Reimagining the Last Mile in Banking

Sponsored by

The way banking looks and feels has been much the same for a long time — you’d go to your bank (typically via branch, desktop, or mobile) and access a range of financial products (checking accounts, savings accounts, loans, etc.). Depending on the kind of customer you are, i.e. retail or commercial, you might have a relationship manager or another point of contact. Either way, though, at the heart of the model has generally been a direct line between the bank and the end client. That’s now starting to change.

As with many other industries — in-store shopping to e-commerce or traditional cable to video streaming, for example — the way banking products are being constructed and delivered is evolving away from this direct, 1:1 paradigm, and toward multifaceted distribution. That means, in addition to provision through bank-owned channels, we’re seeing access to bank offerings extending outside of an institution’s walls with growing frequency. This can come in many forms, from being able to open a checking account with a neobank like Chime or Current that’s partnered with a sponsor bank to accessing point-of-sale (POS) lending products embedded in an online checkout flow.

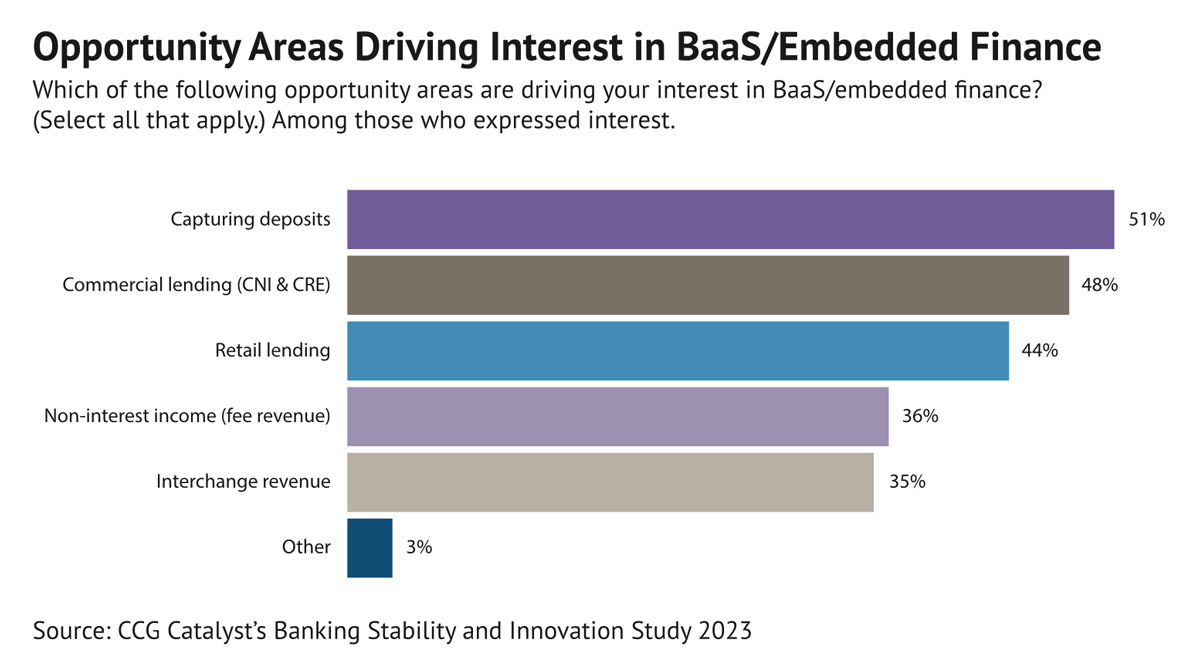

A major driver of this shift is the rise of Banking-as-a-Service (BaaS), which enables banking institutions to acquire customers by providing access to the financial system to nonbank companies, including fintechs, that want to offer financial services. Through BaaS, banks can extend their ecosystem and deliver products and services through third parties that own the end customer relationship. This proposition took the industry by storm a few years ago as a slew of fintech companies emerged in need of sponsor banks to offer financial services, and banks took an interest driven by the promise of new revenue in a highly competitive environment. 1 Now, as the concept matures, we’re beginning to see the wider implications that BaaS has for the future, especially when it comes to the last mile of delivery in banking.

