Successes in Transformation: Lessons from the Field

The need to transform the banking industry is understood and urgent. Banks are no longer clinging to their traditional ways of doing business — rather, most institutions are well aware that they need to make changes to bring their organizations in to the future, and they know that the time is now. However, that’s often where the conversation starts to lull. When it comes to taking actual steps to future-proof these organizations, many executives are struggling to figure out exactly what to do. Or, put a different way, the “how” of transformation is proving extremely difficult.

Such difficulties are borne out in the low number of banks currently that are considered leaders in innovation. In fact, there are really only a few traditional providers that have successfully remade their businesses for an evolving world and are getting attention for it. These institutions, though, are as important as they are rare, as they’re at the forefront of change in banking. It’s these banks that are leading the charge by experimenting with emergent technologies, playing in new areas like Banking-as-a-Service (BaaS) and embedded finance, and overall, taking a proactive approach to finding new and productive ways to serve customers. But how did they get there?

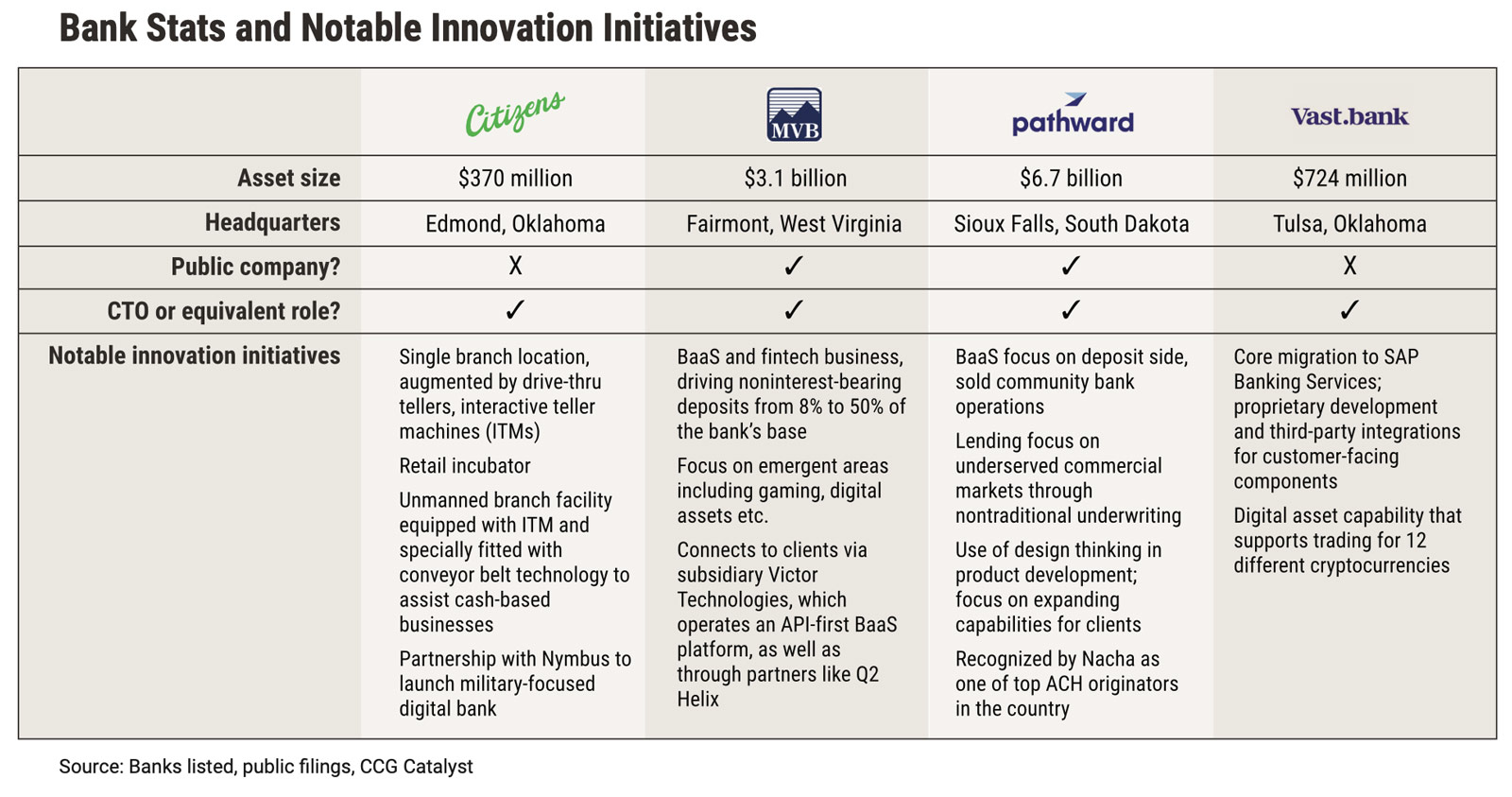

In an effort to provide a window into this kind of success, we took a look at a few of these institutions. Specifically, we conducted deep-dive interviews with executive leaders at four US banks that have achieved recognition for their forward-thinking approaches to banking and transformation — Citizens Bank of Edmond, MVB Bank, Pathward (formerly MetaBank), and Vast Bank — and analyzed their perspectives and responses to distill common themes.

