The Banking Battleground 2023: Pulling Back and Pushing Ahead

There’s no other way to say it: We are in an uncertain time. Last year began full of potential but was quickly met with rattled markets, troubling inflation, and global geopolitical turmoil. For banking providers, this meant contemplating what the changing environment would mean for customers and, in turn, business, particularly as the possibility of a recession began to swirl. Meanwhile, the promise of fintech took a hit in the face of this economic instability as concerns about compliance and operational efficiency emerged, and regulators began to zero in on the relationships that banks were eagerly forging with companies in this sector. In the end, after a few years of flying high, perhaps too high, on innovation and new frontiers, 2022 knocked everyone in financial services down a peg. Now, institutions are faced with how to recalibrate.

This third edition of The Banking Battleground presents the findings of CCG Catalyst’s 2023 US Banking Study and explores how the industry is thinking about what comes next. Building on last year’s report, we asked C-level bank executives in the US about their attitudes and priorities as we look toward the future. As in prior installments, this report focuses on the differences in perspectives between more forward-thinking institutions and those that have generally taken a traditional approach. It’s meant to help bank executives better understand what their peers are focused on, especially as it grows more important to separate the wheat from the chaff and find the opportunities that will make a real difference.

Methodology and purpose

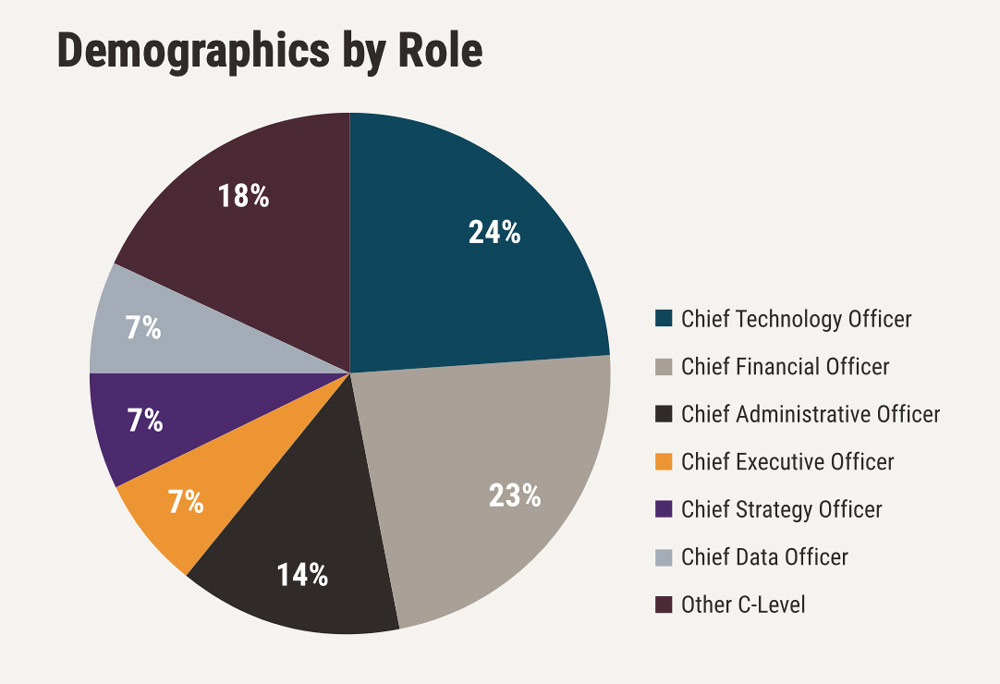

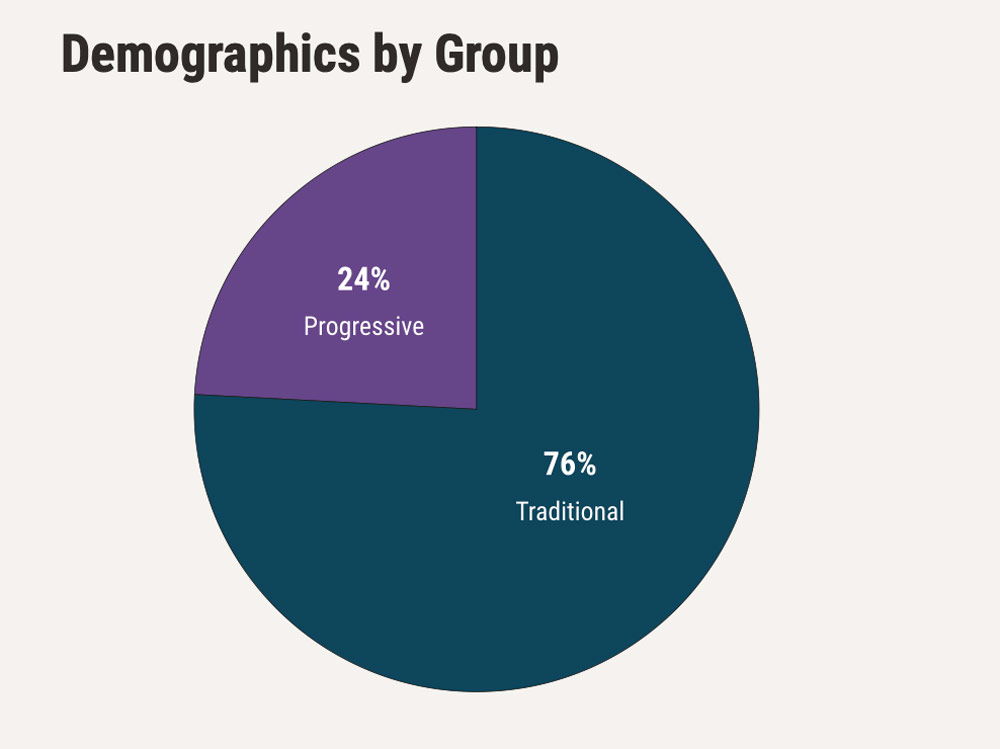

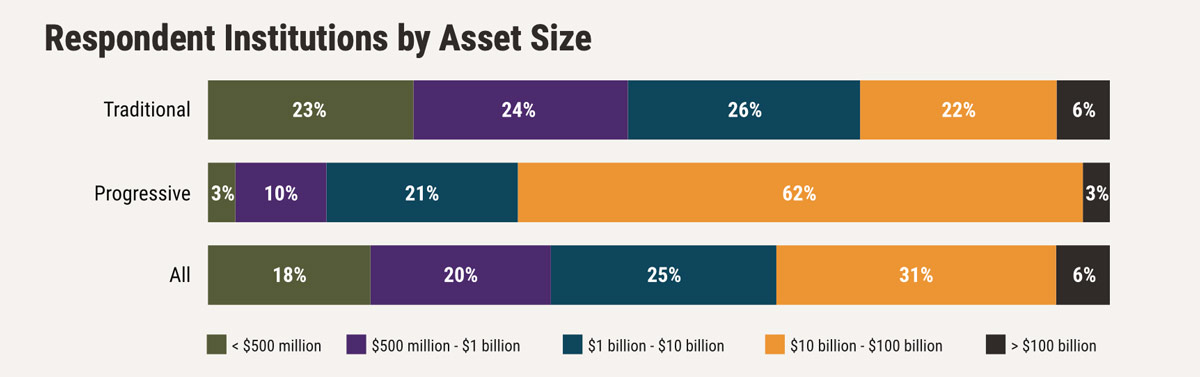

CCG Catalyst surveyed 122 C-level bank executives between September 2022 and February 2023 to gauge their attitudes and perspectives on their businesses and the market. Using the same criteria as in the past two years, we’ve grouped respondents into two categories: traditional and progressive. To be included in the progressive group, a respondent had to report acquiring less than 50% of their technology from a single vendor, working with fintech companies as an integral part of their strategy, and making at least one fintech investment. Based on this segmentation, we conducted an analysis to determine how the groups approach the market and how prepared each is for the future. Our focus this year again included three core areas: business trends and priorities, technology and innovation, and new frontiers. The survey data is unweighted, and the analysis that follows is based on our sample.

