy areas like integrating with fintechs and Banking-as-a-Service (BaaS) in our latest survey. This marks a shift from 2021 and is likely down to progressives’ already established positions (or at least strategies) in these spaces and traditionalists’ desire to catch up. Progressives, meanwhile, are turning increased attention to other areas like improving their data analytics capabilities, perhaps as they look to further advance in their efforts to drive better experiences and achieve greater efficiency.

Commercial-specific trends

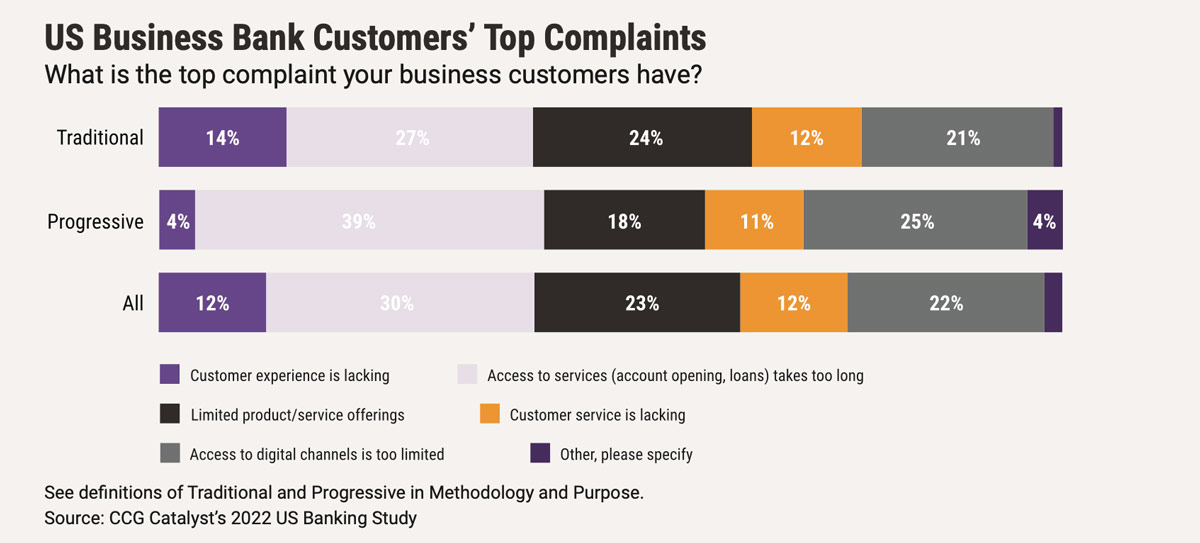

On the commercial front, executives are still grappling with baseline digital capabilities like digital account opening. In fact, still just under half of all respondents say they can open business accounts fully digitally, the same as last year. And this is an area of development even among progressives — the top complaint from business customers across groups is that access to services takes too long.