The goal is to provide insight into what’s made certain transformation efforts effective and what a couple of key elements to understand might be for those looking to embark on a similar journey. This report is our attempt to shed some light on the “how.”

What do we mean when we say “transformation” in banking?

Transformation can mean a lot of things — and it’s a word many in banking have come to hate as a result. But what do we actually mean when we say it? Ultimately, it’s about change, changing your business, your operations, your technology, and anything else you need to, to get your business to a point where it can support anything you want to do now or in the future. Through that lens, transformation is the act of changing your organization in a way that allows it to perpetually support other changes.

The reason such flexibility is so necessary is because the environment we’re operating in is advancing at an increasingly rapid pace, leading to heightened competition and making it very hard to stay even one step ahead. Therefore, in order to remain relevant, banking providers need to be able to shift and adjust with the tides. There are a few specific pressures that have led to this dynamic, including:

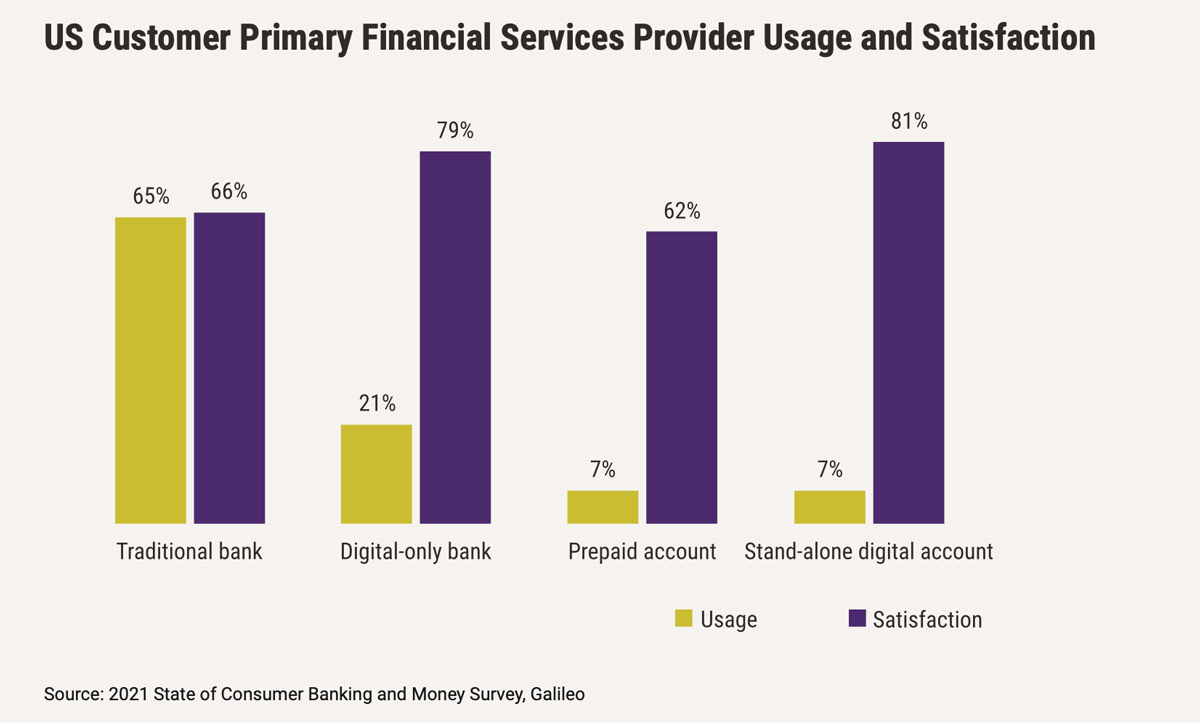

Fintechs and other competition. Even despite recent tumult, 1 fintech startups and other tech-savvy providers remain a key force driving the bar higher when it comes to digital experiences. These companies are known for pulling in users with thoughtfully designed propositions backed by user research and built using cutting-edge technology. And that’s created real pressure on traditional institutions — according to Galileo’s 2021 State of Consumer Banking and Money Survey, just 66% of respondents who use a traditional bank (defined as a bank or credit union with at least one physical location) said they were satisfied, compared with satisfaction levels of 79% and 81%, respectively, for those who use a digital-only bank (e.g. Varo Bank) or a stand-alone digital account (e.g. Venmo). Due to such players’ influence, banks are now being faced with the prospect of competing on differentiation in areas that have long been commoditized, for example, like typical checking and savings accounts. Moreover, these alternative providers have changed what is considered baseline from an experience standpoint — a target that is likely going to keep moving, meaning what’s expected today could be very different from what’s expected tomorrow.