Business trends and priorities

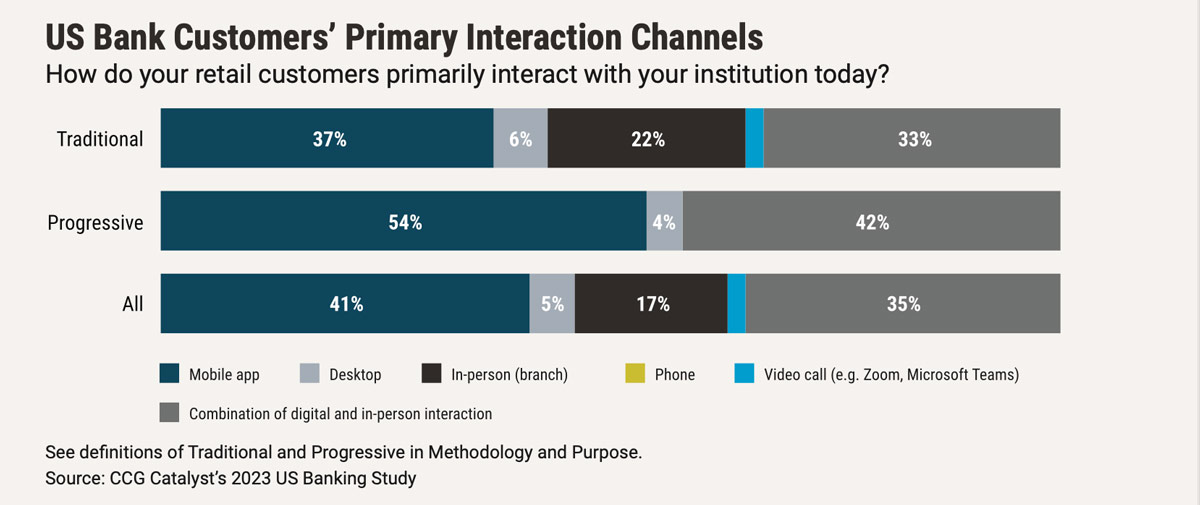

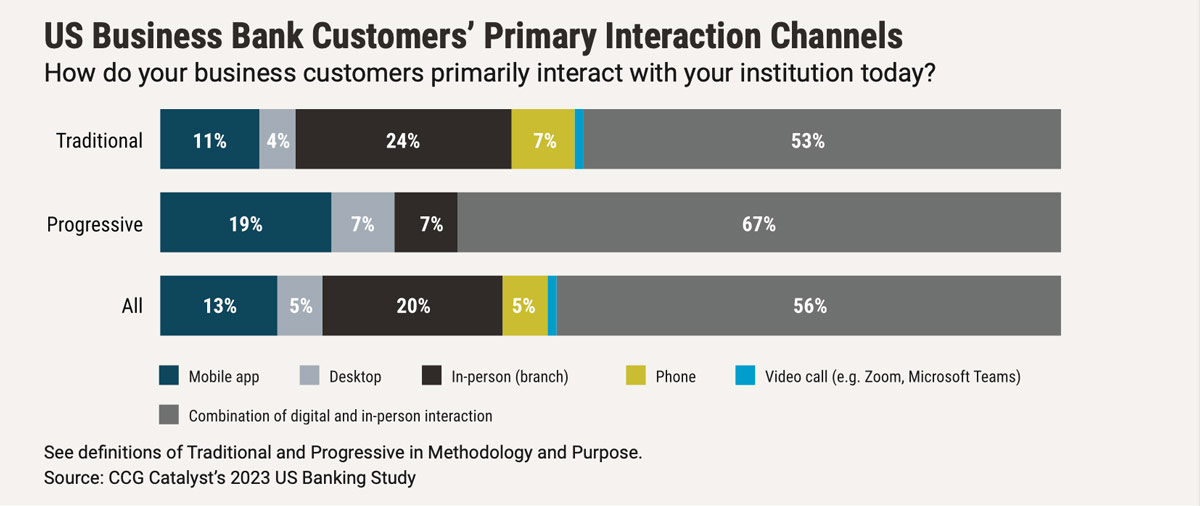

Most bank customers are leveraging some kind of digital interface to interact with their provider. However, traditional institutions continue to see some customers prioritizing analog channels — for example, about a quarter of both retail and commercial customers at traditional institutions still prefer coming into a branch. On the commercial side, this is the same as last year, while it’s up slightly for retail, probably coinciding with the general return to normal life in 2022 that made banking in person a realistic option again. As with remote work, it seems that digital-only banking didn’t have quite the widespread staying power many thought it would. 1 Additionally, economic uncertainty could be pushing more reluctant digital users back into physical locations if they are in need of or looking for reassurance. Meanwhile, progressives say more than half of their retail customers primarily use mobile at this point, up from 41% last year, with the rest either using desktop or employing a mix of digital and in-person interaction. Progressives’ commercial customers, on the other hand, are by and large taking a hybrid approach to interacting with their bank.

The drive toward digital continues, but it’s clear that, at least for now, the future is one that combines digital interfaces with human assistance. Even among progressive institutions’ retail customers, who appear the most receptive to digital across all four customer groups, there is a good chunk (42%) still looking for a mix of interactions. The past few years pushed digital into the spotlight, but with restrictions now lifted, we’re seeing a lasting affinity for human contact. And that’s likely to continue, particularly given its supportive nature in turbulent times. Nailing the hybrid experience, including providing consistent digital experiences across interfaces and finding the right places to insert a human touch, will be key. A good way to think about it is like this: While digital channels are critical to the future success of the bank, human interaction, at least for now, is critical to the success of those channels.

Over time, as digital experiences further mature, this desire for human interaction should decrease, or even subside entirely. But, in the meantime, figuring out when customers want to go it alone, when they are happy for a digital option or assist, and when they want to talk to a person should be a key component of developing any digital strategy. Customers are complex, and delivery should reflect that, while also appearing seamless and simple. On the flip side, for those institutions which continue to see portions of their customers gravitating toward strictly in-person interactions, it’s important to ask why that is. It could be because they skew older, for example, but it could also be because the bank’s digital offerings are lacking.

Overall, the way customers expect to access services, inside and outside of banking, is changing. They want things to be easy — no matter what the interface is. Of course, the digital wave of the last few years impacted behavior, but there are subtleties that need to be understood, especially in a post-pandemic era. As banks grapple with these subtleties, it’s impacting how they think about their businesses and the future. Or, put another way, the need to figure out how to thrive in an increasingly digital but also nuanced world, and one that is no longer driven by economic abundance, is a central imperative driving approaches and priorities.

Priorities in retail and commercial banking

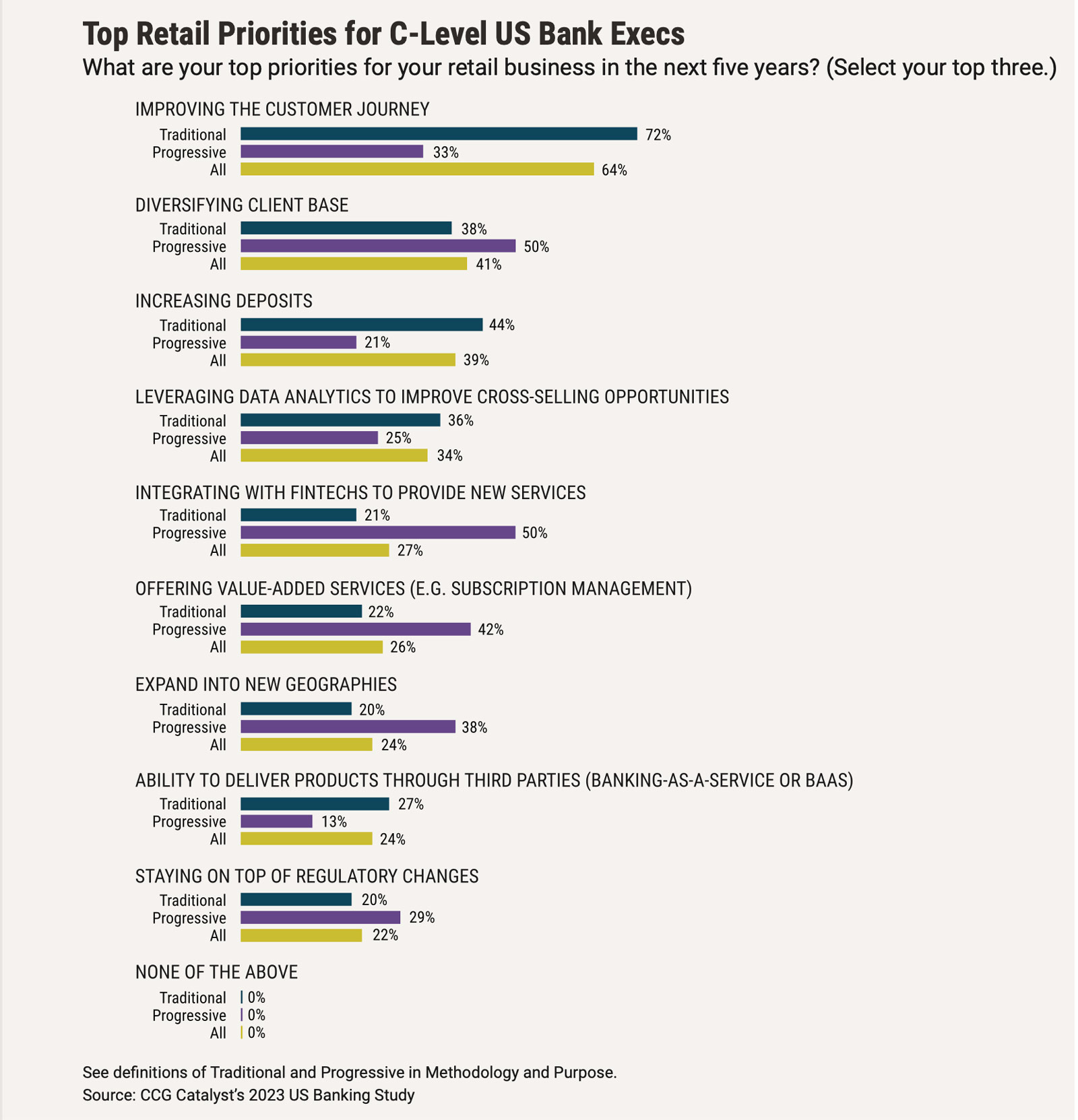

On the retail side, progressives are showing a clear preference for expansion of capabilities with their top priorities for the next five years including integrating with fintechs, diversifying client bases, creating value-added services, and geographic expansion. They show greater interest than traditionalists in all of these areas. Additionally, these providers are putting more emphasis on staying on top of regulatory changes, which makes sense in light of their tendency to play in more novel fields. This suggests that, even in the face of ambiguity, progressive banks still see value in investing time and resources into innovation efforts and plans for the future.