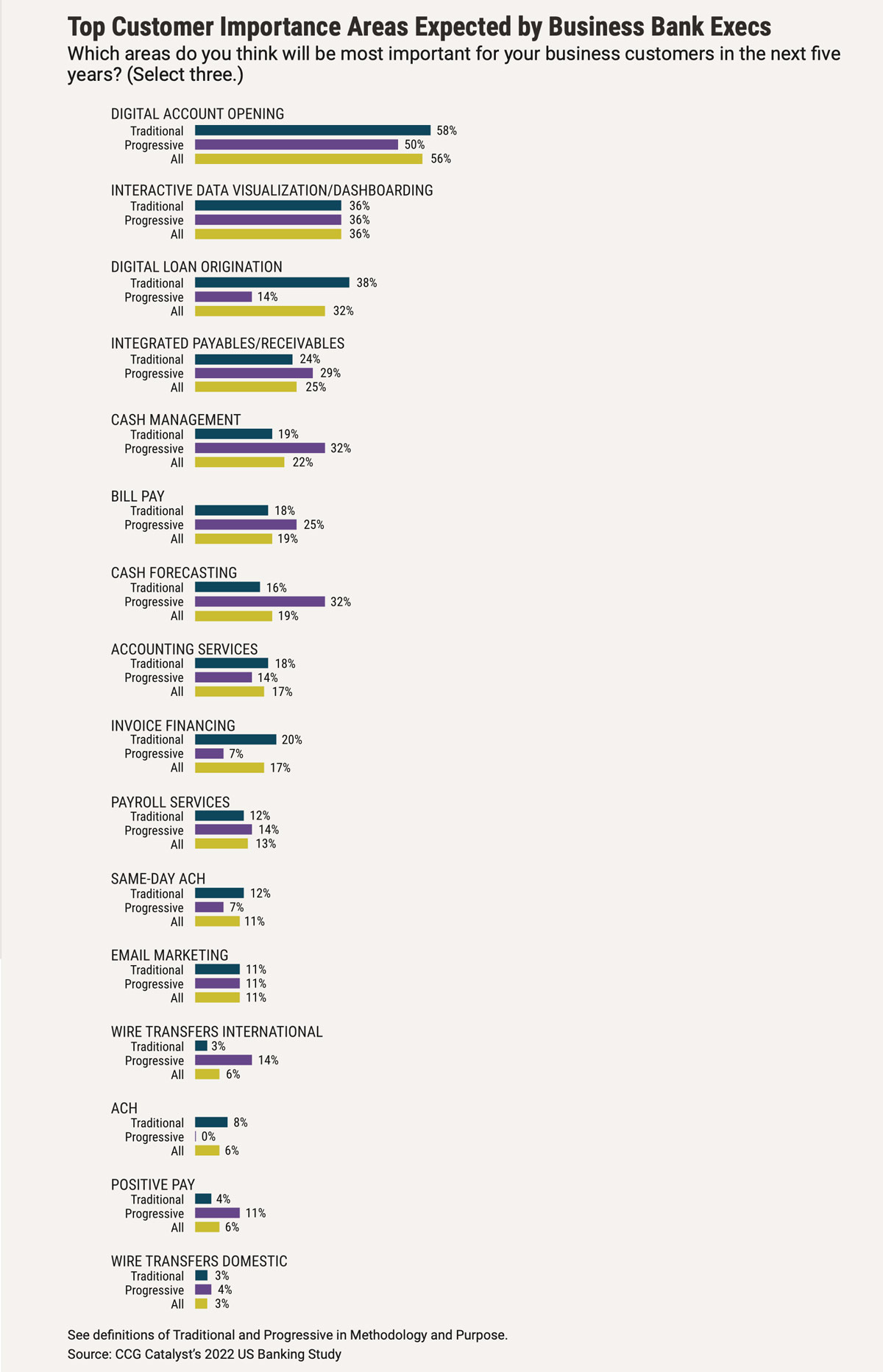

Digital account opening is likely to remain a major focus for business bank executives for the time being — unsurprisingly, it topped the list for both traditionalists and progressives when we asked respondents to rank a number of areas based on how important they believe each will be to customers in the next five years. This is a very hard arena that respondents agree is important and needs to be solved for. As we explored in our recent report, Digital Account Opening in Business Banking: Getting It Right, the difficulty is largely down to the more complex relationships and workflows involved, which make it challenging to automate key functions like verifying business entities. As a result, for now, much of the focus is centered on where and how to use technology when opening business accounts digitally, rather than fully automating workflows. We can expect the process to evolve to pull in greater automation as institutions get more comfortable using technology to onboard, especially in certain critical areas like verifying business documents.

Additional areas of focus for traditionalists on the business banking side out to 2027 are also tied to basic digital features like digital loan origination, while progressives believe customers will begin to start looking for more advanced tools by that point — like integrated payables/receivables and cash forecasting. This suggests that progressive institutions are thinking a bit more ambitiously about how far the industry will go in five years’ time and the capabilities that will be coming to the fore. It’s an important indicator, and institutions broadly will need to consider what they need to support such a future, especially from a technology and infrastructure standpoint, as legacy systems can make it difficult to quickly deploy new features and offerings. As we move forward, it will be necessary for banking providers to make sure they’ve got the foundations in place to continue to build out new and enhanced functionality as customers look for more.

Overall, we can expect commercial to continue to follow in the path paved by retail in many ways, with progressive institutions taking the lead in key areas on both fronts. For traditional players, paying attention to where these institutions are turning their efforts, especially when it comes to features and adoption, will be valuable in providing insight into trends likely to cement themselves in the future.