In this report, we examine how BaaS is evolving from a hot (arguably novel) trend into a new way of looking at delivery entirely, with many different permutations and possibilities. In particular, we look at how the needs of a sponsor bank are changing in response to increasingly complex client demands and regulatory pressures as well as how it’s playing with the adoption of additional distribution models like embedded finance and bank-owned marketplaces. As part of our analysis, we spoke with a number of banks in the BaaS space to assess their pain points and desires and have distilled the findings from that exercise into a series of important considerations for the future.

A changing delivery landscape

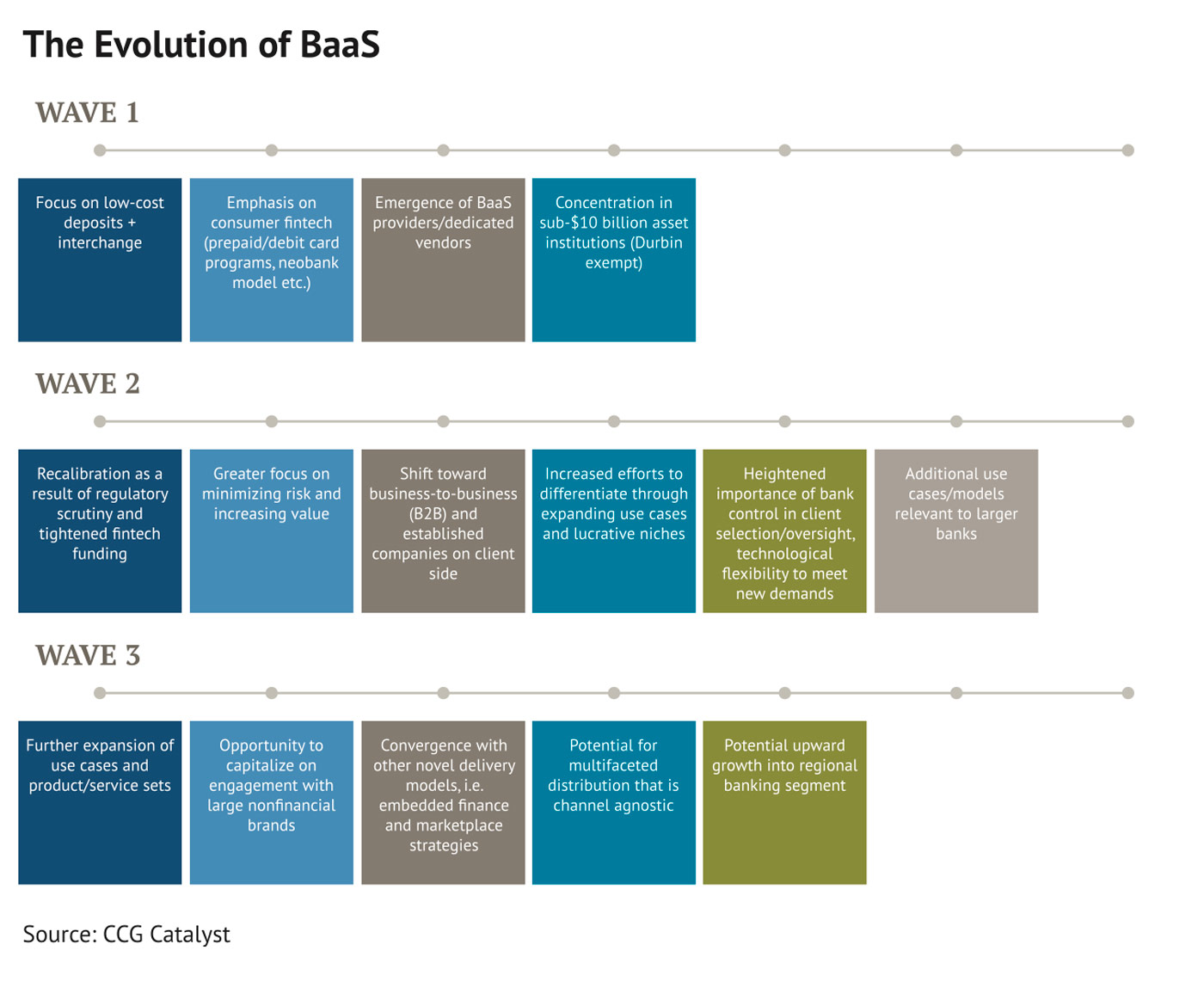

The most common understanding of BaaS is centered on the ability to provide a debit or prepaid card program and hold deposits on behalf of a third party. 2 As a result, it’s long been associated with the neobank model by which a sponsor bank holds the deposits for a fintech looking to provide transactional accounts (often retail) that are insured by the Federal Deposit Insurance Corporation (FDIC). However, BaaS is now accelerating beyond this basic offering to more actively embrace niche use cases that are customer driven. In particular, we are starting to see a lot more activity in the business-to-business (B2B) space, as well as in additional product areas like lending, pushed forward in part by difficulties facing the consumer fintech market 3 and in part by banks’ desire to drive greater utility through differentiated propositions. If Wave 1 of BaaS was foundational, Wave 2 is characterized by an ability to differentiate with specific customer segments, bringing the concept of community banking to a new level. The end result of this evolution (Wave 3) will likely see a shift toward truly extensible channel distribution, with increasingly unique value props, taking things far beyond BaaS itself. Below, we take a look at each of these eras and how they’re contributing to the future.

