New Frontiers in Banking 2023: Contemplating the Future

If 2022 shook the financial services industry out of the flying-high dreams of the last few years, 2023 is putting it through the ringer. Between economic pressures and stability concerns, not to mention major challenges hitting fintech companies (and the technology sector broadly), uncertainty is a prevailing constant of today. And, understandably, that’s left many grappling with how to approach the future. “Do I pull back on investment for innovation while things settle down?” or “Do I need innovation to get through this?” if so, “Where should I be directing my efforts?” These are the kinds of questions that are coming up over and over again in board rooms all across the country as executives work through their plans to move forward.

This report, based on CCG Catalyst’s Banking Stability and Innovation Study 2023, which asked C-level bank executives in the US about their attitudes and priorities in the current environment, attempts to answer those questions. It is designed to help industry leaders see how their peers are thinking and where they are focusing their attention. Specifically, the material that follows builds on a key section of our annual Banking Battleground Report, called New Frontiers, which analyzes institutions’ intentions across a number of key emerging areas. The goal is to provide an understanding of where the industry is headed when it comes to innovation and some of the specific spheres dominating the conversation.

Methodology and purpose

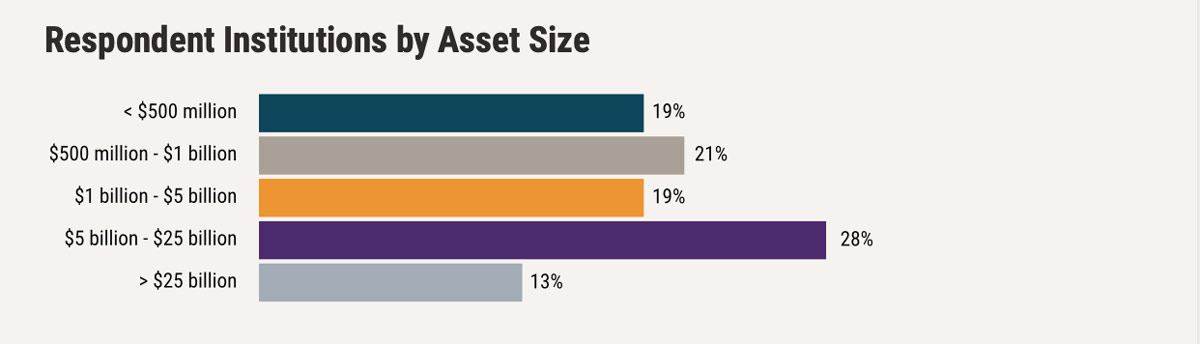

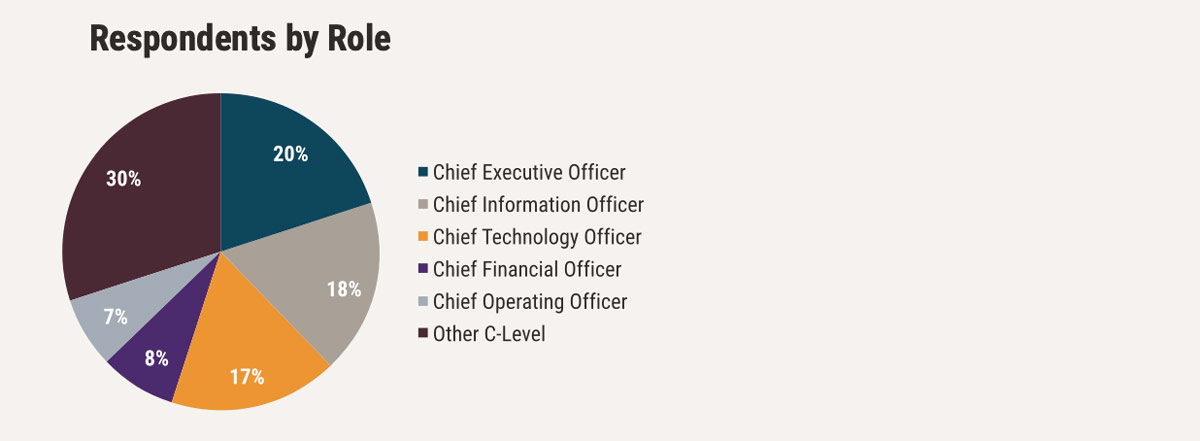

CCG Catalyst surveyed 108 C-level bank executives between May and June of 2023 to gauge their attitudes and perspectives on the current environment with specific emphasis on technology, innovation, and new areas of opportunity. As part of our analysis, we’ve segmented key findings from this survey into three core sections: technical readiness and expectations, new business frontiers, and new technology frontiers. Of important note, the frontiers we’ve chosen to cover represent only a subset of the opportunities out there. We’ve focused on these because of the central roles they’re taking in conversation presently. The survey data is unweighted, and the analysis that follows is based on our sample.