Technology and innovation

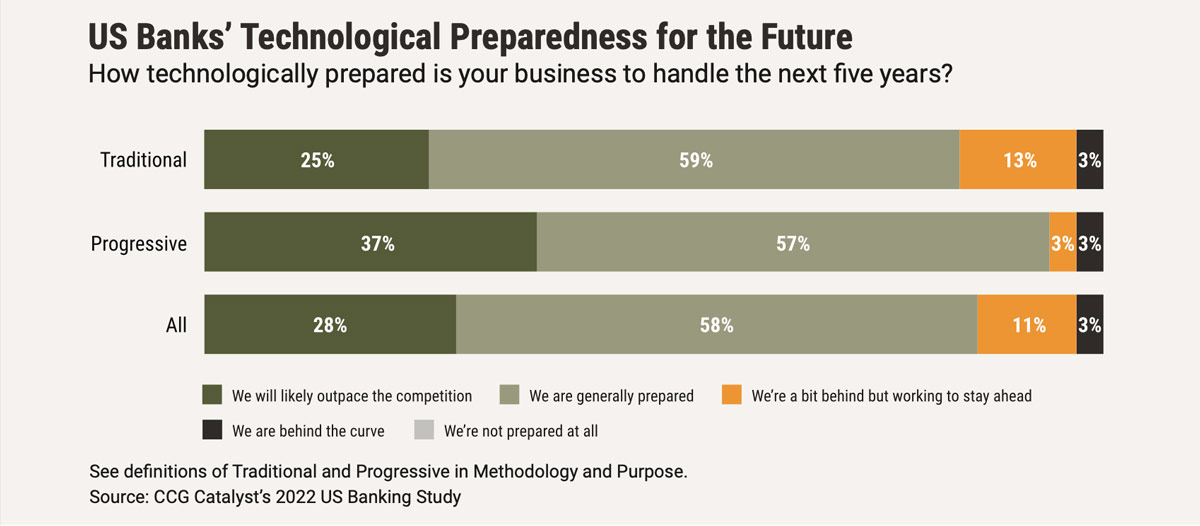

Technology and innovation is one of the most important areas to assess because it speaks directly to agility and preparedness for the future. A bank that is well positioned from this standpoint can far more easily tackle new advancements as they come down the pike, if it’s not driving those advancements in the first place. As in our 2021 survey, the large bulk of all respondents believe they are at least generally technologically prepared for the next five years. However, progressive institutions by and large feel more prepared from a technology standpoint than their traditional peers. Unsurprisingly, 37% of progressive institutions expect to outpace the competition, compared with just 25% in the traditional category. Meanwhile, 16% of traditionalists feel at least a bit behind versus only 6% of progressives. This marks a shift from last year when very few respondents across both groups reported feeling behind at all. The departure here could be tied to a greater focus on getting ready for the future and the realization that transformation efforts are set to accelerate at an even faster pace.

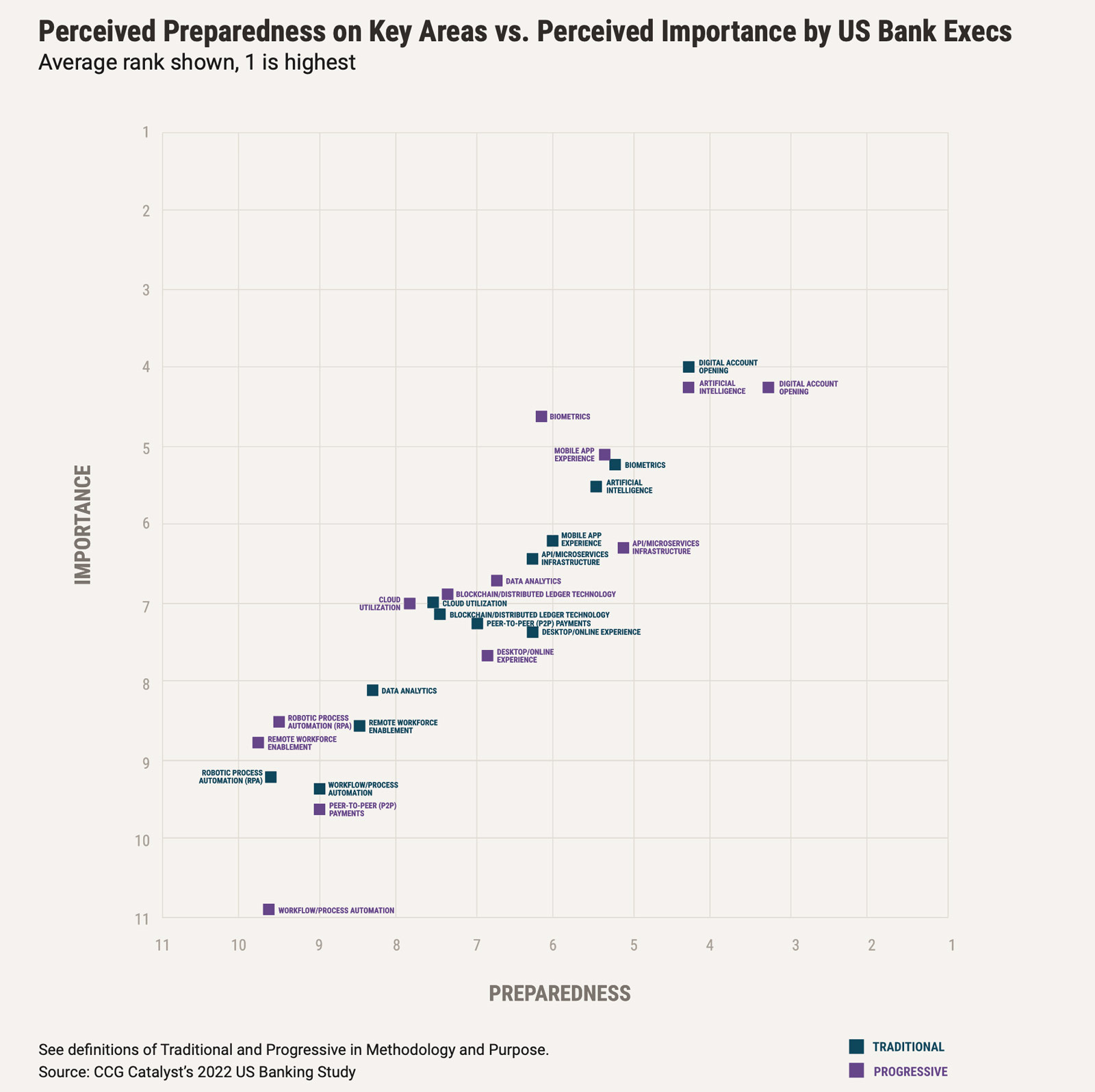

To understand how well these institutions are doing specifically and where they are putting their efforts, we again asked respondents to rank a number of areas based on their bank’s preparedness to tackle each in the next five years as well as the expected importance of each to their business. Like last year, we then plotted these areas for each group using their average rank in the results.