Traditionalists, meanwhile, remain very focused on the customer journey as well as increasing deposits. They’ve also pulled back on their interest in working with fintechs, likely in an opposite reaction to their progressive peers in the current environment as choppy capital markets 2 put pressure on the fintech sector and perception of the risk involved increases. This is an important point, because it indicates that, while progressives are still thinking largely about opportunity, traditionalists have grown more cautious and are focusing more on the here and now. Notably, however, Banking-as-a-Service (BaaS) receded as a priority this year for both groups, likely as a result of regulatory scrutiny and recent actions against partner banks. 3

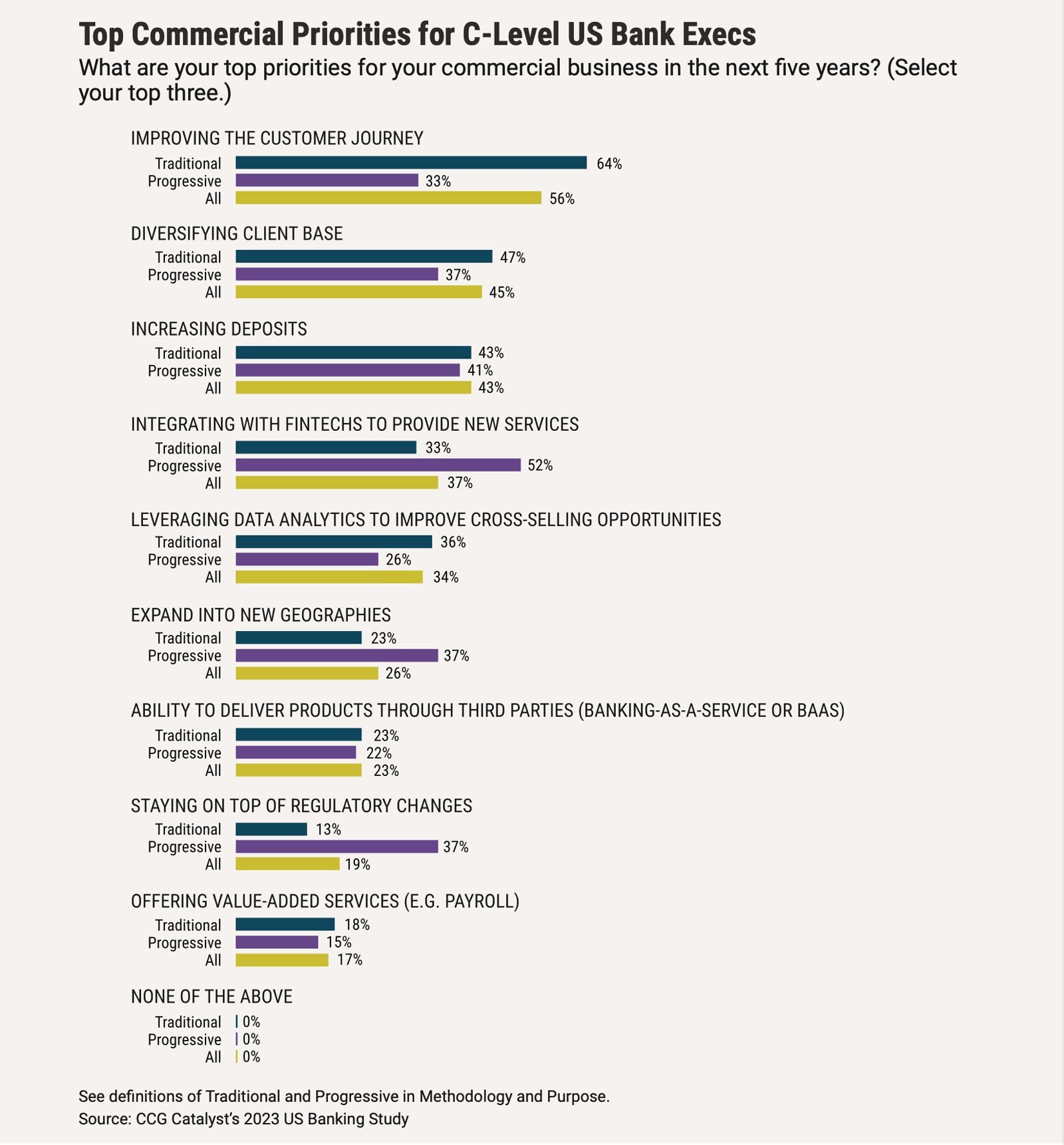

Meanwhile, on the commercial front, progressives’ top priority is integrating with fintech providers to provide new services, and their interest in this area far exceeds their traditional peers’. Likely uncoincidentally, they are also showing more interest in staying on top of regulation on this side of the coin, as well. For traditionalists, on the other hand, it’s a similar story to retail — focus is on the customer journey.

This reinforces the idea that an evolving economic and regulatory backdrop is driving a widening gap between traditionalists and progressives on their priorities and views on the future. In fairness, traditionalists are coming from a reasonable place — global fintech funding, for example, has generally been on the decline, 4 with even big-name companies like Stripe and Klarna slashing valuations and cutting staff. 5 Meanwhile, the outlook for consumer spending remains blurry amid efforts to combat inflation. 6 However, it’s generally those which can see the opportunities in the mud that will fare best long term. In this sense, traditional institutions may want to take a page from progressives who seem confident they can navigate the chaos to their advantage.

Ultimately, across both retail and commercial, we observed traditional banks pulling back a bit in their ambitions as progressives push further ahead but with an eye toward regulators. That theme is quite clear, and it has real implications for the future with regard to who is able to prevail in an increasingly challenging environment and how exactly they go about it. When everything is flying high, even the most conservative bank might feel emboldened. It’s times like these that reveal who is truly committed to exploring new avenues and value propositions. If traditional institutions pull back too hard, they will risk falling behind the market and customer expectations as a whole.