Wave 1: BaaS foundations

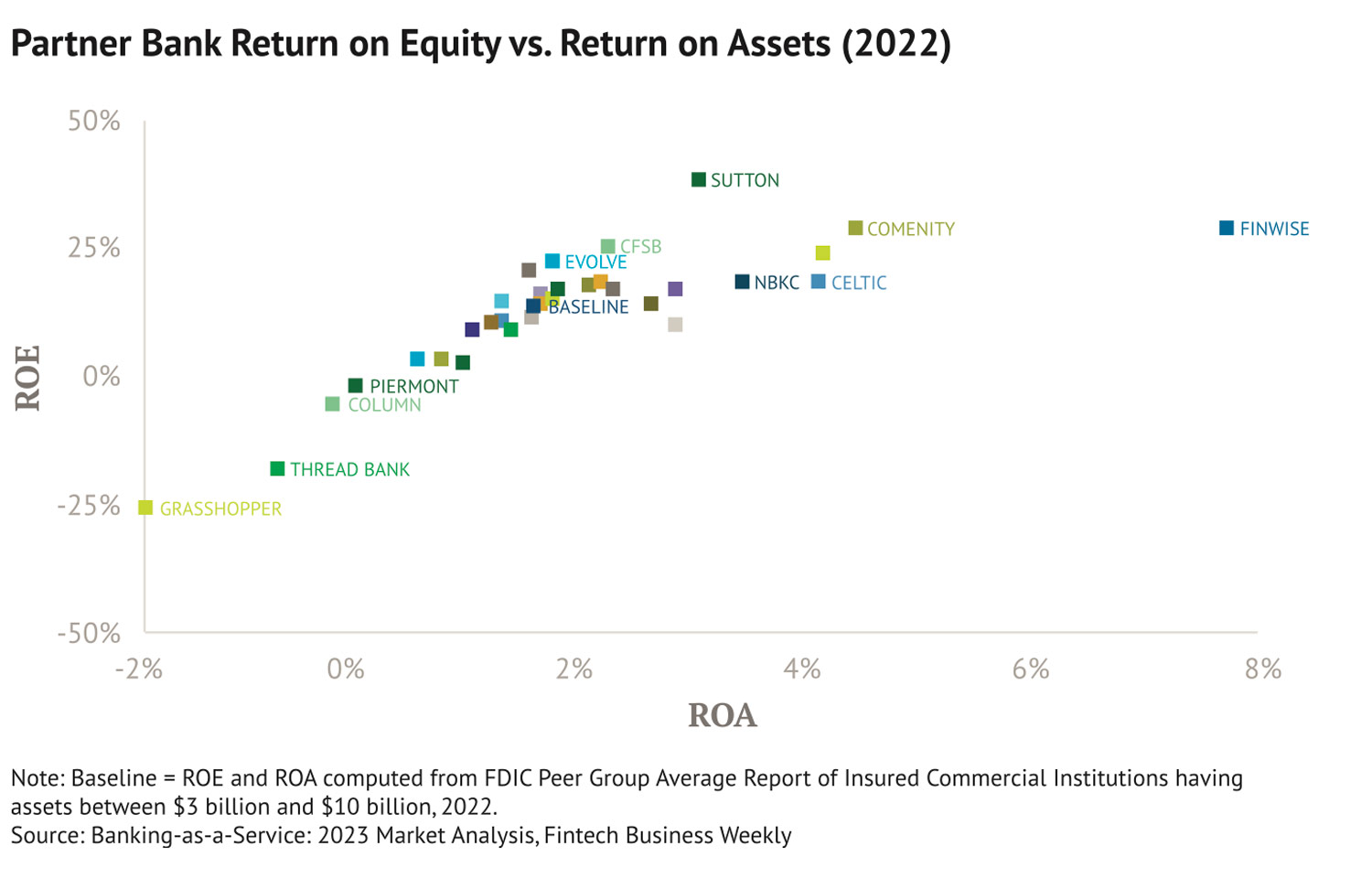

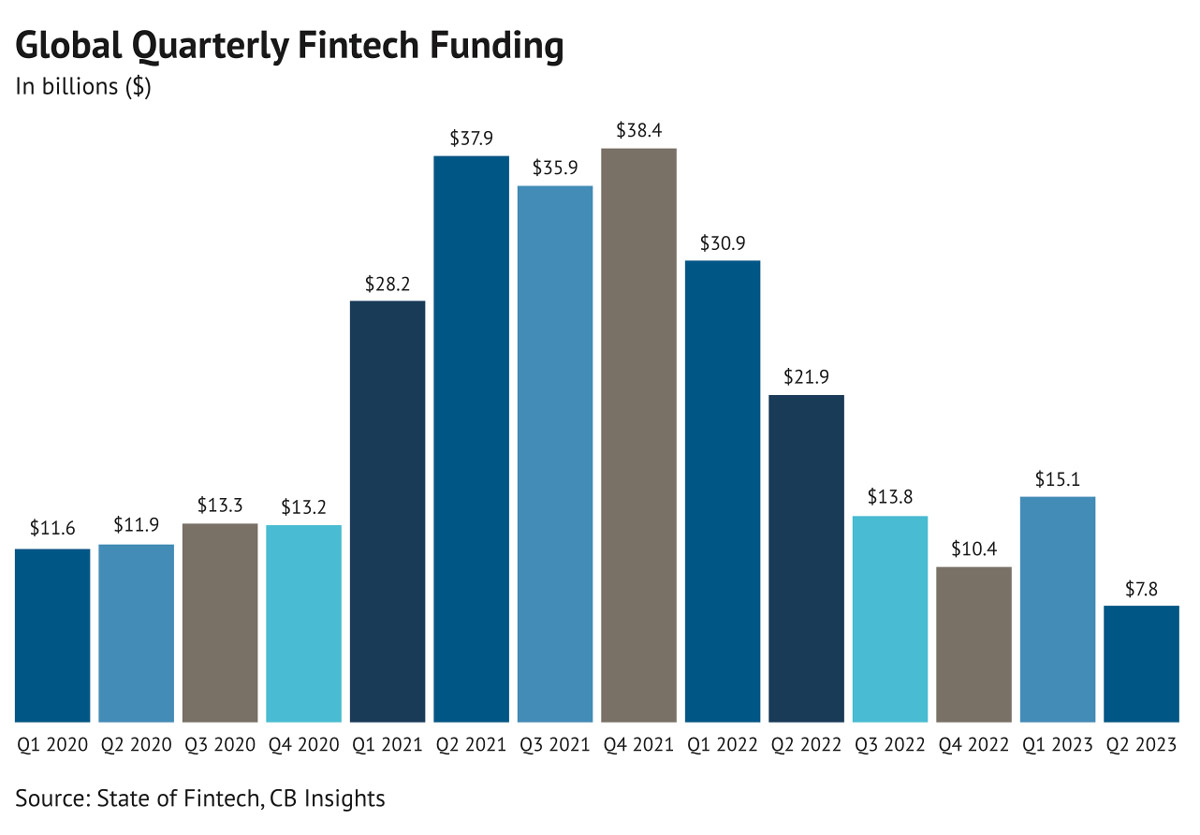

The origins of BaaS date back several decades, to the rise of co-branded cards, 4 but the concept really took off in the last five years or so in response to a large influx of private capital into the market, especially in 2021, when fintech funding reached $140.4 billion, dwarfing the prior year by a factor of nearly three, according to CB Insights. That made it easier for companies to secure funding and resulted in many new fintechs that needed sponsor banks to underpin their services. This got the attention of a growing flock of community banks who were looking to diversify in an increasingly digital world and pull in low-cost deposits. Additionally, the potential to drive interchange revenue, a core business model of many fintechs in the early days of BaaS, made the space a good fit for Durbin-exempt institutions with less than $10 billion in assets. And, while not a silver bullet, the model proved quite successful, with many of these early players touting returns above their peer group, creating even more interest in the space.