Overall, we observed some key differences between the two groups. For example, progressive institutions feel more prepared and place greater importance on data analytics than traditionalists, reinforcing the idea that these players are starting to look at new ways to improve the customer journey and drive efficiency. Moreover, they indicated greater confidence in (and put more importance on) artificial intelligence (AI), which is an extremely challenging area that’s tied closely to data analytics. AI broadly encompasses algorithms designed to mimic the human brain, and it has numerous applications in banking, from improving customer service to helping to manage risk. However, it also requires clean, useable data that can be applied to train those algorithms, which means getting organized is a must to make the most of this opportunity. Data analytics and AI are likely areas traditionalists should be paying more attention to, as it’s very possible the interest progressives are showing here indicates they could become new frontiers for competition. In outside evidence of this, the AI in financial services market alone is expected to reach $22.6 billion globally by 2025. 2

Meanwhile, progressives also feel more prepared on application programming interfaces (APIs)/microservices than traditional institutions this year. This is a departure from last year’s survey and indicates that traditional players may be waking up to how hard it is to tackle some of these more advanced initiatives. Infrastructure flexibility continues to be a very important trend for the future, especially as more institutions pursue best of breed strategies. And, based on our data, progressive banks are indeed ahead here — as in 2021, they are much more likely to build and manage their own API layer in-house rather than relying on a vendor to provide them with the APIs they need to integrate with third parties. This remains a critical difference because true differentiation comes from freedom of choice.

On more basic areas like desktop and mobile, the groups remain split — traditionalists continue to feel more confident on their ability to deliver on desktop, while progressives are more confident on mobile. Additionally, traditional institutions put more importance on the desktop experience than progressives do, while for mobile, that’s flipped. This is unsurprising yet a little concerning, as it stresses the likelihood that traditional players are focusing on areas that their peers in many cases have already moved on from.