Technical readiness and expectations

Before a bank can begin to think about which specific areas it wants to play in, it first needs to ensure it has the proper foundations in place. That’s true for all elements that drive future readiness, including processes and operational structure, but it’s especially true for technology. A bank that is well equipped on the tech front can far more easily stay on top of changes and shifts in different directions as things get less predictable.

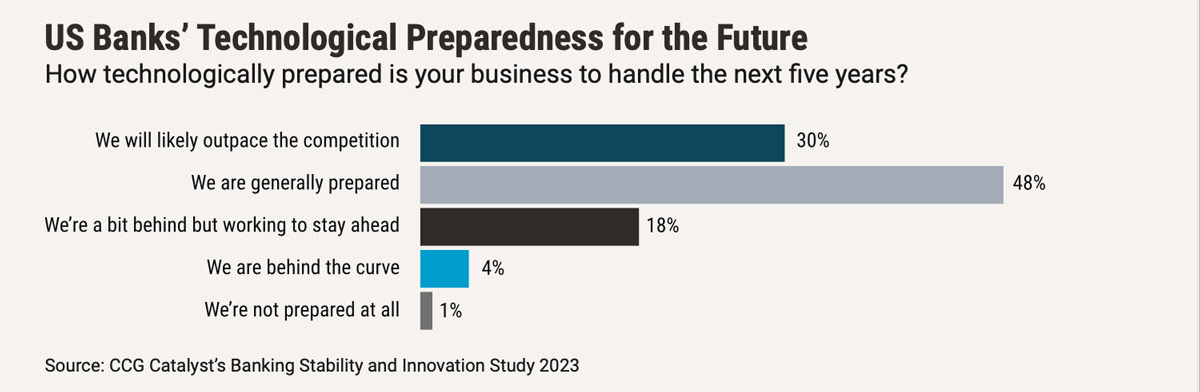

Our results on this are mainly positive, but not without caveats. Overall, a majority of respondents to our survey feel generally technologically prepared. However, they are still less confident now than they were previously — specifically, although we’ve observed some bounce back from this question’s responses in our 2023 US Banking Study, which was fielded between September 2022 and February 2023 to the same target audience, the data represents a nearly 10-percentage-point drop-off from 2022. This shift is likely attributable to a number of dynamics, including regulatory and capital pressures afflicting the fintech market and the turbulent economic backdrop making it harder to prioritize technology investment for some banks, particularly as the war for deposits ramps up. The goal, though, should be to resist the urge to pull back too hard — especially as it appears broadly executives remain relatively confident. While uncertainty is understandable in the current climate, institutions will need to be strategic about (and committed to) ongoing investment, being sure not to retreat in areas they decide are important to their future.