Meanwhile, as part of this rolling wave, technology-first facilitators emerged to make it easier for banks and fintechs to connect. These BaaS providers come in different flavors and provide things like ledgering and reporting capabilities as well as a slew of other functions that can range from relationship sourcing all the way to handling cardholder disputes and customer service. They essentially act as a middleman between the bank and the fintech, with varying degrees of involvement in the relationship. The rise of these providers made it much easier for banks to get up and running with their BaaS programs, lowering the barriers to entry dramatically. This, combined with the potential to drive new revenue and better metrics, catapulted BaaS from a burgeoning opportunity to the forefront of innovation in the industry. New deals were inked on a seemingly daily basis, and there was probably no arena quite so hot.

And that’s precisely when BaaS began to face some real challenges. Specifically, several sponsor banks came under regulatory scrutiny due to lack of oversight of their BaaS programs, 5 and in many of those cases, they were relying on a BaaS provider for much of their relationship management. 6 This led to a shift away from setups that abstract away the bank-fintech relationship and toward models that give the bank more control, forcing banks to rethink their compliance and due diligence approaches. Meanwhile, just as this was taking hold, tightening private capital against an uncertain economic backdrop started to put pressure on fintech funding, giving these companies far less room to run and making it harder for sponsor banks to identify and win the right clients. As a result, after several years of flying high, it became clear that BaaS needed to recalibrate — with two things in focus: minimizing risk and increasing value.

Wave 2: Minimizing risk and increasing value

This recalibration brought us to the phase of BaaS that we are in now — one in which sponsor banks are looking to improve the control they have over their relationships, while at the same time finding ways to drive sustainable value. Based on our conversations with executives in this space, that’s led to far less emphasis on consumer fintech companies, especially those pursuing the neobank model, and more focus on those that already have established revenue streams and want to add financial services. Such a strategy minimizes risk considerably because it shifts attention to companies that are already established and thus less likely to go under. Additionally, these players aren’t relying on interchange fees to drive value; rather, they are looking to make their own products and services stickier. As a result, banks can diversify how they define those relationships, creating more thoughtful revenue streams in the process.

As Liz Myers, SVP of payments & fintech partnerships at Republic Bank of Chicago, told CCG Catalyst, “BaaS activity cannot continue to be centered around a consumer debit card. There’s only going to be a few winners on the fintech side. We have got to look for other areas like B2B.” In particular, Myers said she sees opportunity in areas like trucking and the gig economy where disbursements need to be paid out on a regular cadence. This is a sentiment we heard echoed over and over again, in different capacities — for example, Wade Peery, chief innovations officer at FirstBank, said, “So much of the BaaS business is based on debit interchange. We are a $13 billion bank. We are looking to do credit, especially credit in the business space.” In fact, nearly all of the use cases we discussed with bank executives for this report were outside of the typical card program that made BaaS so popular. And for that matter, many of the banks we talked to didn’t fit the usual sub-$10 billion in assets BaaS institution. This suggests that with the embracing of more unique propositions, the opportunities for banks in this arena, including who can play, are also changing.

However, the elephant in the room is that, as banks get focused on specific niches and customer segments outside of the “traditional” BaaS model, they are going to have to support unique and increasingly challenging needs. We’re no longer in a one-size-fits-all environment. And banks that want to attract clients that serve these customer segments must differentiate on products and client experience. This is creating a number of hurdles, especially from a technology standpoint. Marty Miracle, chief information security officer at Sutton Bank, told us, “Differentiation comes from an ability to customize. As a result, we need things that are bespoke and allow some control.” Sutton Bank primarily caters to payment program partners in the prepaid/fintech space. These clients are now asking for things like direct access to their transaction data via application programming interface (API) and customized views of their activity.