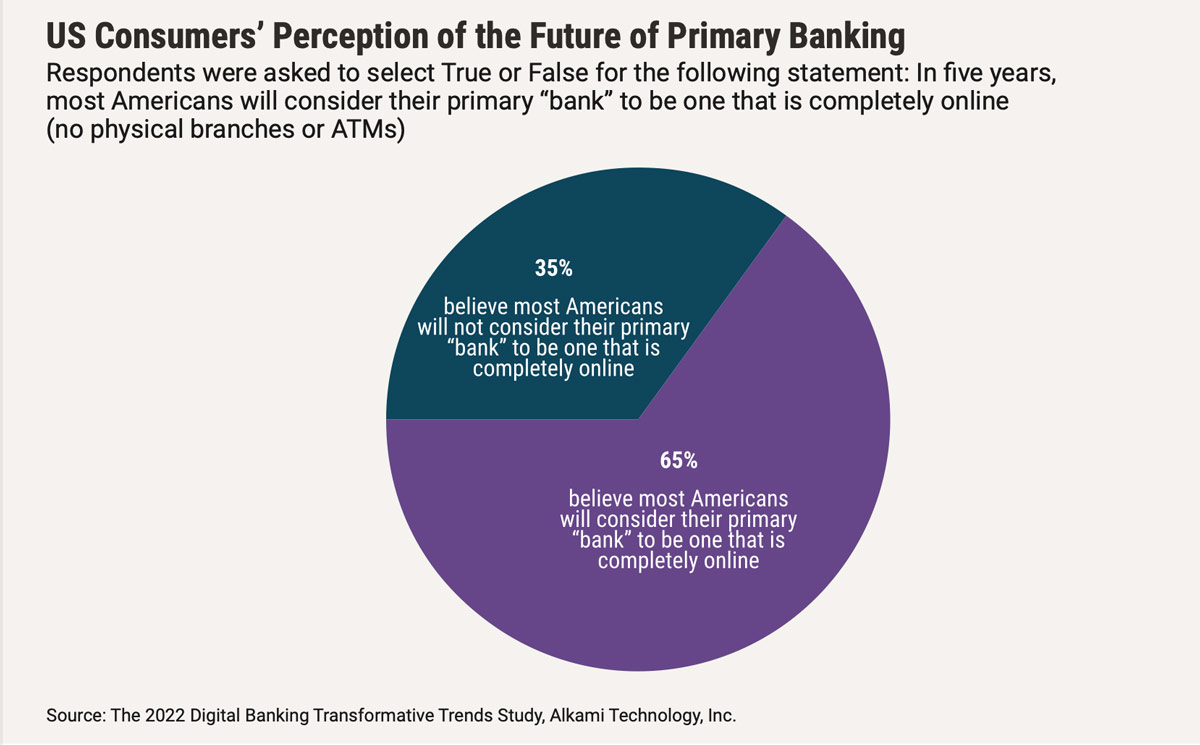

Changing customer expectations. As tech-focused providers move the bar higher, customer expectations are moving along with it, especially as it relates to digital. In fact, according to a recent survey by Alkami, a whopping 65% of respondents said they think most Americans will consider their primary bank to be one that is completely online in five years’ time. While that may or may not end up being the case, this data points to a trend among customers toward further adoption of digital at the heart of their financial lives. And, as a result, for traditional banking providers, their ability to win over these users is going to rely heavily on their ability to adapt as digital interfaces continually evolve. Meanwhile, it’s not just the wider availability of digital-first solutions in the market that’s having an impact here; customers are being conditioned to expect seamless, exceptionally designed services by other industries. Everyone’s got Uber at their fingertips and Amazon at their doors, and expectations built around the experiences those organizations provide, which are largely intuitive and almost mind-reading, are now impacting what people want from their banking provider, as well. That means banks are having to think beyond digital and consider how to cater to customers’ deepest needs and desires, including those they might not even be aware of.

Technology advancements. Technology advancements ultimately underpin the two areas above. It’s the incredible leaps made on the technology front that make it possible for the bar to move at all. Indeed, from the use of application programming interface (API)-driven architectures that make it easier for systems to communicate to the adoption of artificial intelligence (AI), and everything in between, the evolution of technology inside and outside of banking is a major driver behind the change the industry is experiencing at present. These advancements are also happening at a rapid pace, and will likely continue to do so, leaving many bank executives grappling with what to implement and how. At a minimum, banks are now reconsidering their underlying infrastructure and what it’s designed to support, but the industry as a whole is being pushed to consider what new areas will emerge in the future and what it will take to capitalize on opportunities as things further unfold.

As these pressures converge, it’s forcing banks to think about how they can stay top of mind with customers by placing the right bets, in the right ways. And it’s that part that seems to be tripping many executives up — essentially, there are too many paths forward, too many options, too many ways to transform, creating analysis paralysis for decisionmakers. In the following sections, we lay out a number of lessons from our research that are designed to bring some clarity to the process. These are organized across four key areas: executive alignment and vision, culture and operational structure, technology and infrastructure, and the risk-reward balance. While not an attempt to narrow the choices for any particular bank, this material aims to offer guidance on how to create an organization that knows how to approach them. Each section details specific learnings for a given area, explains how they’re expressed across the sampling of banks in our study, provides insight on how they might be manifested elsewhere, and includes a “Bank Spotlight” that dives a bit deeper into one particular example.