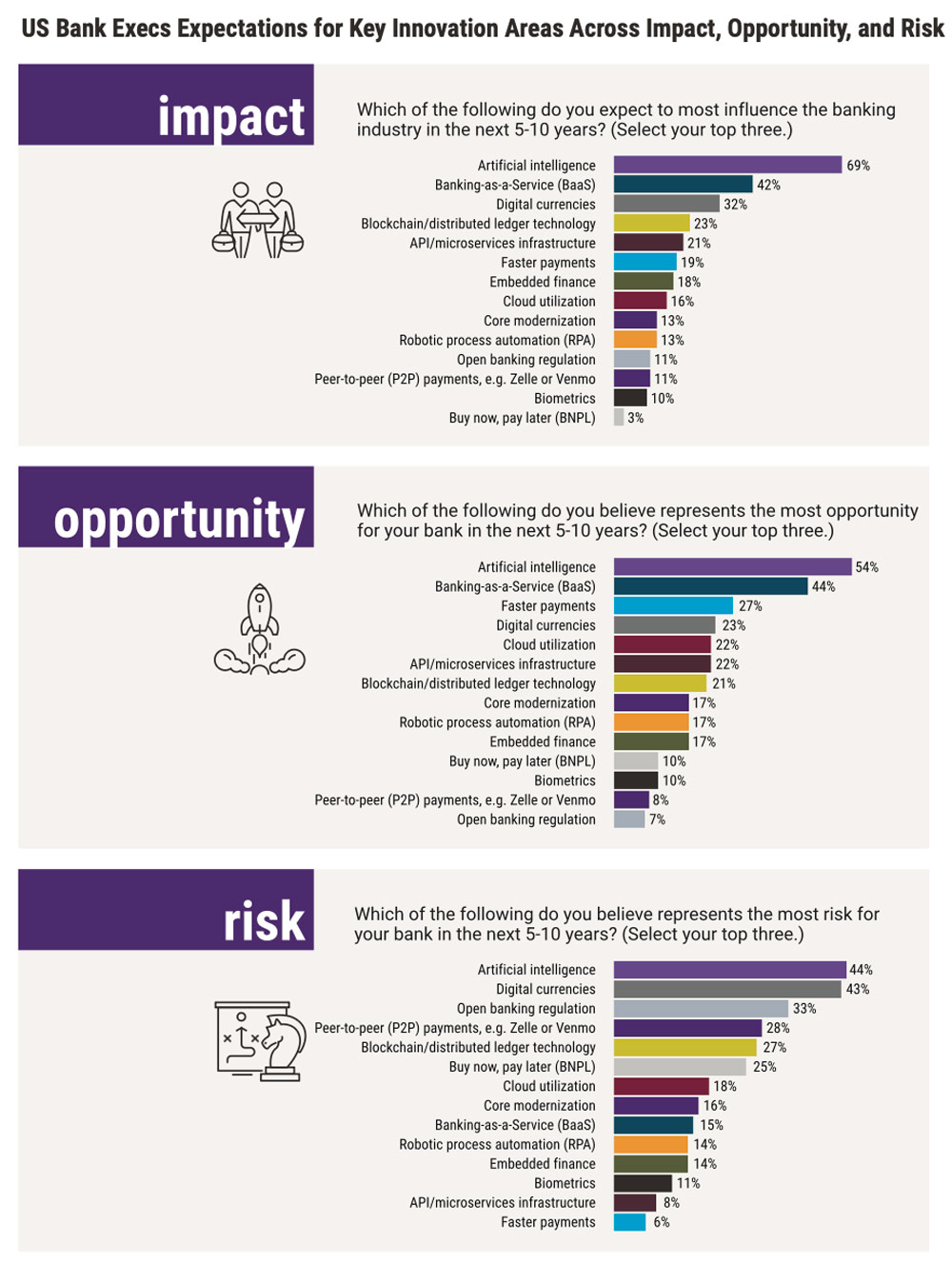

As far as what those areas are, we provided executives with a range of innovation-related possibilities and asked them to select their top three for each of the following categories: potential impact to the industry, opportunity for the bank, and risk to the bank. The intention was to understand which areas are perceived to be most impactful at a high level and where bankers see specific opportunities and threats to their business. Through these questions, we found respondents believe the top three areas of influence in the next 5–10 years for the whole industry will be artificial intelligence (AI), Banking-as-a-Service (BaaS), and digital currencies, while both AI and BaaS also made it into the top three on opportunity, along with faster payments. AI, digital currencies, and open banking regulation took the top slots when it comes to risk.

The key takeaways from this data are:

To begin with, that AI — which broadly encompasses algorithms designed to mimic the human brain — spans every single question speaks to the overwhelming presence it has in current discussions both inside and outside of banking. It is an area that is taking a central role in today’s discourse, and we devote ample attention to it later in this report. Of particular note here, though, is that 69% of respondents put AI in their top three for industry influence, followed by 54% for opportunity for their bank, and 44% for risk. This suggests that the overall perception of AI is more positive than negative.

On the other hand, the belief that digital currencies are likely to have a strong impact and present a lot of risk while missing the top three on opportunity demonstrates a mismatch between this space’s potential influence and its expected promise. This indicates that, while execs see a lot of impact coming from digital currencies — which include any currency available only in digital form, such as cryptocurrencies and central bank digital currencies — that impact is seen as more negative than positive, likely due to a lack of confidence on how to leverage any opportunity digital currencies offer. Such data is not at all surprising given the still very unproven nature of this technology as well as the many difficulties it’s presented already, particularly with regard to the boom and bust cycles of the cryptocurrency industry. 1 We explore this further through our deeper analysis of the crypto arena laid out below.