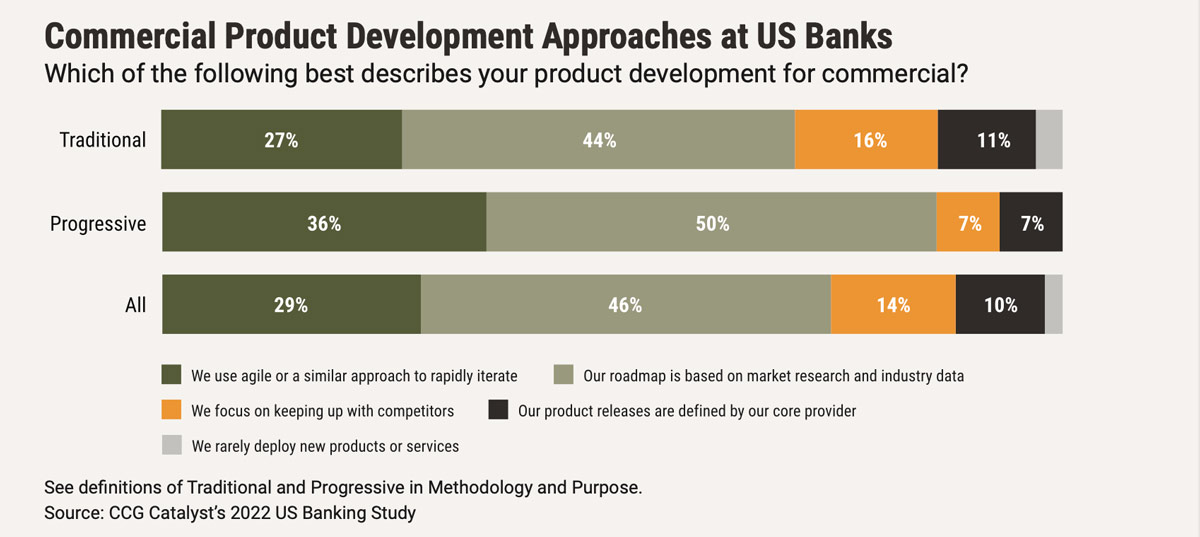

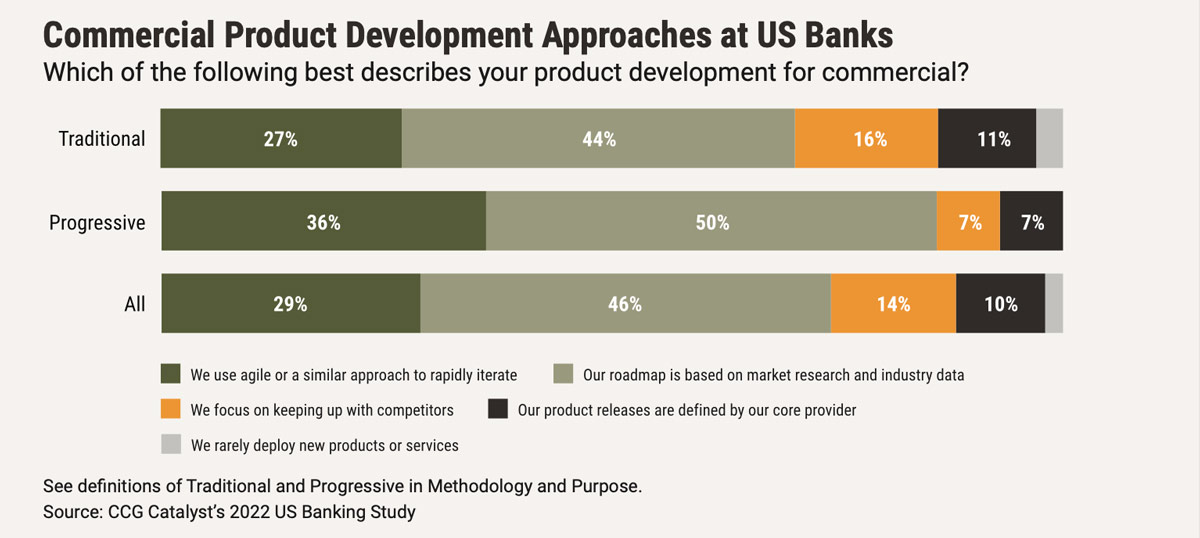

Perhaps the most central element to this discussion is how exactly each of these groups is choosing where to focus. To that end, progressive institutions are much more likely than traditionalists to be employing an agile approach to product development. For context, agile refers to a product development methodology that encourages frequent iteration, usually in the form of “sprints,” to incorporate customer feedback quickly and drive new products and updates to market faster. It’s used heavily among technology-first companies to keep up with customer needs and encourage continual improvement. While both groups still have work to do in this area — less than half of each overall leverage an agile product development strategy across retail and commercial, similar to last year’s sample — progressives’ tendency to embrace such methodologies more often than traditionalists could speak to some of the divergences among the two groups. This is crucial because the extent to which you can tie your innovation and product roadmaps to real customer needs, the more likely you are to drive business.

New frontiers

This year, in addition to their approaches to technology and innovation generally, we analyzed institutions’ intentions across a number of emerging areas. These included open banking, BaaS, cryptocurrency, and cannabis banking — all of which we expect to be important frontiers heading into the next few years. Overall, the data sheds light on how executives broadly are looking at each concept as well as illustrating some key differences in how progressives and traditionalists see these fields of play.

Open banking

Open banking continues to be top of mind for many in the US banking industry today, especially as the Biden Administration last summer asked the Consumer Financial Protection Bureau (CFPB) to issue rules around consumer data-sharing. 3 That move prompted renewed speculation that open banking regulation may finally be coming to the US, where the movement thus far has been largely undefined, and institution led.