Executive alignment and vision: Innovate from

the top

Successful transformation starts at the top. It must come from the executive leadership team and at the board level. Every bank in our study stressed this as essential, and it was clear across the breadth of our conversations. All of the executives we talked to are aligned with their peers on the direction of their bank. They didn’t necessarily agree with each other on every little thing, but they were on the same page in terms of strategic priorities and how to implement them. And they all had a clear vision for the organization that they could articulate.

This area is very important because leadership sets the tone for the whole institution. But getting aligned if you aren’t already can be difficult. And vision can be even harder. Below, we explore a few elements these banks have in common when it comes to alignment and vision that can help provide a foundation for such a feat:

Ability to focus. None of the executives we spoke with could be accused of shiny object syndrome — they know what they’re trying to achieve, what their core capabilities are, and where to direct their efforts, whether that means bringing in low-cost deposits, reaching new customer segments, or entering entirely new business lines etc. They’ve all taken the time to determine exactly where their bank can add value and how. This ability to focus plays a big role in their successful initiatives, all of which are quite targeted. Pathward, for example, drives low-cost deposits through its BaaS relationships and uses those deposits to fund commercial loans, primarily to small- to medium-sized businesses (SMBs). That’s the heart of its strategy. And, as it looks to build for the future, it’s with those foundations in mind: “It’s about adding new products to the third-party management [BaaS] framework we already have,” Brett Pharr, CEO of Pathward, explained. “We have clients that need more products to push through their channels.” This approach has enabled the bank to go from around $500 million in assets in the early 2000s to a little under $7 billion in its latest earnings release. 2

Entrepreneurial spirit. The executives across our study exhibit an entrepreneurial spirit. They are not content to roll with the pack; rather, they tend to think outside of the box, which is especially critical in an industry like banking where risk aversion often tends to reign at the expense of innovation. Now, this quality may sound like something you either have or you don’t — and, to a certain extent, that is true. But, even if it doesn’t come naturally, there is an opportunity to tap into inklings that may be there and amplify those tendencies in others, as well. The truth is, all you really need is one visionary that can get everyone on board — a champion, if you will. For example, when Matt West, chief strategy officer at MVB Bank, was pulled into a small group of people in 2017 and told to get aligned on the fintech opportunity, it was at the direct request of CEO Larry Mazza. “He was determined to figure out fintech and not stick our head in the sand,” West explained. That drive spread to other leaders, spurring them to build what is now a sprawling BaaS and fintech business that’s helped move noninterest-bearing deposits from 8% to 50% of the bank’s base.

Communication across stakeholders. Communication from the top down is probably the most important aspect related to alignment and vision. It’s one thing to get everyone on the same page at the executive level; it’s another to communicate your vision clearly to the rest of the organization. But, ultimately, in order for transformation efforts to succeed, the messaging needs to permeate throughout all parts of the business, spreading those entrepreneurial and open-minded attitudes. Based on our research, the biggest thing for executives to keep in mind in this regard is to start early and communicate often. For instance, leadership at Vast Bank began socializing its plan to move its core infrastructure to SAP Banking Services, a modern banking system and novel player in the US market, with the board a full 2 years before any work took place, and it started talking about it with employees in all-hands meetings about a year before, according to Brad Scrivner, CEO of Vast Bank. The goal was to make sure it achieved buy-in across the organization, which he and his peers knew would take time and be central to success. It’s this kind of foresight that executives need to emulate when thinking about their own communication strategies. While those who operate at the top may set the tone, vision is implemented by everyone.

The takeaway from all of this is that executives need to make sure that they are in sync, that they agree on a desired future state, and that they can bring the rest of the bank along with them. Before launching any kind of transformation effort, leadership should take stock of where they stand as a group on these things, with particular focus on the items outlined above. Of course, perfection is not what we’re aiming for here — no one is expected to summon the spirit of Steve Jobs; however, mulling over why characters like him are so successful is probably a worthwhile exercise. Regardless of how exactly you approach this work, though, getting aligned and establishing your vision and direction for the bank should always be the first step.