Setting those priorities

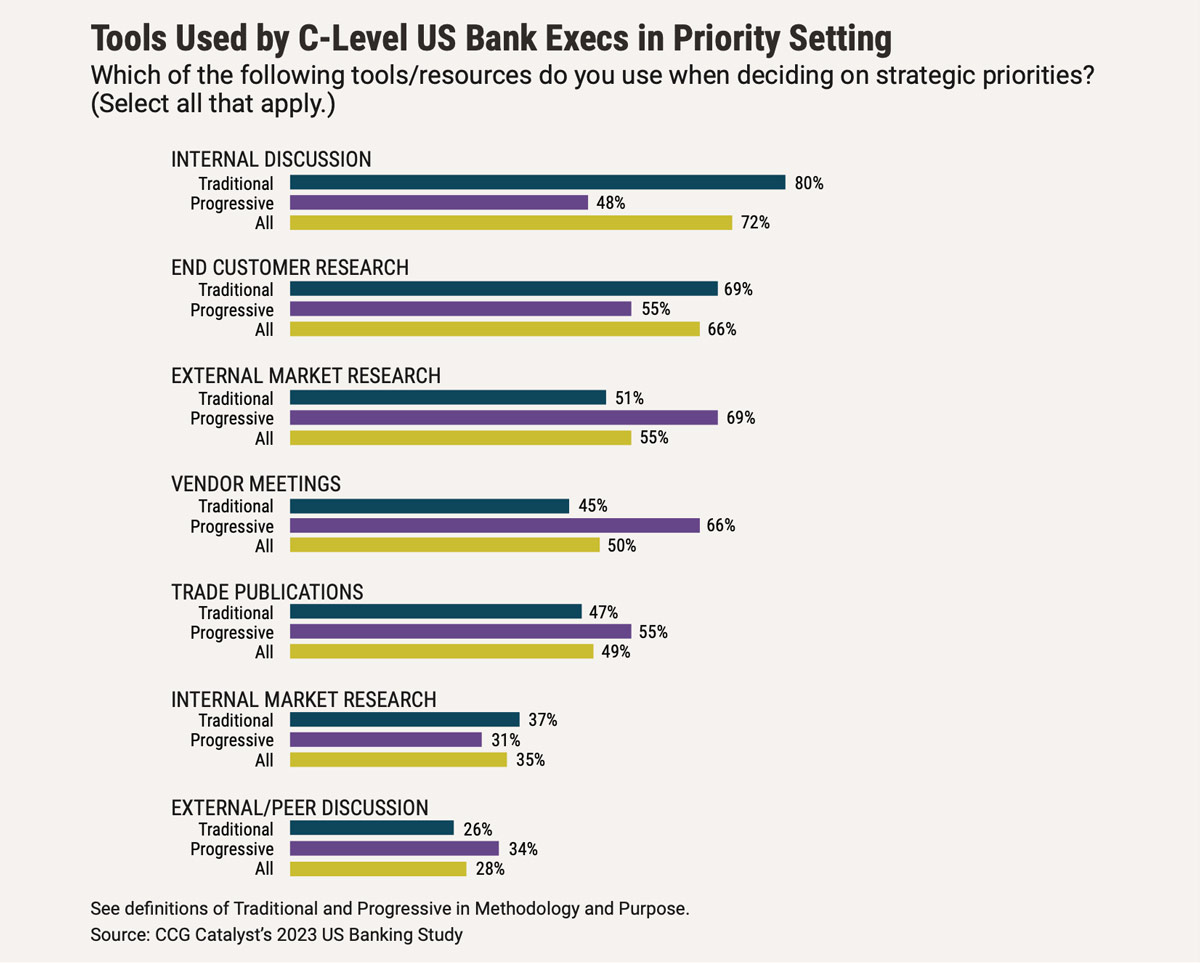

This year, we added a set of questions that asked executives about the tools they use in determining their priorities and how they work to understand their customers. The goal was to better understand how the different groups approach the decision-making process and how it might impact where they end up devoting their time and effort. Overall, progressives are making use of a greater range of tools, including external market research, vendor meetings, and trade publications. Additionally, progressives put far less weight on internal discussion than traditionalists, suggesting an “outside in” view — indeed, the tools they use most tend to be external, likely because they are looking to spot trends to capitalize on early.

How bank executives inform their choices in setting priorities is extremely important. If an executive team is mostly talking internally, those discussions are probably going to be less aligned with where the market is headed overall. As a result, the strategic initiatives that emerge could be somewhat narrow. Alternatively, leveraging a range of tools allows an institution to consider more perspectives and ideas, making it easier stay on top of market dynamics. It makes sense that progressive institutions would go for the latter; they’re not trying to keep up, they want to stay ahead. But such an approach would likely be valuable to traditionalists, too, as a deeper understanding of where their peers are directing their attention can help them remain current. Being the first one to the table may not be the target for traditional banks, but it’s useful to at least know what game is being played and who is already sitting down.

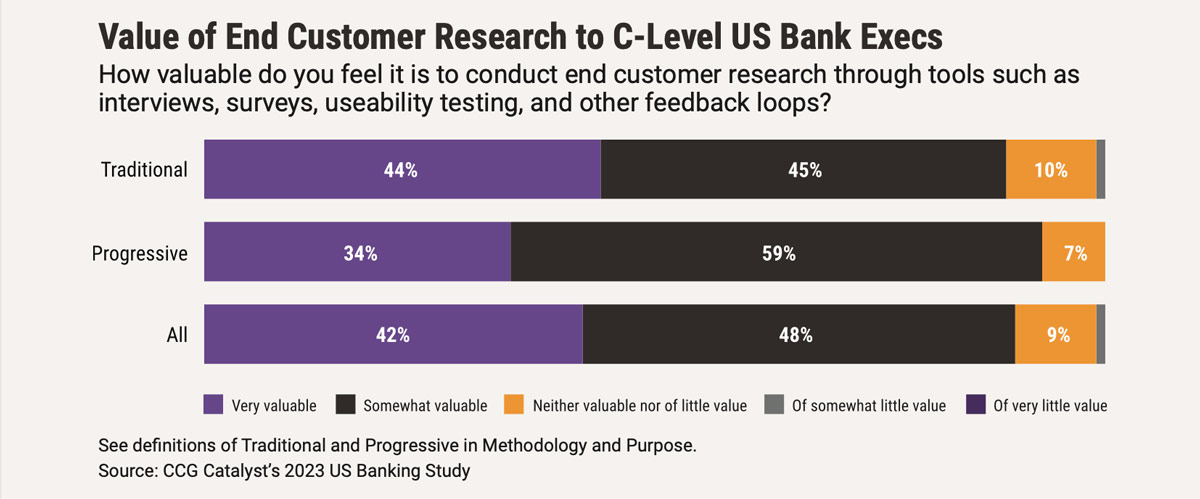

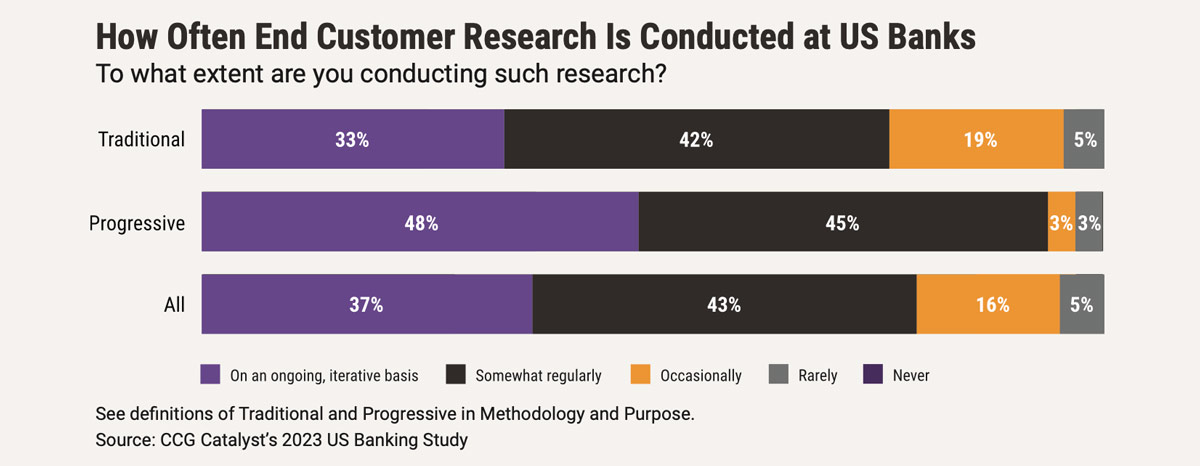

We also asked specifically about the value bank executives see in conducting end customer research through tools such as interviews, surveys, useability testing, and other feedback loops, as well as how often they are doing so. This is a critical pillar for many fintech companies well-known for moving the bar on customer experience and pushing the rest of the industry forward. Interestingly, while both groups reported seeing value, progressives are slightly less likely to find end customer research very valuable — even though they are conducting it on a much more regular basis. They are also less likely to use it when setting strategic priorities, though it does fall into their top three. This could be for a number of reasons, including the breadth of sources progressives are employing, which keeps any one factor from carrying too much weight. However, that progressive institutions are choosing to conduct such research frequently — nearly half say they do so on an ongoing, iterative basis — is notable in and of itself. Beyond demonstrating a commitment to the voice of the customer, this points to what is reasonably at the heart of the progressive approach to informing decisions: To collect as much information as possible and use it loosely as a guide. This is a critical point — they’re likely using this information directionally rather than to create a blueprint. In the end, most progressive institutions also probably rely quite a bit on gut.