Meanwhile, BaaS, as expected, is viewed quite positively, indicating that executives still see a lot of promise in this area, despite recent pressures. (Note: BaaS refers to the (arguably) novel model by which a chartered institution provides the regulatory umbrella necessary for a nonchartered company to offer financial services.) To be sure, the sector has endured its share of headaches over the last year or so as regulators began to crack down on banks in the space and shrinking fintech funding started making it harder to find strong clients to work with. Somewhat surprisingly, though, given all this, it falls quite low on the risk spectrum, suggesting that institutions may now be feeling more confident in their ability to cope with compliance requirements and third-party oversight as the market evolves and moves upstream.

Perhaps the most surprising finding, however, is open banking regulation landing in the top three when it comes to perceived risk. This is likely due to uncertainty around what the regulation will contain, the prospect of sharing data widely (more on that later), and general understanding or misunderstanding of the concept. Moreover, open banking regulation falls very low on industry influence and is at the bottom when it comes to opportunity. Sentiment here is clearly very negative, but given open banking regulation is undoubtedly on the horizon, 2 institutions are going to need to think about whistling a different tune on this one. Otherwise, they risk having to comply with new requirements without a strategy in place for how to drive value for their bank.

And finally, we have faster payments, which made the top three only on opportunity. This is quite interesting and suggests that faster payments is an area where banks expect to gain a lot of efficiency and value, even if it isn’t seen as a driver of the entire industry from an innovation standpoint. (This is a space to keep an eye on for the future, especially with the launch of FedNow, 3 as it may grow in influence.)

Altogether, this data brings some clarity to which of the many pockets of innovation bankers are devoting their attention to and what the risk-reward dynamic and mindset looks like for each one. As with any new initiative or field, it is important to have a good handle on all of the implications before moving forward, for the industry and for your organization. In the end, success will ultimately come down to navigating investment across the impact/opportunity/risk spectrum. Those who do this well will be those who have a well-defined strategy for and approach to innovation as well as an ability to resist the urge to make decisions on things out of fear.

New business frontiers

Now that we’ve explored perspectives at a high level, we’re going to dive into how executives are approaching specific areas at their bank.

These cover some of the innovation-related arenas discussed above as well as others, including a few that may be less technology-driven but nonetheless represent novel and often discussed opportunities. In this section, we focus on new frontiers that highlight the way financial services are constructed and delivered as well as how institutions operate. In this first edition of New Frontiers, we’ve included BaaS, embedded finance, bank-owned marketplaces, cannabis, and sustainability. We asked respondents about each of these areas specifically and provide a dedicated subsection for each one.