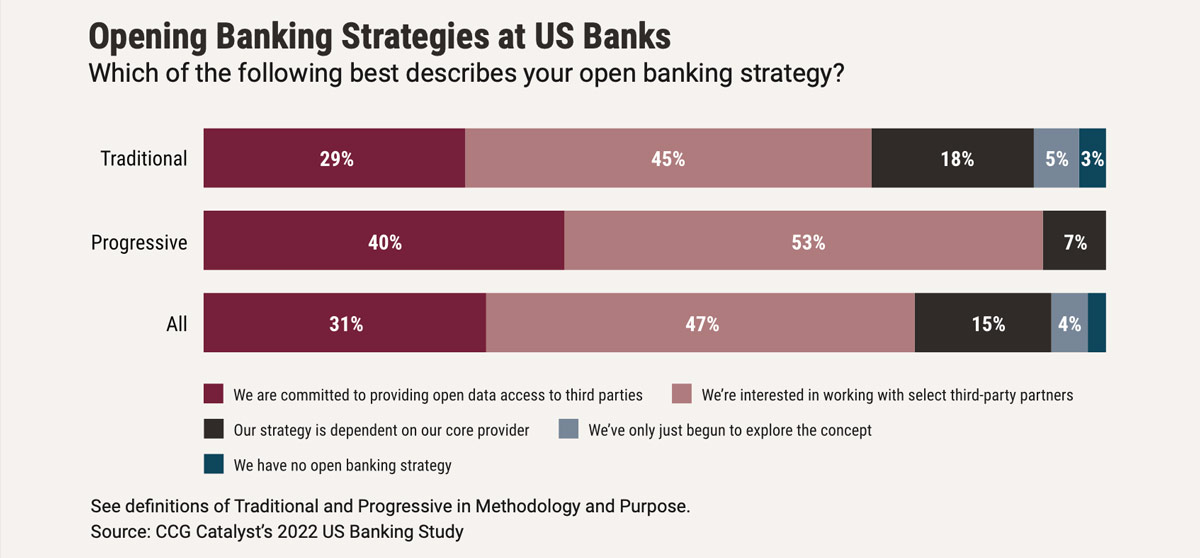

However, despite widespread claims among financial institutions that open banking is a priority, only about a third of respondents to this year’s survey overall are embracing the concept’s central idea that customers should be able to share their data with whomever they like, about the same as in 2021’s study (which was fielded before the announcement). Specifically, when asked to describe their open banking strategy, 31% said they were committed to providing open data access to third parties, aligning with the definition laid out in other jurisdictions by regulation like the Second Payment Services Directive (PSD2) in Europe, which mandates that financial institutions share data with third parties at a customer’s request.

Progressive institutions showed a bit more confidence in providing data access widely (40%) versus traditional institutions (29%), but both groups feel more comfortable working only with select third-party partners. The data suggests that many institutions will need to undergo a shift in mindset as open banking becomes a reality in the US. And that will likely come down to education and understanding. In Europe, for example, third-party providers that want to participate in open banking are required to get licensed. 4 It’s likely that a similar scheme would emerge here should expressed rules come into effect. In essence, this means the government would be laying out the protocols by which risk is managed. Grappling with these nuances can go a long way in ensuring your bank is prepared to not only comply with potential regulation but also to capitalize on the opportunities that come with the ability to provide open data access, including building loyalty by equipping customers with greater control and freedom.

There clearly remains quite a lot of work to be done here, but, promisingly, it does seem as though institutions are at least taking this movement seriously — in fact, very few respondents reported having no open banking strategy at all, and they all hail from the traditional category. This indicates that, while things are still solidifying, bank executives believe open banking will become part of the fabric of financial services in the US and are looking toward that future.

BaaS

There’s perhaps no area “hotter” than BaaS at the moment. That’s because it is effectively a way for banks to white label their regulated banking services and deploy them through a third party (often, a fintech) that manages the front-end customer experience. As such, a BaaS business model allows a bank to outsource a two very important elements: customer acquisition and the customer experience. Banking products provided by some of the biggest fintechs in the country are powered by banks in this way: Unicorn neobank Chime, for example, is backed by a few partners including The Bancorp Bank and Stride Bank, while digital wealth manager Acorns offers a debit card powered by Lincoln Savings Bank.

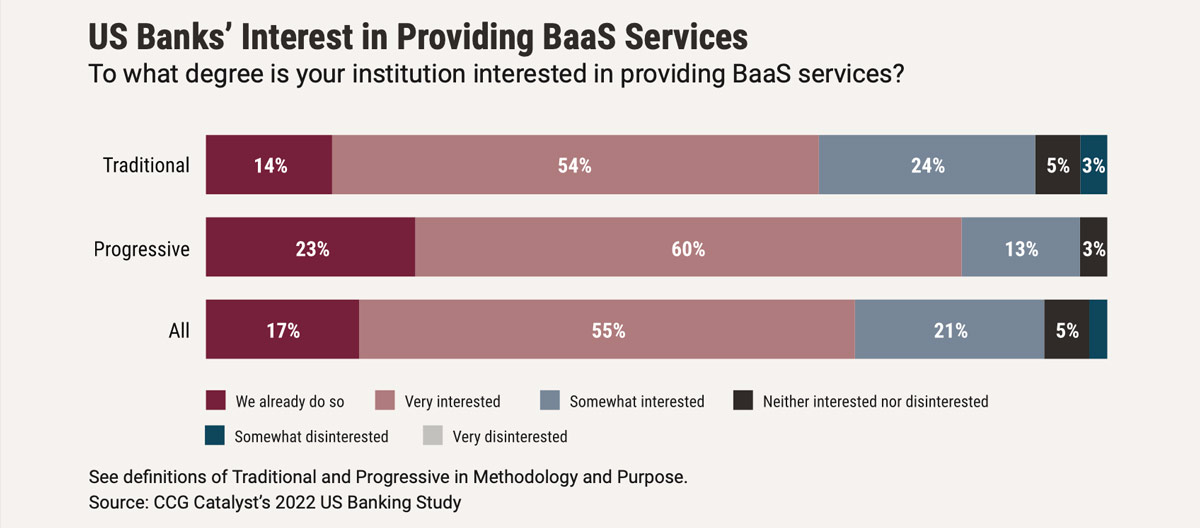

The economics of BaaS — which include access to low-cost deposits and fee revenue — are making it an extremely attractive proposition for banks across the country, especially those with under $10 billion in assets, which are exempt from interchange caps 5 and can therefore make money via customer swipes. In fact, according to our data, while progressive institutions are more likely to already offer BaaS, bank executives broadly express strong interest in this area. Specifically, 76% of respondents to our survey across both groups are at least somewhat interested in providing BaaS services, if they don’t already do so, with more than half saying they’re very interested. This suggests BaaS has officially hit the mainstream, and we will continue to see banks jumping in at an accelerated pace.