As a result of all of this, we are seeing a lot more emphasis on flexibility from banks operating in the BaaS sphere. All sponsor banks need to work with technology partners on their programs — that could be a BaaS provider, it could be through a bank-owned platform that integrates with an array of vendors in a direct model, or it could be a mix of the two. Based on the conversations we’ve had, though, the most important thing is that you’re able to support your clients’ needs as they arise. This is also where the possibilities of BaaS are really starting to transform the last mile of delivery in banking. It’s no longer simply a channel to back fintechs but a pathway to rethink how financial services are constructed and delivered holistically. As Peery explained, you’ve got to figure out what you’re good at, and then find ways to extend distribution in those niches. “Community banks are letting deposits get eaten away — they already know they need to have a niche to survive,” he said. “Beyond that, some banks are doing basic BaaS. But put those together, and you’ve got BaaS plus niches where you can play in a differentiated way.”

Wave 3: BaaS today, what tomorrow?

So, where are we headed? We’ve established that BaaS is expanding to include many different use cases, offering banks an opportunity to create new niches and serve additional customer segments. Beyond that, however, is an even bigger shift in distribution, specifically, as BaaS smashes into two other emerging trends: embedded finance and bank-owned marketplaces. Here’s a look at these two concepts and how they are playing into this broader dynamic:

- Embedded finance. Embedded finance is closely related to BaaS in that it also involves providing access to the financial system to nonbank companies, but it is generally focused on use cases that position delivery at the point of need — for example, embedding a buy now, pay later (BNPL) offering in an e-commerce website. Because of this, embedded finance offers banks an opportunity to take their BaaS ambitions far upmarket, as many of the companies that are interested in such propositions tend to be large brands. 7 This coincides nicely with banks’ desire to focus more on clients with existing revenue streams, over higher risk fintech startups, and prioritize their needs. As such, over time, we can expect to see the line between BaaS and embedded finance blur considerably, leading to increasingly complex and advanced opportunities. For context, the addressable market for embedded finance is estimated to reach $7.2 trillion by 2030. 8

- Bank-owned marketplaces. This concept refers to the provision of an ecosystem by a bank in which a range of products and services are offered up, both from the bank and from third parties it’s partnered with. For example, a bank may want to provide its small-business customers with access to accounting tools or email marketing. CCG Catalyst has talked about this before as “the flipside of embedded finance” by which a financial institution starts to embed more services into their own offerings in order to provide greater value. 9 However, it is becoming extremely applicable in the new age of BaaS as banks look to provide value-added services that make their propositions stickier.

As BaaS evolves further away from its original mandate and merges with these other areas (and potentially additional distribution pathways that haven’t emerged yet), it’s creating a truly differentiated way to think about the last mile. Imagine a scenario in which a bank could provide access to deposits, lending, and payments through its commercial customers (be they small businesses or big brands, in whatever niche or niches that make sense) and then turn around and sell those customers the same products with the addition of nonfinancial services like payroll or accounting tools. Now, imagine that same bank allowing its clients to resell those payroll or accounting tools to their own customers. That is multifaceted distribution.

The question then becomes, “How do I as a bank support that?”

Capitalizing on the new last mile

Ultimately, what we are likely to see going forward is more sponsor banks with perhaps a small basic BaaS offering (like the ability to support a consumer card program) but with greater emphasis on use cases where they can differentiate, especially on the commercial side, where true embedded opportunities and ways to add additional value come into play. As a result, their needs are going to be very different from what they’ve been. Based on our discussions, we distilled several key imperatives for institutions as we move through Wave 2 to Wave 3. Of course, some banks will not participate in the new last mile at all, and that is perfectly fine. But for those that want to capitalize on this evolving delivery landscape, the below considerations are a good place to start.

Achieving product and service extension

Banks in this new environment will need to be able to enter new client segments and business areas easily. And, in particular, they will need to be able to support extension beyond typical deposit or payments use cases. Lending/credit products are going to be key. As Chris Black, CEO and president of Thread Bank explained, “True BaaS is providing deposits, lending, and payments all at once. Or at least more than one of those things. That is the future.” As part of this, sponsor banks will also need to be able to integrate with an array of vendors to support their offerings. They may work with multiple BaaS providers or, as mentioned above, pursue a combination model by which some programs are handled by a BaaS provider while others are handled in a direct setup owned by the bank. According to executives we spoke to, a combination model can be attractive because it allows the bank to benefit from the relationships and base-level offerings a BaaS provider can provide while also enabling it to add new products and services that may not yet be supported — for example, access to real-time payments or credit products. Additionally, banks can benefit from the commercial advantages of having a direct business.