Construction and delivery

BaaS

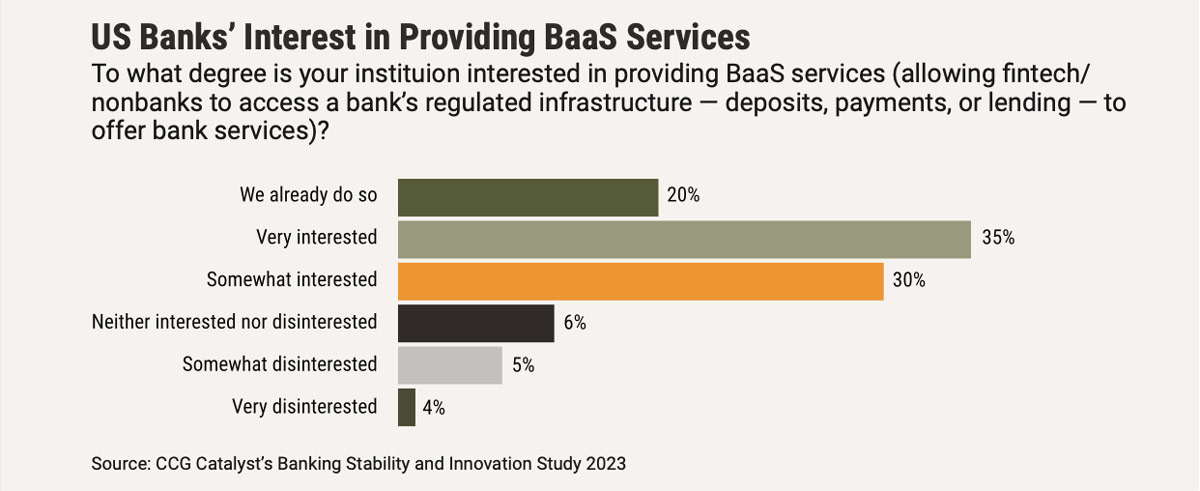

BaaS took off a few years ago, but 2022 pulled it back down to earth as a number of dynamics hit the sector, including regulatory pressures and difficulties inside of the fintech industry, as mentioned earlier. That said, this space clearly isn’t going anywhere. Fifty-five percent of respondents say they are either very interested in offering BaaS services or already do so. And only 9% of respondents reported a lack of interest. It is worth noting that this interest represents a drop from the results to this question in our 2023 US Banking Study; however, that interest overall remains strong, coupled with respondents’ belief that BaaS will continue to play an important role in the industry and as an opportunity for their bank as outlined above, suggests that it may be weathering the storm better than many thought.

The allure of BaaS is that it is a diversification strategy — it allows a bank to tap into segments it could not otherwise reach. Look at Sutton Bank, for example, which is a community bank in Ohio serving millions of additional users through its relationships with companies like Marqeta. 4 Or Coastal Community Bank, located in Everett, Washington, that’s working with Walmart-backed One to provide financial services to employees and customers. 5

This approach expands a bank’s remit and acquisition channels and, notably, is turning out to be very valuable in an environment where winning customers is an “all-hands-on-deck” effort. In fact, in a separate analysis, CCG Catalyst recently looked at deposit performance at BaaS banks compared with regional banks across 15 financial institutions in the first calendar quarter of this year. As expected, regional banks largely posted declines, but nearly all of the BaaS banks we looked at showed deposit growth over that timeframe. This indicates that, for those banks able to navigate the compliance hurdles, there is still a lot to be gained from offering BaaS.

Embedded finance

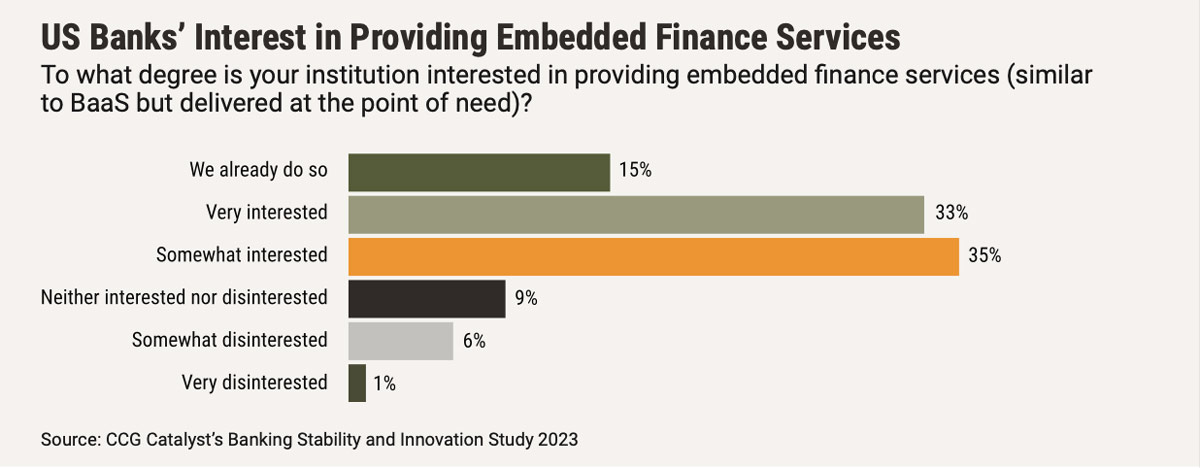

Embedded finance is closely related to BaaS and also garners a lot of interest, with 48% of respondents saying they are very interested in playing in this field or already do so. This is a newer area, but it’s been popping up a lot more lately and will be one to watch, especially as it promises to pull in larger, more established companies than BaaS has traditionally catered to on the client side, minimizing risk and potentially increasing value. Overall, embedded finance also involves providing access to the financial system to nonbank companies, but it is generally focused on use cases that position delivery at the point of need — for example, embedding a lending product into an online checkout flow. Because of this, embedded finance offers banks an opportunity to take their BaaS ambitions far upmarket, as many of the companies that are interested in such propositions tend to be large brands.