Technology and innovation

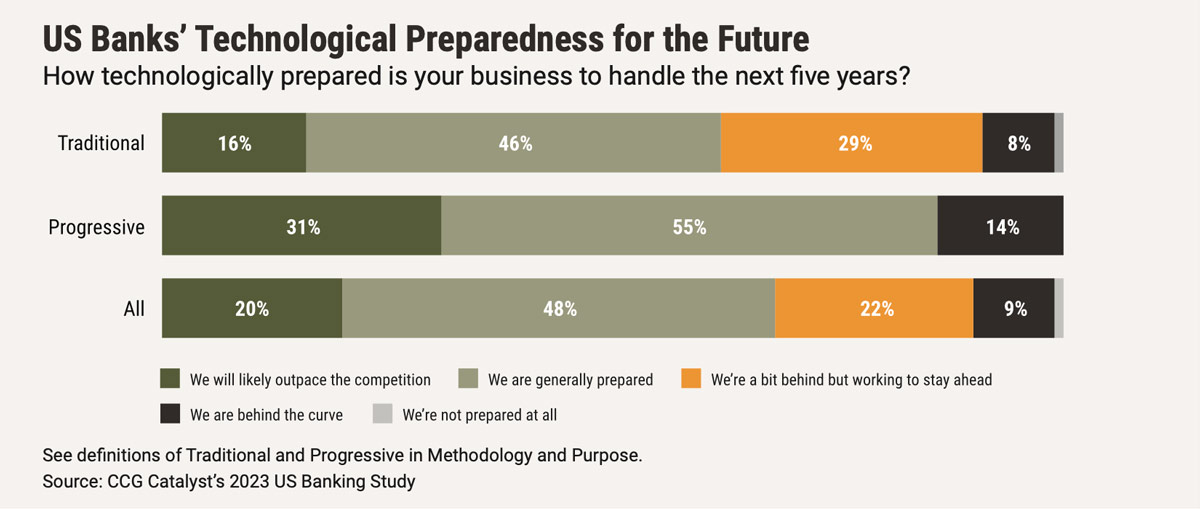

Even in an uncertain climate, technology and innovation are key levers for future direction and thus represent a vital area to assess when looking at where banks are today. And it seems as though executives know this — 70% of respondents to a recent study by Arizent said they expect to increase spending on tech in 2023, while half believe the changing competitive environment will be one of the most impactful trends of the next three years, despite continued turbulence miring the overall landscape. A bank that is well equipped on the technology front can far more easily stay on top of such changes, especially as things shift in different directions with less predictability. Promisingly, to that end, a majority of respondents to our survey continue to feel at least generally prepared to handle the next five years from a technological perspective. However, both groups reported feeling less prepared in 2023 than they did last year. Specifically, 86% and 62% of progressives and traditionalists, respectively, reported feeling at least generally prepared this year, compared with 94% and 84% in 2022.

This could be because it’s less clear currently what exactly the future will hold and where institutions need to be placing their bets. In particular, working with new, tech-savvy fintechs used to be seen as somewhat of a silver bullet, but now, it’s evident that finding opportunities will require far more effort. Fintech companies subsist largely on private capital, and as mentioned, investors are tightening their purse strings. Moreover, the private markets are putting much more emphasis on cash flow than they did in the last few years when money was flowing quite freely. As a result of these shifts, there are likely many, many startups out there that raised capital when everything was easy and full of promise which will simply not survive; for banks, that means a smaller pool of candidates to work with. Additionally, fintech startups (and neobanks in particular, which represent a major potential partner pool for banks) have publicly struggled of late in critical areas like compliance and fraud prevention. Overall, while it is reassuring that executives remain generally confident in their technology approaches, our data suggests that there may be some fine-tuning to be done.

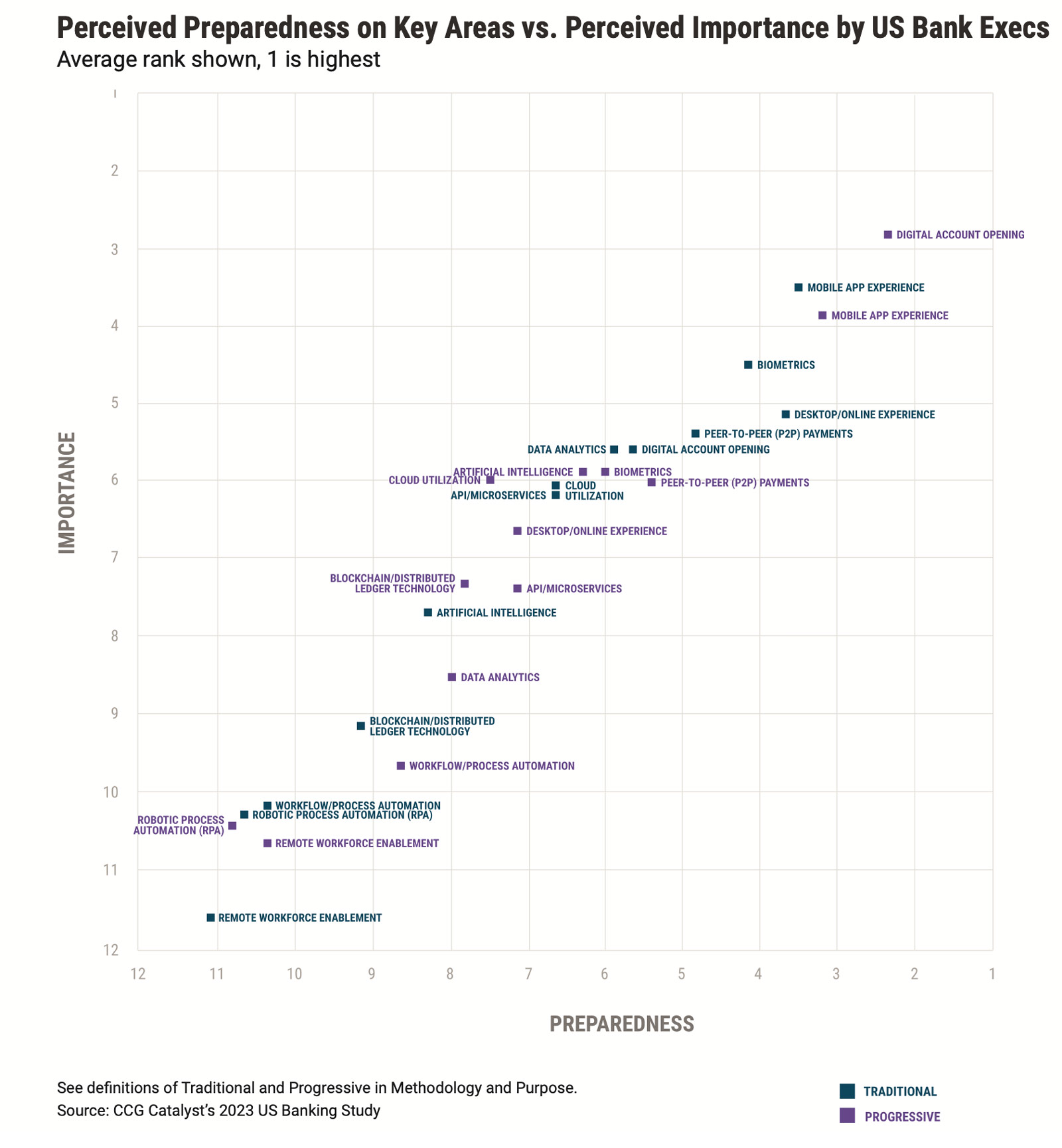

In exploring what that fine-tuning might look like, we again asked respondents to rank a number of areas based on their bank’s preparedness to tackle each in the next five years as well as the expected importance of each to their business. As in prior iterations, we plotted these areas for each group using their average rank in the results.

There are only two areas that cracked the top five areas of importance for both groups — mobile app experience and biometrics. Beyond that, traditionalists are looking at desktop/online experience, peer-to-peer (P2P) payments, and data analytics as top areas of importance, while progressives have digital account opening, artificial intelligence (AI), and cloud utilization rounding out their top five. This likely coincides at least in part with traditionalists’ inclination to return to the basics we’ve observed elsewhere. Progressives, meanwhile, continue to feel more confident than traditionalists on advanced areas of technology like AI and blockchain.

This data suggests that, while it may be challenging, progressives generally feel confident in their ability to identify the right opportunities and make the right calls long term, even when it comes to advanced technologies. In particular, their emphasis on AI is interesting (and corresponds with our results from last year), as a flurry of activity 7 is hitting the market in the wake of the launch of ChatGPT, the AI-powered chatbot from OpenAI, in November 2022. 8 This kind of AI, called generative AI, is gaining wide attention for its ability to create content, including new text, images, video, audio, code, or even synthetic data, on its own. 9 In financial services, this could translate into use cases like chatbot-powered customer service (done well), improved personalization, and AI-driven fraud prevention. 10 Traditionalists, on the other hand, allowed AI to drop out of their top five areas of importance this year all the way to the ninth spot. This alone speaks volumes about how each of these groups sees the market and the value they place on staying on top of new trends, especially amid fluctuating dynamics.