Finding and supporting differentiation

In Wave 3, every bank is going to be a little different, and each will need to be able to solve unique client problems and create stickiness with specific segments as a result. As such, a standard set of tools and expertise is no longer going to cut it. Especially as these banks begin to serve more complex commercial clients, they’re going to need to be able to take a consultative approach, solve problems, and deliver data and functionality how their customers want to consume it. According to Miracle at Sutton Bank, speaking about the bank’s clients’ desires for customized views of their activity, that includes not only being able to deliver API access to third parties but also the ability to deliver UI/UX. That could, for example, be achieved by creating embeddable widgets via orchestrated APIs with an interface overlay, similar to how offerings from companies like Stripe and Plaid have evolved. 10 Additionally, value-added services will be critical to competing effectively, and the ability to bundle those services will be important. That means being able to curate offerings from third parties and deliver those offerings through the bank’s infrastructure to end clients. These institutions are also going to have to really think about who they are hiring to run their operations and the deep knowledge that will be required to take things to the next level.

Driving efficiency and sustainability

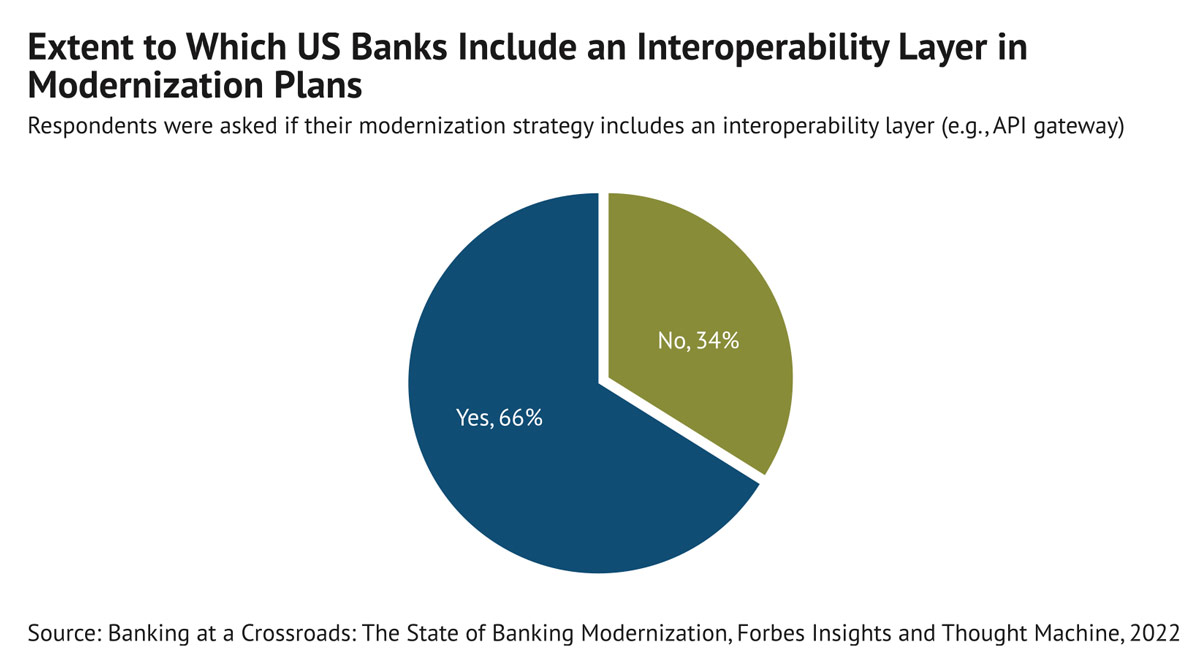

As more complexity is added to the equation, the ability to standardize where possible is going to be key. To this end, the bank executives we’ve talked with stressed the importance of being able to deliver everything they do in a reusable way through multiple endpoints — for example, Myers at Republic Bank of Chicago talked about the possibility of embedding a credit score with a loan application into a third-party app that also lives in the bank’s online banking portal. “That’s multiple steps today,” she said, explaining that, ideally, the bank would want to be able to easily drop modular components into different distribution channels, depending on what makes sense. This kind of endpoint-agnostic distribution will require an ability to combine API orchestration, data mapping, and UI/UX as outlined in the prior subsection. It also speaks to something CCG Catalyst talks about often 11 (and is alluded to multiple times above) — the need to ensure the bank is operating on modernized infrastructure that is fully API enabled and interoperable. Ultimately, this can be achieved in one of two ways: either by implementing a next-generation core system with multitenant capabilities or by leveraging an interoperability platform layer that sits above the core. In most cases, banks we’ve engaged with that operate in the BaaS space (both for this report and outside of it) are on traditional infrastructure, in part because taking a gamble on novel core technology while participating in such an innovative field feels for many too risky a proposition. As such, achieving the ability to bundle and deliver offerings seamlessly across channels will likely mean pursuing an “above the core” strategy for a majority of these players. This is also likely to be an important component in enabling these banks to combine all of their activity into a single view, especially as they consider combining approaches to their programs.