Good examples of this are buy now, pay later (BNPL) companies like Affirm and Klarna, which are often embedded at the point-of-sale (POS) and partner with banks on loan originations as well as other financial products. 6 Over time, we can expect to see the line between BaaS and embedded finance blur considerably as BaaS banks focus more on those with existing revenue streams as customers, over higher risk fintech startups, and prioritize their needs. For context, the addressable market for embedded finance is estimated to reach $7.2 trillion by 2030. 7

Bank-owned marketplaces

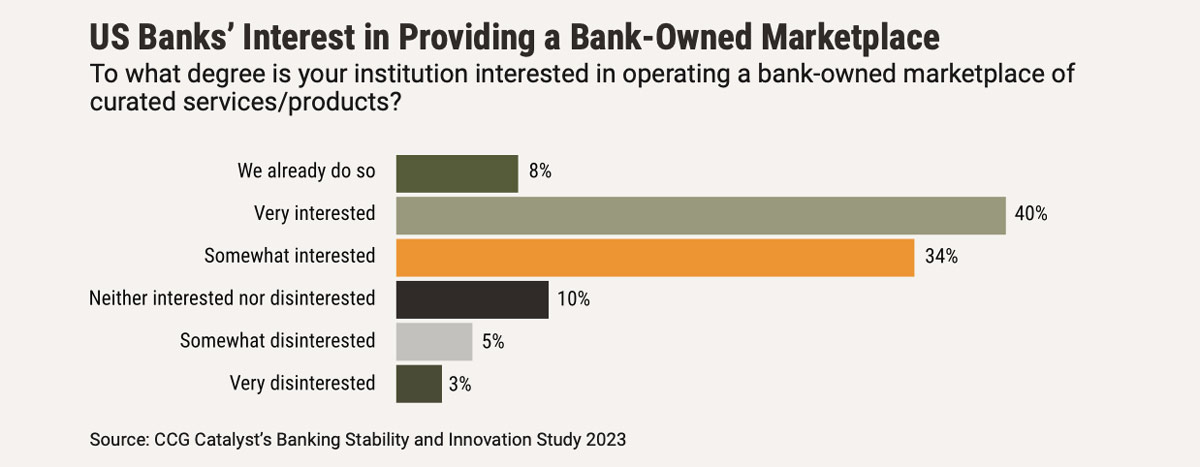

Bank-owned marketplaces mark the third and final area we are covering when it comes to delivery. This concept has been percolating for some time (though no one has quite nailed it yet) and refers to the provision of an ecosystem by a bank in which a range of products and services are offered up, both from the bank and from third parties it’s partnered with. For example, a bank may want to provide its small-business customers with access to accounting tools or email marketing. We’ve talked about this before as “the flipside of embedded finance” by which a financial institution starts to embed more services into their own offerings in order to provide greater value and create stickiness. And, based on our data, interest in this opportunity appears high; in fact, 48% of respondents say they are very interested in offering such a marketplace (or already do so). However, as alluded to, the portion of those in market is the smallest across these new delivery models, at 8%. This is likely down in large part to difficulty of execution — in order to do this effectively, you’ve got to be able to connect seamlessly with external partners through application programming interfaces (APIs), which, for many banks, remains a big hurdle. Additionally, building out a third-party risk management framework that can support working with many different brands in this way is a monumental task. Over time, however, as these barriers are overcome, we may see more institutions heading this way, especially given how often the topic comes up in conversation/industry coverage.