Looking further ahead, as more banking providers develop BaaS strategies, the competitive battleground will likely shift from offering such services to differentiating yourself as a provider. This is an important point, because thinking beyond simply enabling nonbanks to offer financial products (i.e. “renting your charter”) is probably where the long-term value will lie. Think, offering fintech or nonbank clients advanced fraud capabilities or even the ability to provide cryptocurrency services down the line. This kind of creative thinking is what will make the difference between those that get on the bandwagon and those that take this concept to the next level.

Cryptocurrency

On the cryptocurrency front, there’s been a tremendous amount of activity lately, including accelerated consumer interest in popular tokens like Bitcoin, 6 the emergence of new digital assets like nonfungible tokens (NFTs), 7 the long-awaited launch of the first Bitcoin futures exchange-traded fund (ETF), 8 and President Joe Biden’s recent executive order aimed at studying and creating guidance around cryptocurrency, 9 as well as a plethora of new crypto services hitting the market. 10 As a result, we’ve seen a number of banking institutions getting in on the action and launching crypto services, including heavy-hitters like U.S. Bank. 11

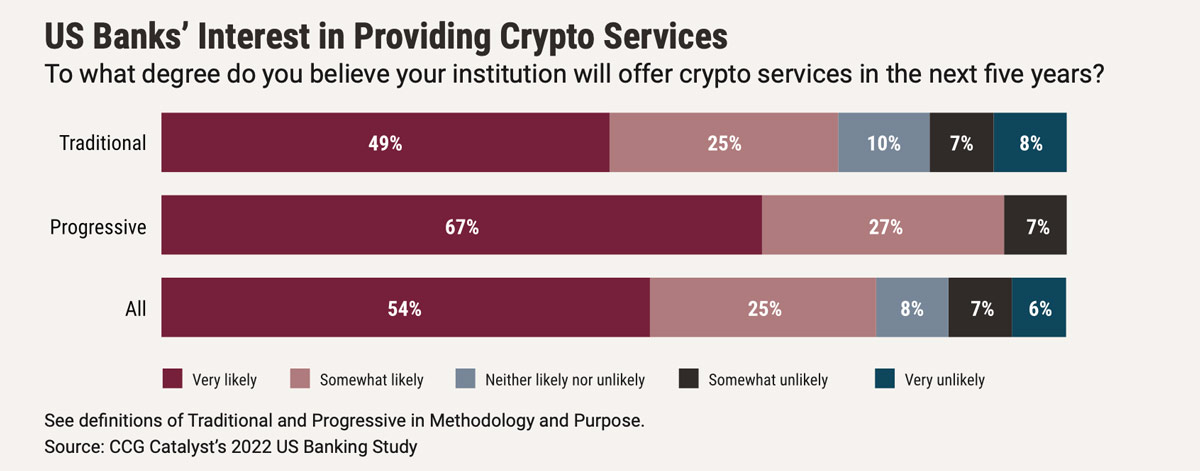

This trend is aligned with our prediction in 2021 that more banks would begin to jump into this pond as consumer adoption pushed forward and demand became clear and actionable. And it seems as though this movement is poised to accelerate further, especially among progressive institutions. In fact, a whopping 67% of progressive institutions in our latest survey believe their bank is very likely to offer crypto services in the next five years. On the traditional side, there is slightly less interest, with about half of respondents saying the same, though this is still a pretty promising showing. Meanwhile, in total, 79% of all respondents say their bank is either very likely or somewhat likely to join the fray in the years ahead.

It’s clear that crypto is not likely to be an optional frontier for much longer, which means it would be wise to get a strategy in place for how to tackle it now. This may seem overwhelming for many banking providers, especially smaller ones, but it doesn’t have to be — the emergence of companies like NYDIG that are designed to make it easier to offer crypto services is paving the way for increased adoption for banks of all sizes. NYDIG, in particular, is integrated with a number of key technology providers including FIS, Fiserv, and Jack Henry, 12 and is likely to be an important player in bringing crypto services to the masses through online and mobile banking apps. Moreover, there are smaller institutions already laying the groundwork for others — Oklahoma-based Vast Bank, which has just under $1 billion in assets, launched crypto banking services this past summer to allow its customers to buy, sell, and hold digital assets from within their banking app. Now, it plans to take this capability to other financial institutions through a crypto BaaS offering. 13