Bank Spotlight: Citizens Bank of Edmond

When president and CEO of Citizens Bank of Edmond Jill Castilla joined the bank in 2009, it had just gone through a difficult examination that exposed credit- and fraud-related issues. Castilla spent her first few years working to come back from those problems by re-establishing standards of operation at the bank and building a culture centered on customer needs. By 2012, the bank had managed to get back on solid footing, in what Castilla says was considered the fastest turnaround in the country without adding capital. At that point, the executive team and the board had a choice to make — sell or move forward. According to Castilla, the decision not to sell was unanimous. “We decided we wanted sustainability. To do that, we had to shift our mindset and approach from survival to relevancy,” she

explained. That set the tone for the vision of the bank moving forward. Since then, Castilla and her team have concentrated on building an organization that is hyper-focused on the local community in Edmond, Oklahoma and uses that position to drive its business. It focuses on digital investments that resonate with its specific customers like interactive teller machines (ITMs), while also spearheading other more creative, community-building initiatives, such as the Heard on Hurd street festival, which brings together around 60 retail and food vendors each month from the surrounding area. The bank emphasizes noninterest-bearing deposit growth, with about 20,000 accounts open currently and 100-150 accounts opened each month — 10x what it was doing in 2015. For Castilla and her team, it’s all about being decisive, pivoting quickly if it doesn’t work, but at the same time, making it clear that failure is acceptable and trying is admired.

Culture and operational structure: Thrive don’t survive

Culture is perhaps the most important factor in transformation. Transform your culture, and it will transform the bank. That’s hard, though. And it requires organizing your business in a way that will encourage people to embrace what you’re trying to build. The most common thread among those in this report when it comes to culture and operational structure is an emphasis on thriving versus surviving. Not a single one of the banks included is looking to survive — they are all working to create a culture and organization that is capable of sustainability.

Here’s a couple of specific characteristics they all share:

Hiring and communication. Hiring the right people and making sure they understand the bank’s mission and objectives are key elements in building an organization that is ready for the future. The executives in our study highlighted the importance of hiring people with big ideas and a willingness to challenge and debate with their colleagues, while also ensuring those hires are balanced out by people with more traditional backgrounds in risk and compliance. The goal is to craft an employee base that’s very good at bringing ideas to the table, with mechanisms in place for assessing risk in a reasonable way. The second part of this is communication — you’ve got to continually reinforce the objectives of the bank and empower people to drive change. And that, in turn, will help to draw in even more strong talent. According to Scrivner at Vast Bank, high-performing people are attracted to companies that encourage entrepreneurial thinking: “We’ve created a culture where people feel comfortable challenging the CEO. Communication of that has to come from the top. And, as a result, we’ve been able to attract people who are really ready to roll up their sleeves and work together.” Essentially, the idea is to try and tap into a virtuous cycle by which hiring and communication, two powerful tools for cultural change on their own, are amplified when used together. “We pound our culture and values through communication, and we hire to it at the same time — that’s the key,” Scrivner said.

Open-mindedness and fast-fail mentality. Tied very closely to the above is creating an environment that supports open-mindedness and taking chances that might not pan out. Whether it’s exploring a new business line or implementing a novel technology, the freedom to try new things came up over and over again as a real driver behind the success of these banks. Notably, the executives we spoke with exhibit this not only in their treatment of ideas, but also in the methods they use in assessing those ideas and resulting initiatives. For example, a number of them are leveraging agile methodologies, which encourage rapid iteration and versioning across projects, and a few are starting to experiment with design thinking, a user-driven, iterative approach to problem-solving and prioritization. At Pathward, for example, they’re beginning to incorporate Jobs To Be Done theory, a frequent element in design thinking that focuses on using customer needs to drive decision-making, into product development — according to Charles Ingram, chief technology and product officer at Pathward, the bank is trying to move toward creating products and services that are intentionally designed to solve a specific customer need or “job” as a part of the customer journey. The use of such techniques, which are commonly found among some of the most successful large technology firms and fintechs, demonstrates a commitment to careful consideration of options and opportunities at the top, helping these organizations to stay laser focused on what matters without running the risk of prematurely rejecting things that might seem far-fetched but have merit.

Organizing around focus areas. As vital as culture is, it’s not enough on its own — to be sure, you can have all the good ideas in the world, but without the ability to organize, you will be lost. A bank looking to thrive for the long haul needs the right people with the right kind of thinking onboard, but it also must create an operational structure that can support their development. That means organizing around your strengths, around your focus areas, and making sure the entire institution understands what you’re trying to achieve and how everything ties together. This is something each bank in our study manifests in its own way. MVB Bank, for instance, has four distinct business lines today: its traditional bank, focused on asset generation; fintech banking, used as a funding source and fee avenue; fintech-building through majority investments; and fintech-backing through minority investments. All four of these areas complement each other — the BaaS business feeds the traditional business, while the investment arms allow the bank to benefit from new technology advancements and stay on top of changes in the market. In another example, when Citizens Bank of Edmond made the decision to pursue a more digital-centric strategy after its turnaround, reducing its physical footprint to one branch was part of that effort. That single branch is now a focal point of its community-first approach, serving as not only a bank branch but also a coworking space and gathering area. As bank executives contemplate what their own future operations might look like, it’s essential to come back to what you’re trying to do. That could mean a dedicated fintech group or it could be a focus on project management and well-defined project management office (PMO) etc. It could even mean a full organizational restructuring. Ultimately, you need to create a structure and processes designed to support your desired future state.