New ways of operating

Cannabis banking

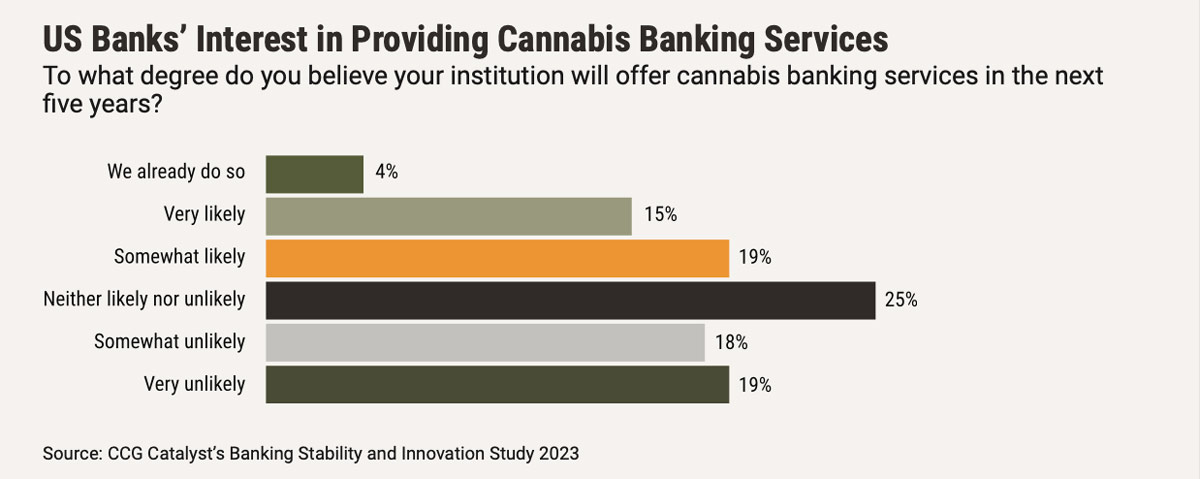

Cannabis banking is a growing topic of discussion, but few institutions actually play in this space, with just 4% of respondents saying they do so. Meanwhile, only another 15% say they are very likely to offer such services in the next five years. This reluctance is in line with prior data we’ve collected on the topic and is probably due to a lack of regulatory clarity as well as the ongoing split in legality between state governments and at the federal level (it’s still illegal under federal law).

As the regulatory picture evolves, it’s very likely that cannabis will morph into a legitimate industry that needs financial support — in fact, annual legal cannabis sales could reach $72 billion by 2030, according to New Frontier Data. 8 However, the problem is things are moving painfully slowly and real progress on the regulation front could still be a long way off — the SAFE Banking Act, for instance, which would ensure legal cannabis companies can access financial services, is still up for debate but has persistently failed to make its way through Congress. 9 As a result, this is an area where bank executives appear to be largely opting for a wait-and-see approach, at least outside of the most progressive and risk-tolerant institutions.

Given the potential opportunity, though, we do expect the topic of cannabis banking to continue to garner a lot of discussion and activity. US voters are certainly onboard — 66% of US adults support implementing legislation that allows cannabis businesses to access banking services, per a survey conducted by Morning Consult on behalf of the American Bankers Association. 10 And with close to half of US consumers now living in an area where cannabis use is legal, according to Pew Research Center, 11 it’s clearly only a matter of time before such businesses become mainstream. While being cautious now is certainly understandable, being aware of that reality and how you might respond is probably a worthwhile exercise for any financial institution.