Cannabis

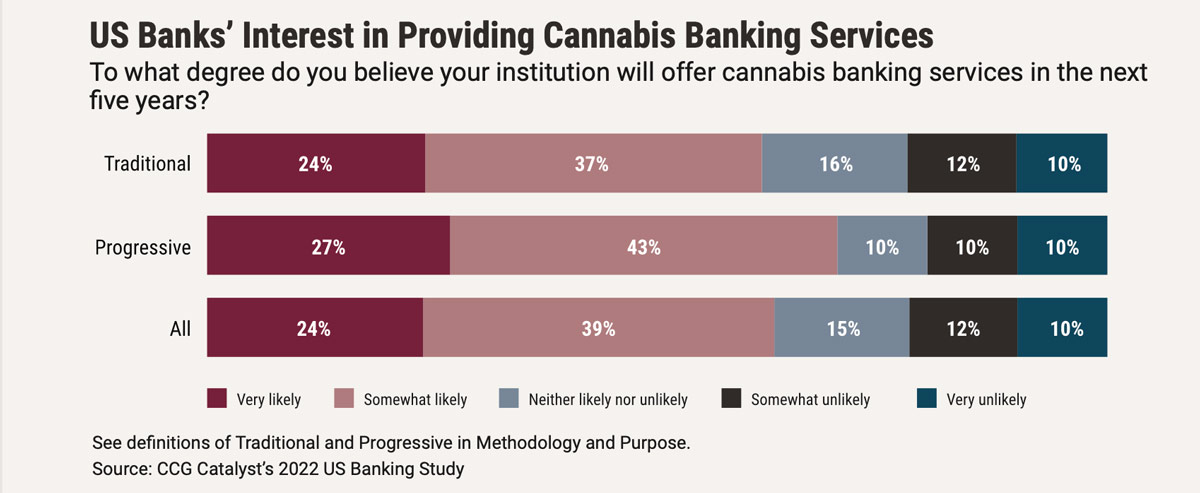

With marijuana clearing legal hurdles in many states, the cannabis industry is growing rapidly. In fact, cannabis sales in the US are expected to surpass $30 billion in 2022, according to marijuana analytics firm Headset. 14 This represents an entirely new business sector that will need access to financial services, and thus a greenfield for the country’s banking providers. Despite the opportunity here, however, bank executives express considerable reluctance when it comes to getting involved with the cannabis industry. Specifically, only about a quarter of progressives and traditionalists in our study alike think they will very likely offer banking services to cannabis companies in the next five years. This hesitation is likely down to a lack of clarity around regulation and legality.

Cannabis poses a potential gold mine for financial institutions — it will be a highly regulated industry that will demand knowledgeable advisors and financial stewards. In short, a perfect fit for banking. Except for one key issue, and that’s risk. This is an extremely new area, and there still isn’t a ton of information around how banks can safely cater to cannabis businesses. The lack of guidance is probably a major sticking point for institutions worried about how getting involved in cannabis might impact their relationship with regulators. This makes sense; however, there are efforts underway on this front: The SAFE Banking Act, for example, offers proposed legislation that would force regulators to allow institutions to provide financial services to cannabis companies. 15 And there are other pathways being explored by government leaders, as well. 16 In time, it appears inevitable that legal frameworks for cannabis banking will emerge, coinciding with the legalization of the industry itself, which means it’s worth taking a closer look at how your bank might play here. The banking sector needs more direction, of course, but paying attention to how this arena is unfolding seems wise. At the very least, banks should feel prepared to move when the light turns green.

The above section details just a few of the frontiers that banks should be considering as the industry looks toward the future. There are undoubtedly other areas to consider as well and new arenas popping up all the time. These, though, we chose to focus on because of the increasingly central roles in the conversation they are taking today. As such, keeping on top of these corners of activity — and how your peers are handling each one — will be critical to staying current. Going forward, we expect open banking, BaaS, and crypto to continue to gain considerable traction, with cannabis banking making slower but relevant progress that’s worth keeping an eye on.

Final thoughts

The purpose of this report is to give banks a better understanding of where their peers are today — and not just when it comes to capabilities. It’s one thing to look at how other banks are deploying new tools — who has the fastest digital account opening, for example, or who deployed the snazziest budgeting interface — and there is value in that. But there is perhaps even greater value in looking at how institutions are thinking about things. Perceptions and attitudes are ultimately what drives the future. Capabilities come in to support those perceptions and attitudes with investment.

As always, you should take these insights as they make sense for you. The data in this report is meant to show how different institutions are approaching the future and identify areas more forward-thinking participants are focused on. Those areas may or may not be applicable to your bank. The objective is to look at the data and take from it lessons that can inform your perspective and strategy into the future. If anything, the material above should serve as a compass, indicating general direction on certain key segments of the industry. We don’t all have to go exactly the same way.

Survey Respondent Demographics

©CCG Catalyst 2025 – All Rights Reserved

No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording or any information storage and retrieval system, without prior permission in writing from the publisher.

Read The Banking Battleground: Views from the C-Suite

Read The Banking Battleground 2023: Pulling Back and Pushing Ahead

Download a PDF of this article