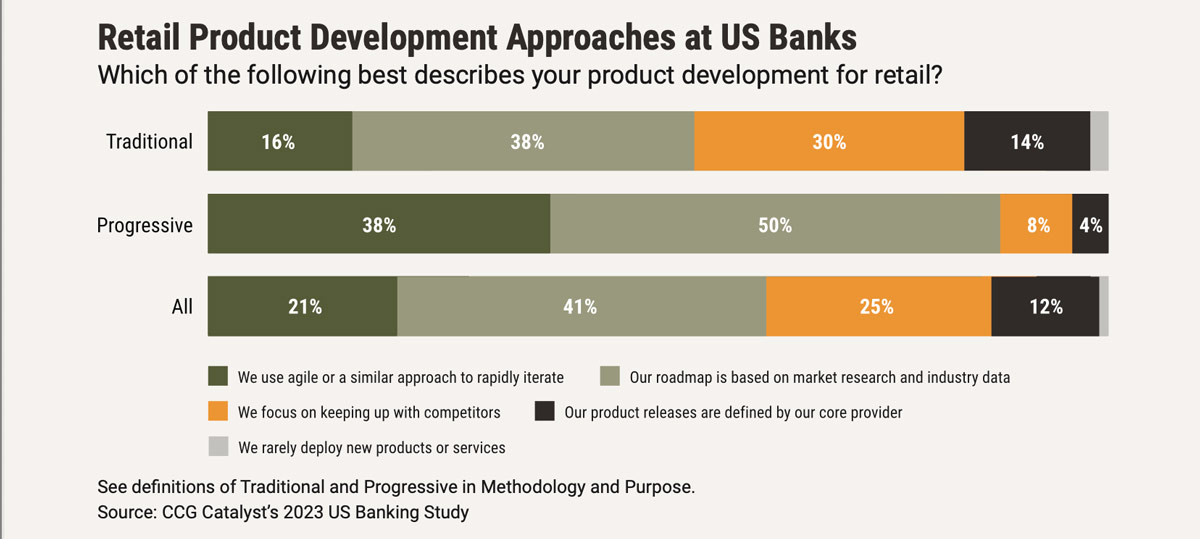

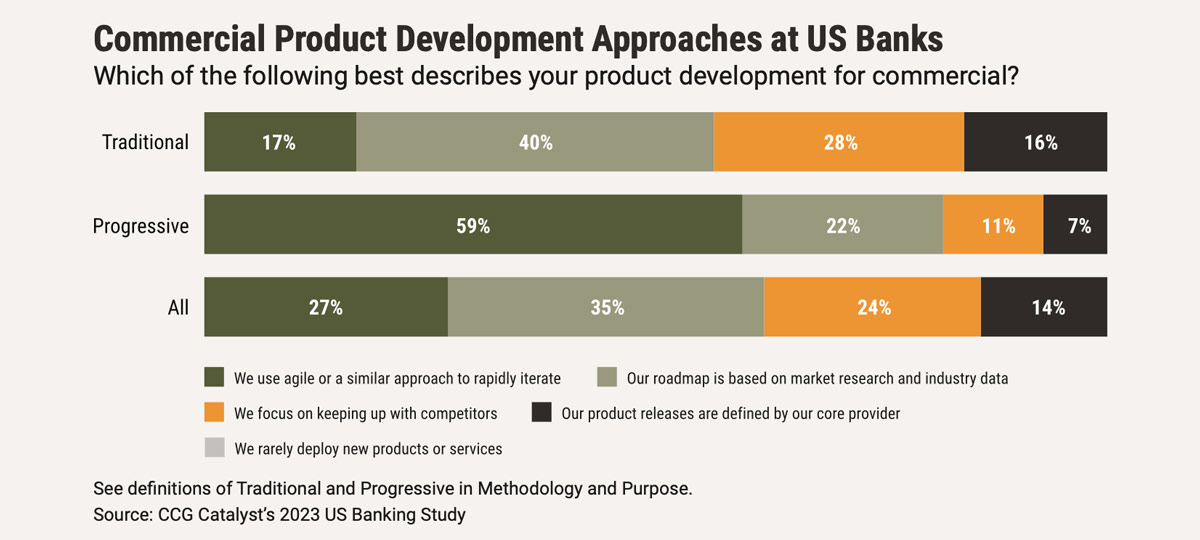

It’s one thing to reassess and adjust, it’s another to pull back out of fear. Progressive institutions appear to realize this — they may feel a little less confident than they did last year, and they’re probably looking at risk differently (as evidenced by their focus on regulatory considerations outlined above) but they’re still focused on the future. Traditionalists should take note here; the goal shouldn’t necessarily be to stop moving, but rather to keep moving with a more discerning eye. Doubling down on desktop and P2P payments, for instance, screams playing it safe. And probably too safe. Meanwhile, progressive institutions continue to appear more advanced when it comes to planning for future technology-related efforts, as they remain more likely to employ agile methodologies when building their innovation or product roadmaps. This aligns with their more thorough approach to priority setting discussed earlier.

New frontiers

Beyond their approaches to technology and innovation generally, it’s worth understanding how institutions are thinking about and approaching certain areas that are taking the spotlight and have the potential to impact the wider market. Following on from last year, we’ve again analyzed bank executives’ intentions across a number of new frontiers — open banking, BaaS, cryptocurrency, cannabis, and newly added in this installment, sustainability. Overall, the data sheds light on how executives broadly are looking at each concept as well as illustrates some notable differences in how progressives and traditionalists see these fields of play.

Open banking

Open banking isn’t a novel idea — it’s been percolating for a long time in the US, and it’s already maturing elsewhere. 11 However, it’s been a very slow march toward anything that resembles a formal open banking scheme in this country, where the movement thus far has been largely undefined, and institution led. In this past year, though, meaningful progress was made, most notably with the director of the Consumer Financial Protection Bureau (CFPB), Rohit Chopra, announcing at Money20/20 in Las Vegas that the agency will propose an open banking-based data-sharing rule under Section 1033 of the Dodd-Frank Act. 12 If this rule comes to fruition, it will require financial institutions to share consumer data on request, marking the first concrete, government-led open banking framework in the US. The CFPB has since released a discussion guide for public comment and says it expects to issue the proposed rule later in 2023, with plans to finalize and implement it in 2024.

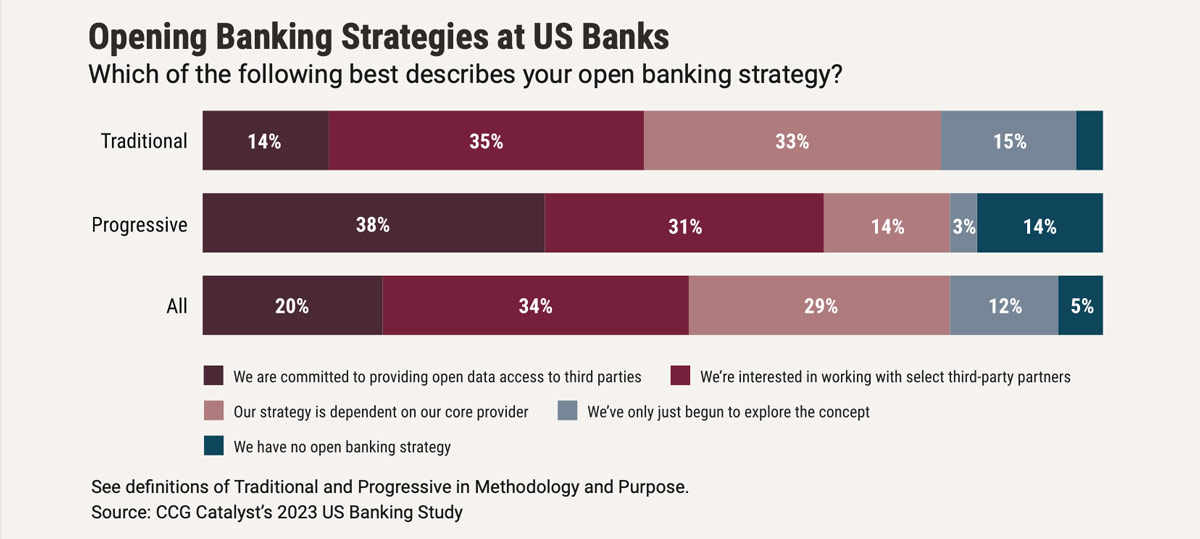

Unfortunately, the banking industry isn’t necessarily expressing the same enthusiasm for open data access. Specifically, while we’ve certainly seen banks in the US show interest in elements of open banking, those in our study remain hesitant to embrace data sharing on a wide scale. And that’s especially true among traditional institutions — while 38% of progressives in this year’s survey said they are fully committed to sharing data with third parties, about the same as last year, that’s more than double the portion of traditionalists which said the same. In fact, traditionalists have actually become more wary of data sharing. This further strengthens the idea traditionalists have really retreated in their innovation efforts in the last year and are demonstrating more reluctance in working with fintechs or other third parties.