Changes to culture and operations take time and must be done with intention. That’s the most important thing to grasp here — this kind of transformation may seem softer than, say, a technology overhaul, but it’s not. The importance of open-mindedness needs to be reinforced over and over again, and hiring practices must center on those who will encourage such thinking and spread it. Moreover, it’s absolutely critical to do all of this with a sharp operational focus. At the end of the day, the bank’s mission should be clear in who works there, how they interact, and how they are organized.

Bank Spotlight: Pathward

Pathward started its BaaS operations two decades ago as a side business, focused mostly on the prepaid space. But, as the business began to grow, it became clear that BaaS had the potential to be the main growth engine for the bank. Leadership doubled-down on that possibility, selling off the community bank and turning its attention to its BaaS clients, which now make up its primary deposit business. The bank had to completely restructure its organization to support this shift, creating just a couple of divisions as a result: BaaS — which includes payments, issuing, credit solutions, and tax — and commercial finance. Both of those divisions roll up to Pathward president Anthony Sharett. Additionally, it had to invest heavily in risk, compliance, and technology to support the growth of its BaaS operations. That changed the culture of the bank quite a lot, according to Pharr, because it began looking for talent with a more entrepreneurial spirit. Today, Pathward bears little resemblance to the 12-branch community bank it once was, both organizationally and in terms of reputation in the market, where it’s well known as a heavy- hitter among banks with under $10 billion in assets involved in BaaS. Meanwhile, according to Nacha, the bank is one of the top ACH originators in the country, 3 and per Sharett, it’s doubled its lending portfolio since 2018, when it acquired Crestmark Bancorp.

Technology and infrastructure: Flexibility, flexibility, flexibility

So far, we’ve discussed two foundational components of transformation; the next step is implementation, or making sure you’re able to put your strategy into practice. And that requires tools, which brings us to technology. If vision and culture represent the heart of transformation, technology is the backbone — it’s what drives the speed of change. However, with a majority of banks still running on core systems built and initially implemented decades ago, keeping up can be very difficult, especially when it comes to integrating with new tools and services. As a result, transforming their infrastructure to overcome this legacy technology is an imperative that many are dealing with. Technology transformation can take many forms, though — there is no set way to get to the future in this sense. The goal, rather, is flexibility. All of those included in this report have managed to achieve flexibility with regard to their technology stack that allows them to adapt to new trends and opportunities by leveraging different partners and solutions easily and at a risk level comfortable for their organization.

There are three main ways they are doing this:

Creating abstraction to streamline integration. This is a very popular approach to technology modernization, as it creates flexibility without requiring an actual core system migration. Rather, it involves leveraging an API-driven layer that sits between your current core infrastructure and anything you want to integrate to. In this scenario, your existing core system doesn’t matter all that much. Both Pathward and MVB Bank have pursued this strategy in some capacity — Pathward, for example, has built an abstraction layer that allows its clients to integrate to the bank in a standardized way, while MVB Bank connects to clients via its subsidiary Victor Technologies, which operates an API-first BaaS platform that the bank has had integrated with its current core, as well as through partners like Q2 Helix. In both cases, these banks had to work closely with their core providers and commit considerable resources to the development of their infrastructure. However, the result is the freedom to integrate as they please, with control, and without having to make any major changes to underlying systems.

Migrating to a new API-first core system. This is what most in the industry would refer to as a “big bang” approach. It is aptly nicknamed because it means fully changing over your core infrastructure to something entirely new, which can be both risky and scary. It’s also a long-term approach to future-proofing your business, especially if you are moving to a modular, API-first solution that can be iterated on easily in perpetuity. The key for banks pursuing this path is to evaluate all of the options, new and old, while also considering core processes you have offloaded to subsystems that can influence a core replacement strategy. In our study, the only bank pursuing this strategy is Vast Bank, which is in the midst of its migration from Jack Henry & Associates (JHA) to SAP. According to Scrivner, the bank wanted to move away from a bank-in-a-box approach to technology and really compete as a digital leader. It considered a range of solutions as part of this effort, including from Infosys, Temenos, Oracle, Fiserv, Finastra, and its existing provider. In the end, Vast Bank chose SAP, he said, because it came with global enterprise resource planning (ERP) power and the ability to provide a real-time system, with a single source of truth, in the cloud.

Taking a greenfield approach. Banks today may also opt to build a greenfield bank on modern technology. This reduces a lot of the risk associated with core modernization by allowing the bank to test the waters without fully committing to a new platform. In a greenfield play, a bank essentially creates an entirely new and separate entity, usually with a very specific mandate. Citizens Bank of Edmond, for instance, is currently working on such an initiative with banking technology solution provider Nymbus to power its new digital bank offering aimed at meeting the unique needs of newly enlisted members of the armed forces. The upcoming offering will operate under a standalone brand and is expected launch in early 2023. 4 As part of the initiative, Nymbus will help with brand creation, go-to-market strategy, and ongoing growth support. According to Youssi Farag, the bank’s chief financial officer, it will start by targeting the 70,000 or so new soldiers that matriculate into Oklahoma’s military bases each year and is expected to offer cutting-edge features like digital account opening in about two minutes.