Managing complexity in compliance

Last but most certainly not least are the regulatory and compliance considerations of all of this. Moving to Wave 3 is going to create a ton of asynchronous activity that needs to be managed effectively. And this is particularly pertinent at a time when regulatory scrutiny of the BaaS space and bank-fintech engagement generally is heightened. All of the bank executives who contributed to this report acknowledged this as a chief concern for the industry, and one that is likely to continue to grow in prominence. They also agreed that investing in building a compliance-first outfit is a crucial part of driving success for any sponsor bank. This is key, because it reinforces how important it is that banks maintain control of their oversight activities — a point that will be especially true for those participating at the foremost frontiers of delivery. In order to do this well, though, banks will need to hire the right people and spend a lot of time developing the right processes. Robin Garrison, strategic innovations director of compliance at FirstBank, told us that the most essential thing is to ensure you are incorporating your BaaS or embedded operations into your existing compliance umbrella. Ultimately, she said, that means treating this like a data problem; you need to be able to pull data out of many disparate systems and create a comprehensive reporting framework that collates all of your activity. And you’ve got to have the processes (human, technology-based, or both) in place to do that efficiently. As use cases grow and more permutations come into the mix, achieving this level of visibility in a unified way will only become more critical. As such, perhaps more than anything else we’ve discussed, it should be top of mind as strategies evolve.

The goal of the above is to provide food for thought for institutions as they contemplate embarking on this journey. While not at all designed to serve as a roadmap, these elements represent the focus areas that we’ve determined will be of most significance to organizations as they look to prepare for a Wave 3 world. If there is an underlying theme across these ideas, it’s really that banks taking on the new last mile will need to be able to support the unknown in order to remain competitive and deepen relationships with their clients. And, at the end of the day, that means achieving true flexibility across technology, people, and operations. It’s such flexibility that will enable the ultimate winners to seize on new opportunities as they present themselves and carve out niches that can create sustainable and long-term value.

To play or not to play?

So, here we are — at the beginning of the beginning. As we’ve stressed already, not all banks need to embrace the reimagining of delivery. Some institutions will continue to cater to their existing niches, and do so very well. Even in the BaaS and embedded space, there will be those banks that are perfectly satisfied with a simple offering to complement their existing operations. This report is not for them. Rather, this material is for those who think differently, who want to push the envelope, and who have done the strategic work to determine that a multichannel approach to the market will serve them well. Likely, it is for sponsor banks that already have considerable experience and are looking to take things to the next level.

If you are going to play, though, it’s wise to understand the true implications. Tackling Wave 3 is going to require serious commitment, investment, and an ability to distinguish perceived risk from actual risk. It is also going to come with what is often the biggest ask for any bank today — taking a proactive approach to your technology infrastructure, what it’s designed to support, and what it needs in order to be able to drive in this future. Everything we’ve talked about touches this idea, from the ability to add new products and services (in a modular way) to the need to deliver on bespoke client demands and the importance of visibility for compliance. In the end, banks that want to participate here will need to bring all of these elements together, under their control and with a best of breed approach to partner choice, culminating in a true platform approach to banking. Nailing that unified stack, coupled with getting the proper people in place and a thoughtful approach to process, is what will bring the new last mile to life.

Sponsored by

Charlotte, N.C.-based Infinant provides the flexible banking platform for financial institutions to power their digital channels including distributing financial products through non-bank applications. The interlace platform differentiates by giving banks the ability to work directly with fintech and brands to power their programs, choice in their selection of features and fintech, with a bank-controlled platform to satisfy regulators. Infinant creates new value propositions for financial institutions to act and advance their market.

To learn more about staying above-the-core, visit www.infinant.com.

©CCG Catalyst 2025 – All Rights Reserved

No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording or any information storage and retrieval system, without prior permission in writing from the publisher.

Download a PDF of this article