Additionally, traditional institutions may be reacting to the technological burden proposed open banking guidelines could come with. According to Chopra, the CFPB expects to propose requiring financial institutions offering deposit accounts, credit cards, digital wallets, prepaid cards, and other transaction accounts to set up secure methods such as application programming interfaces (APIs) for data sharing. 13 This concept, outlined in the CFPB’s subsequently released discussion guide for public comment, has drawn pushback from a number of institutions asking for a phased approach that would ease the technological and cost burdens. 14

Overall, it’s quite possible there is going to be a slog to the finish line on this. The rollouts of regulation in other jurisdictions like the Second Payment Services Directive (PSD2) in Europe were not without problems and continue to face challenges. 15 The good news, though, is that we’re starting to see some real movement on this front. A unified framework would bring a lot of clarity to this concept in the US, helping to improve security and reduce risks associated with practices like screen-scraping that leverage the sharing of login credentials to access customer data. But getting to a point where institutions feel capable and comfortable implementing open banking is going to require collaboration. Based on our study, many banks will need to undergo a shift in mindset as open banking becomes a reality in the US, and that will require those designing these rules to consider their input and incorporate it effectively.

BaaS

BaaS rolled onto the scene several years ago, but in 2021, it exploded. The (debatably) novel model by which a chartered institution provides the regulatory umbrella necessary for a nonchartered company to offer financial services took the industry by storm as a slew of fintech companies emerged in need of bank partners to offer financial services, and banks took an interest at the promise of new revenue in a highly competitive environment. But now, we’re starting to see some shifts, driven by a number of critical and accelerating pressures, including tightening private capital, increased regulatory scrutiny, and market saturation. Together, these pressures threaten to undermine the BaaS model and its potential opportunity.

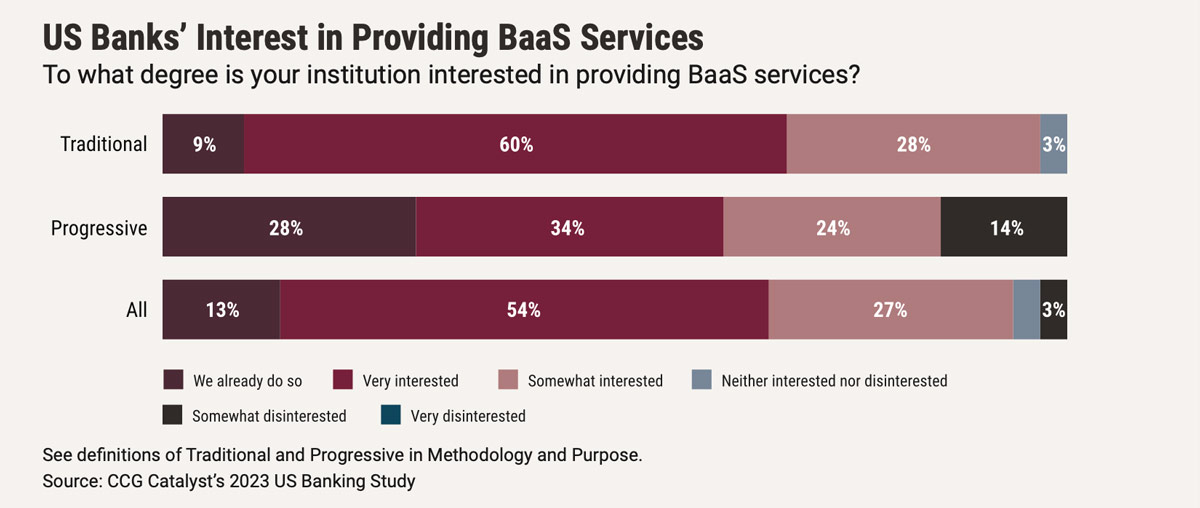

Likely as a result of these dynamics, and as noted earlier in this report, BaaS dropped as a priority for bank executives in our survey this year, both among traditionalists and progressives. However, curiously, interest in the space doesn’t seem all that dampened — in fact, 67% of respondents overall in this year’s study say they are very interested in providing BaaS services (or already do so), compared with 72% last year. This, combined with the shift in priority, indicates that institutions may be taking a wait-and-see approach when it comes to next steps, but an allure is still there. This is particularly evident among traditional institutions, 60% of which say they are very interested in offering BaaS services. Progressives, on the other hand, are more likely to already offer BaaS and express less interest if they aren’t by now in the game. This makes sense, as BaaS is no longer a brand new idea, and many progressive institutions for whom BaaS fits as a part of their strategy are probably already participating.

Going forward, BaaS is likely to experience further growing pains. By this point, the Office of the Comptroller of the Currency (OCC), CFPB, and Treasury Department have all issued comments suggesting increased concern around BaaS and expressing a need for greater oversight. And ongoing challenges in the fintech space are unlikely to relent anytime soon, making it increasingly difficult to find strong clients to work with. Meanwhile, as that pool gets smaller, differentiation will become more important, especially given the number of banks that continue to demonstrate interest in the space.

Ultimately, the most successful BaaS banks will likely be those that understand these nuances. As part of this, it’s important to remember that BaaS is not going to give anyone an easy win — while BaaS can help an institution to generate impressive returns, it generally takes a lot of time and investment to get to that point. In fact, 13 of the 30+ BaaS banks analyzed for a recent report by Fintech Business Weekly actually had below average return on equity (ROE) for their peer group, and those which appear to be benefiting the most are often those that have been around the space for a long time. 16 A bank that wants to pursue BaaS will need to carefully think through how this model fits with its strategy, the investment in resources it will have to make to do it effectively, and its ability to handle hiccups and learnings with agility.

Cryptocurrency

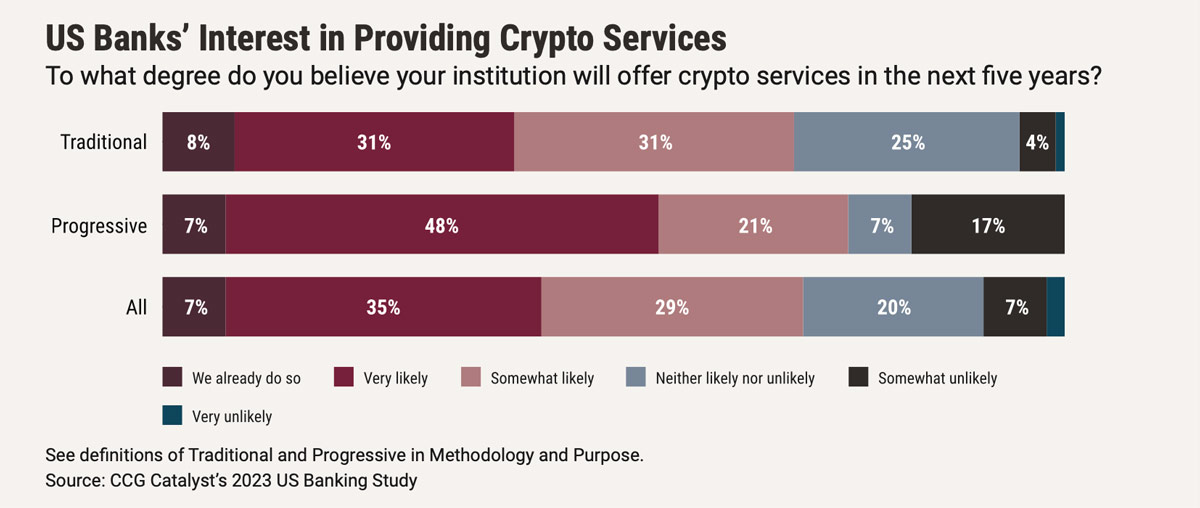

On the crypto front, we’ve seen a huge pullback in interest, even among progressive institutions. Specifically, only 55% of progressives in our study say they are very likely to (or already do) offer crypto services in the next five years, compared with 67% in 2022’s iteration. For traditionalists, those numbers are 39% and 49%, respectively. This cooling is undoubtedly tied to the incredible failures plaguing the cryptocurrency space over the last year, including the spectacular demise of FTX, the collapse of crypto investment firm Voyager Digital, and exchange BlockFi’s bankruptcy, among others. 17 Such failures exposed systemic issues within the crypto sphere that’ve led to amped up regulatory scrutiny and sent many banks heading for the hills, with a number previously involved in digital assets taking a step back. 18 In fact, we believe it’s likely that interest and activity have receded even further since our survey was fielded as new stories related to the space have continued to break, for example, with the downfall of New York-based Signature Bank, which had considerable crypto operations. 19

Over time, it’s not out of the question that the pendulum will swing back the other way — but it’s going to be a long road. Crypto is known for its boom and bust cycles that cause feelings toward the market to oscillate wildly between excitement and fear. However, recent setbacks are arguably on a much larger scale than we’ve seen before, which means crypto is probably in for a rough climb out of the pit this time. Additionally, that climb will coincide with regulatory efforts to de-risk and better manage the industry, 20 which will take a while to form. As those efforts move into fruition, though, and the market responds, it should bring clarity and stabilization. At that point, cryptocurrency may become an attractive arena for banks again.