When considering your own approach to technology, it’s important for banks to understand that not only is there no one-size-fits-all answer, but also that the path you choose must be driven by your own strategy and risk appetite. What you want to do and how much risk you are willing to take on to achieve it should be the key levers in your decisioning. For example, most of the banks we’ve talked to that operate in the BaaS space (both for this report and outside of it) are on traditional core infrastructure. This is often because they don’t need much beyond standard integrations, which an abstraction layer can provide, and benefit from the regulatory cover that an established provider offers when working in such a novel space. Any bank undertaking their own technology transformation effort should be assessing their positioning and aspirations in a similar way. Once you do that, making the necessary choices shouldn’t be all that hard. Remember, there are plenty of options out there. Each of the banks in our study is on a path dictated by their own needs, with the same endpoint of flexibility in mind.

Bank Spotlight: Vast Bank

Vast Bank, family-owned and headquartered in Tulsa, Oklahoma, began its transition to SAP Banking Services in June of 2018. The goal was to create the ability to move fast and make changes easily to support the bank’s digital leadership strategy. It’s done that by leveraging SAP as its core in conjunction with a modular set of technologies, all deployed in the cloud, which means it can now pull things in and out as they become relevant or lose relevancy, according to Stephen Taylor, chief information officer at Vast Bank. “A lot of our peers want to change but are limited in what they can do with existing infrastructure. For traditional banks on traditional infrastructure, they can’t react to market conditions and opportunities,” he explained. SAP provides a powerful transaction and enterprise risk and compliance engine in its SAP S/4HANA product, but it doesn’t include any ready-built customer-facing components. All of that comes from proprietary development and third-party choices made by the bank. The platform is essentially an “empty bucket,” Scrivner said. “We can do anything.” So far, that’s included building its own onboarding and know-your-customer (KYC) components, creating independent third-party network integrations, e.g. with Visa, and integrating to a slew of handpicked services in functional areas like remote check deposit. Additionally, the bank has developed a digital asset capability that supports trading for 12 different cryptocurrencies, which it managed to deploy in just 6-9 months, using SAP’s multitenant and multicurrency capabilities. Taylor’s team of 14 currently leads all design and development work in-house with support from multiple third-party vendors, including enterprise software and solution providers Axxiome and Epam, which altogether provide another 172 technologists. Eventually, the bank plans to move all of its operations over to SAP; it’s taking a slow-and-steady approach to its migration, however, bringing parts of the business over piece by piece as it continues to vet the new system.

The risk-reward balance: Get comfortable

Our dedicated section on risk comes at the end of this report, largely because it is a theme threaded throughout — in each of the other areas, from alignment to technology, the willingness to think differently about risk is what carries these executive teams forward more than anything else. These banks have an exceptional ability to distinguish between perceived risk and actual risk as they assess new possibilities, and that’s a major factor behind their success. It’s where they diverge most from their peers and what truly allows them to reach new heights. Here, we tie the threads together, distilling a few commonalities they share in this regard, including:

Effective measurement of risk-reward dynamics. The key word here is “effective.” Those in our study are very effective at measuring risk and potential benefit, which enables them to get comfortable with novel ideas in a way that others might struggle with. This goes back to the concept of perceived risk versus actual risk — because these institutions push beyond the obvious to better identify actual risk and assess opportunities based on that, they can experiment in different areas that might seem out of bounds for others, who perceive the risk of engagement to be higher. Pathward, for instance, is able to reach businesses that might otherwise struggle to get traditional financing due its underwriting capabilities, according to Sharett. Specifically, he said, the bank can assess a business’ goals and cash flow on a more granular level, and it’s worked to understand the nuances of markets that are often underserved, including travel and hospitality as well as rural communities. Moreover, according to Pharr, the funding cost advantage provided by Pathward’s BaaS business allows it to provide this “controlled, managed credit” at competitive rates and structures, which means those companies are more likely to thrive in the long run.

Operationalizing processes for new opportunities. This follows on directly from the above, as the ability to effectively measure risk comes in large part from formalizing how it is evaluated when looking at possible areas of interest. The banks in our study by and large have processes in place that allow them to consider new initiatives, from new business areas and markets to potential clients and products, in a standardized way, ensuring risk frameworks are applied evenly across their organizations. For example, when MVB Bank is onboarding a new client, dedicated fintech risk analysts are assigned to the application and given specific tasks through a notification structure built into Victor, such as reviewing the client’s compliance documentation or Bank Secrecy Act (BSA) policy. For each application, the assigned analysts conduct a review across nine different risk categories, according to Angela Lucas, chief risk officer at MVB Bank, and a risk score is calculated in the platform based on their inputs. Every potential client must meet the bank’s risk-score threshold in order to be onboarded. This kind of standardization helps to avoid patchwork decisions that could lead to either missed opportunities or botched forays as well as provides a level of confidence that allows decisions to be made with greater conviction.