Cannabis

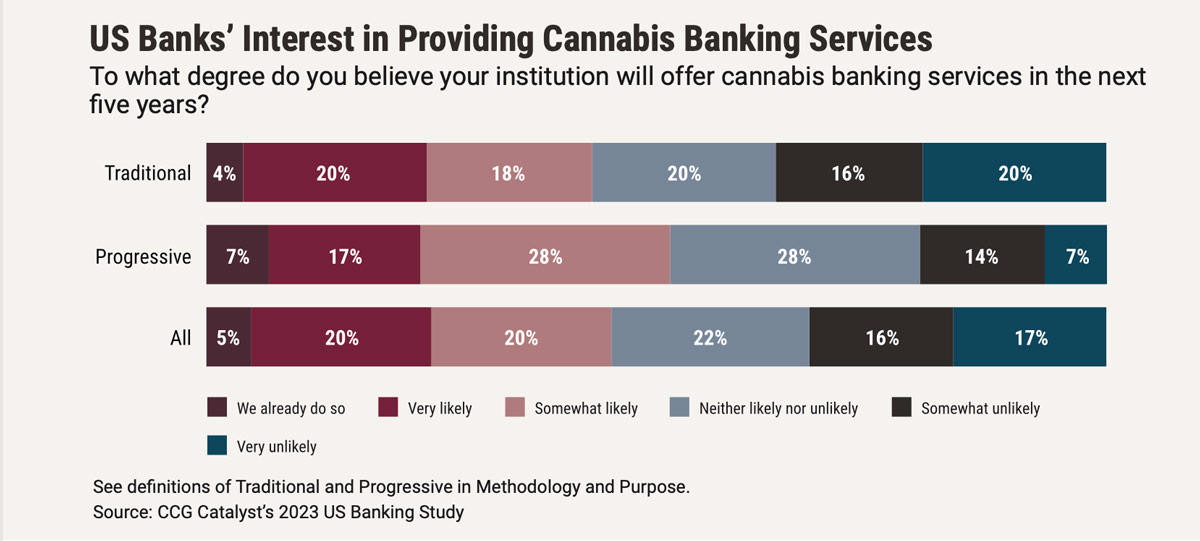

Now legal to some degree in 37 states, 21 cannabis continues to be a hot topic. However, banks appear to be holding firm in their reluctance to jump in too quickly, with still only about a quarter of both traditionalists and progressives saying they are very likely to (or already do) offer cannabis banking services in the next five years. Progressives show slightly more inclination, with 28% saying they are somewhat likely to offer such services, compared with only 18% for traditionalists. Overall, the hesitation is probably tied to an ongoing split in legality between state governments and at the federal level (it’s still illegal under federal law) as well as a persistent lack of regulatory clarity around how banks can compliantly participate. While there are efforts underway to introduce such clarity, including from the still-breathing SAFE Banking Act set to come up for discussion again in 2023, 22 nothing has materialized in the last year to truly put bank executives at ease. As such, until concrete guidance emerges on the regulatory side of things, it’s likely that cannabis will be an area reserved for only the very risk tolerant.

That said, though, a reluctance to be early to the party doesn’t necessarily suggest low interest. The cannabis industry represents a huge opportunity for banks — revenue from direct marijuana businesses alone is expected to surpass $48 billion by 2025, according to data from Arcview and BDS Analytics cited by Bank Director. 23 And, as the regulatory picture grows clearer, it’s very likely that cannabis will morph into a legitimate industry that needs financial support. When that happens, we expect many more institutions to get involved, as anecdotal discussion around cannabis is quite high among financial institutions and indicates they do see the possibilities. 24

Sustainability

The move toward environmental sustainability in banking, particularly in the context of carbon-related initiatives, is seeing increased activity in the US and globally. This is being driven by demand from a number of stakeholders, including regulators, investors, employees, and customers. As a result, new ways of doing business and thinking about financial services are emerging as institutions look to reduce emissions across operations and other activities. Moreover, beyond environmental issues, banks are looking to incorporate fundamentals into their sustainability approaches across areas like diversity and inclusion as well as corporate responsibility. Together all of these elements make up the acronym often used to define sustainability frameworks, ESG, which stands for environmental, social, and governance.

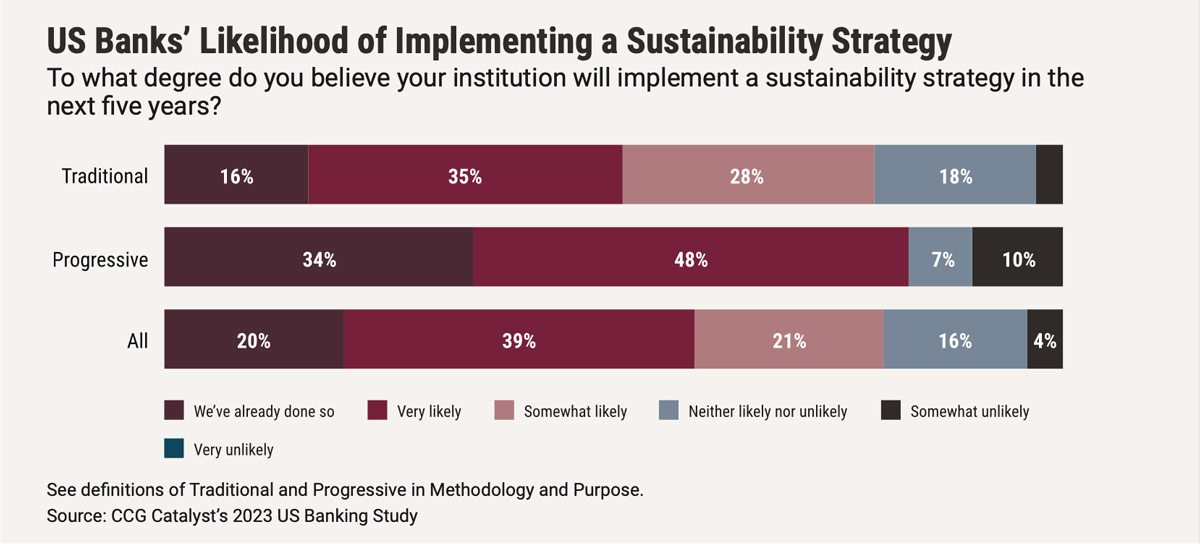

Banks in our study are very much aligned with the wider market trend on this frontier — in fact, 59% of all respondents say they either already have a sustainability strategy in place or are very likely to implement one in the next five years, with another 21% reporting they’re somewhat likely to do so. However, when it comes to headway, progressives are outpacing their traditional peers. Specifically, 34% of progressives have implemented their strategy by this point, compared with just 16% of traditionalists. This suggests that traditionalists are lagging in turning intentions into action.

Overall, though, we are still at the very early days of this. Even those with a strategy in place likely have a way to go, and that’s because this is not an easy arena to tackle. Environmental sustainability, in particular, is complex and scientific, and few banks have fully cracked tracking and reporting on their emissions, let alone their reduction plans. 25 But urgency is growing — from demands by stakeholders to potential regulation to the business and reputational risk involved in staying on the sidelines, pressures to have a plan are only going to mount. Given this, institutions that haven’t started thinking about their approach to sustainability might want to consider getting a move on.

The frontiers we’ve chosen to cover in this section represent a small subset of the opportunities out there. We’ve focused on these because of the central roles they are taking in the conversation, but there are undoubtedly others to consider and new ones popping up all the time. The larger point is that, by looking at how your peers are embracing new areas and trends, you can better identify how they might apply to you. That’s true for the areas discussed above, and it’s true for other possibilities. However, it’s important to stay on top of the ebb and flow of things, as what may seem cutting-edge now could be mainstream tomorrow — or it could be out entirely.

Final thoughts

The purpose of this report is to give banks a better understanding of where their peers are today and how they are thinking about things, from baseline capabilities to the hottest pockets of innovation. No matter how boring or exciting the topic is, there is great value in looking at where your peers are headed in the context of your own business. One thing to note, though, is that it is amazing how quickly things can change, and we should all have a pulse on that, too. The reason we do this report every year is because attitudes and priorities shift — progress is not static by definition. As a result, it is absolutely essential for banks to keep revisiting this exercise and taking stock of how others are adjusting to the environment around them, changing market conditions, new innovations, and any other dynamic that might be relevant.

As always, you should take these insights as they make sense for you. The data in this report is meant to show how different institutions are approaching the future and identify areas more forward-thinking participants are focused on. Those areas may or may not be applicable to your bank. The objective is to look at the data and take from it lessons that can inform your perspective and strategy into the future. We should all be charting our own path, even if we’re generally headed in the same direction.

Survey respondent demographics

©CCG Catalyst 2025 – All Rights Reserved

No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording or any information storage and retrieval system, without prior permission in writing from the publisher.

Read The Banking Battleground: Views from the C-Suite

Read The Banking Battleground 2022: Finding the Opportunities

Download a PDF of this article