Playing to existing strengths and capabilities. As we mentioned before, none of the executives interviewed for this study could be accused of shiny object syndrome. They are all very good at identifying where their capabilities align with opportunity and pointing their efforts in that direction. This ability to focus, in addition to the advantages we’ve already discussed, also plays into their ability to manage risk. That’s because they are doubling-down on their strengths, and thereby their expertise. A good example of this is in Citizens Bank of Edmond’s approach to community-driven digitalization. The bank occupies a unique position in its community, not only as a financial institution but also as a leader and relationship builder. And it’s focused on that position and the proximity it provides to create products and services that are very tailored to those in Edmond. To accomplish this, Castilla and her team look for specific ways they can use technology to add value and their knowledge of the environment to mitigate risk — for instance, when it identified a need for banking services geared toward cash businesses in the community, the bank implemented a 500-square-foot facility equipped with technology typically used in casinos to roll coins and strap dollars that it re-engineered and put a customer interface on. Customers can now deposit and withdraw 24/7 up to $10,000. It was able to manage the risk of such an initiative because of its deep understanding of the community, how the facility would be used, and by whom.

Risk is always going to be the thorn in the proverbial side — the biggest hurdle, the largest stumbling block. It hinders alignment and transformation across culture, operations, and technology. It’s also of critical importance and will never cease to be. As a result, institutions need to get comfortable with it in order to move forward. That doesn’t mean taking outsized risks; instead, this is about finding more creative ways to think about risk and more accurate ways to assess it. The executives we interviewed for this study are very, very good at this. They can see beyond the “unproven” market or the “undesirable” client and identify opportunities where risk can be managed, and where others might not go. In a way, they are finding alpha. And that should be the goal, to figure out where you might be able to use your capabilities to manage risk differently from your peers and thus drive business they’re leaving on the table.

Bank Spotlight: MVB Bank

MVB Bank launched its fintech operations in 2018, with an initial focus on payments and gaming companies, after about a year of research and relationship-building. It now operates six verticals across its fintech banking business line: BaaS, gaming, digital assets, payments, merchant acquiring, and issuing. And it’s formalized its risk approach for assessing new opportunities and governing engagement. Specifically, for each of these verticals, it’s developed a risk playbook, which includes policies, risk assessments, training procedures, audit guidelines, and board reporting requirements. These playbooks serve as the ground rules for selecting, onboarding, and working with fintech clients, according to Lucas. Creating this material was an all-hands-on-deck effort, she said, explaining that it required pulling in subject matter experts embedded in each of these verticals to drive content and development. Today, the playbooks set the standard of risk for the entire fintech part of the organization, per Lucas, with bankwide training on all of them. The result is that client risk is managed transparently and uniformly for every vertical. In addition, while new clients are managed by an implementation team within the fintech business unit, the bank has a dedicated product and services committee that is tasked with assessing potential new offerings. Usually at a client’s request, they will evaluate the risk and reward of a particular opportunity and decide whether or not to engage. If the answer is yes, the bank’s PMO creates the necessary workstreams to get the initiative started. Critically, MVB Bank’s risk framework is part of a three-pronged approach to implementing new opportunities that also includes technology and operations, ensuring all initiatives receive the resources they need to be successful. According to West, the ability to operationalize the way the bank assesses and executes on opportunities is a major reason why it’s been able to grow its fintech business the way it has.

Finding your own inspiration

Across all of the areas we’ve covered above, from alignment and culture to technology and risk, the commonalities these banks exhibit serve to shed meaningful light on what’s made them successful and why. However, as valuable as these similarities are, it is important to note their differences, as well — each of these institutions is also very unique in their strategy and own specific initiatives. Citizens Bank of Edmond’s local, community-centric strategy bears little resemblance to Pathward’s expansive BaaS business, for example. Understanding not only how these banks are similar but also appreciating that they are different is key, because it points to perhaps the biggest lesson of all: The way forward is not to try to replicate any individual bank’s success. Instead, any bank looking to embark on their own transformation journey should use the lessons explored in this report as inspiration.

Ultimately, you should be identifying your strengths and setting your strategy first, and letting everything else follow from there. Regardless of what specifically you choose to do, there’s a reason “ability to focus” is the very first commonality we discussed. Once you’ve tackled this, you can determine what you’ll need to support your strategy and how to communicate and execute on it. Think about the common themes those in our study share — an ability to rally stakeholders, a knack for communicating their vision clearly and building an organization that can support it, the creative and thoughtful use of technology, and critically, an aptitude for distinguishing between perceived and actual risk when assessing opportunities — then, think about how such elements might apply to your own business. There is no blueprint for success, no already chartered path. You’ve got to look at what others have done and make it your own.

©CCG Catalyst 2025 – All Rights Reserved

No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording or any information storage and retrieval system, without prior permission in writing from the publisher.

Download a PDF of this article