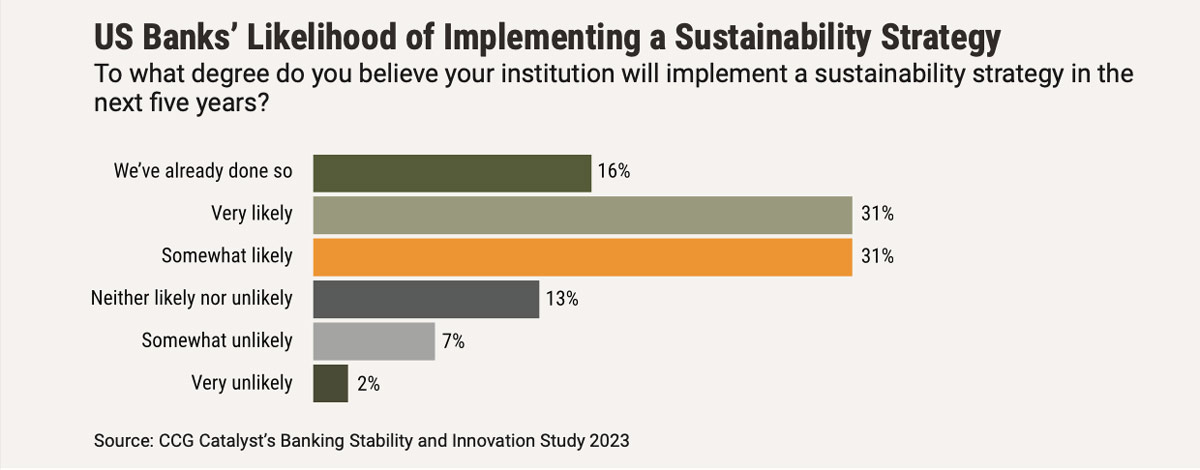

Sustainability

Sustainability — which generally refers to measuring and adjusting for environmental, social, and governance (ESG) factors to improve a company’s impact in the world — is a key area we’ve been tracking for a while; however, it seems to be losing some traction now, likely in favor of other pressing matters. In fact, although a good number — 47% — of respondents say they very likely will implement a sustainability strategy (or have already done so) in the next five years, that’s down from 59% who said the same in our most recent US Banking Study. While this isn’t particularly surprising, institutions will want to keep a pulse here, as the pendulum might very well swing back the other way as the environment normalizes. To be sure, customers, at least globally, have made their positions on this topic clear; for example, more than half surveyed for a 2022 report published by Sopra Steria said an organization’s prioritizing of environmentally friendly issues plays an important role in who they choose to bank with.

Another consideration is how difficult it is to implement such a strategy. Environmental sustainability, in particular, is complex and scientific, and not many banks have fully cracked tracking and reporting on their carbon emissions, let alone their reduction initiatives. 12 This has long been a reason why banks have been slow to put their plans into action (only 16% of respondents to our survey have actually implemented their sustainability strategy). Additionally, much of the activity and scrutiny around this is still centered on bigger and public institutions, 13 not the bulk of the market. However, long term, from demands by stakeholders to potential regulation to the business and reputational risk involved in staying on the sidelines, pressures to have a plan may well mount. As such, institutions that are delaying on sustainability or haven’t yet started thinking about their approach should seriously consider it.

Overall, the above sections speak to frontiers that are changing the underlying mechanics of banking. Often, when it comes to innovation, it is easy to slip right to technology-centric proving grounds because of how vital technology itself is to futureproofing efforts. But the truth is, there are many areas where change is happening that are not purely technology driven. Technology is certainly an enabler in these cases, but the novelty is elsewhere — new ways to think about the last mile, a new industry to serve, or, as with sustainability, a new way of thinking about procedures are all examples of this. As banks contemplate their approaches to innovation, it is important to think holistically about things in this way. That will help to ensure that you have the tools in place to play in the right spaces and keep shiny object syndrome at bay.

New technology frontiers

This section, on the other hand, is focused on those technology-driven areas. These arenas are, of course, important in their own right — they scream future in their names alone. However, critically, they speak less to the business of banking and more to enablement. In fact, if you start thinking that some of these concepts could be applied in or to the frontiers above, you’re not at all wrong. Specifically, for this report, we’ve chosen to take a deep dive into open banking, AI, cryptocurrency, and blockchain/distributed ledger technology (DLT) — all areas that would probably be seen by most as the cutting edge of cutting edge when it comes to technology in financial services. As with the prior section, we asked respondents about each of these specifically and provide a dedicated subsection for each one.

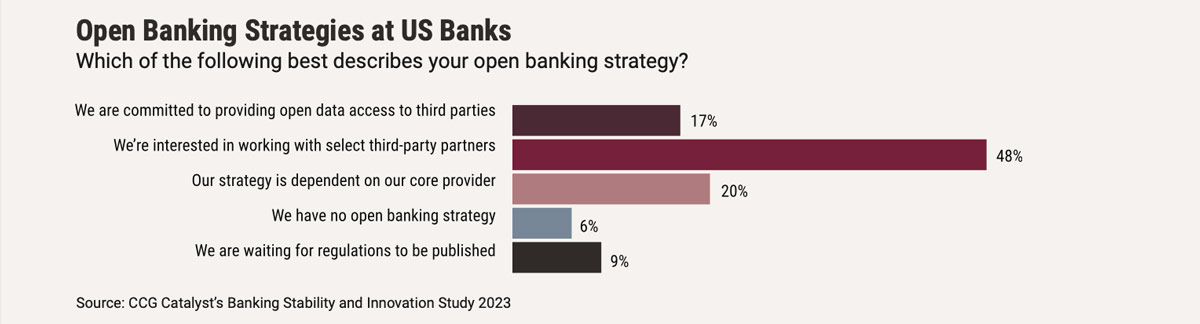

Open banking

Open banking is a tough one for the banking industry — it is top of mind these days as regulation is looming, but banks are showing extreme reluctance to engage with it. In addition to our data above indicating many are concerned about the risk associated with open banking regulation, very few respondents are embracing the concept in its true form, providing open data access to third parties (17%). Instead, they are much more interested in working with select partners (48%). This is in line with data we’ve collected in the past and reinforces the idea that many bank executives are going to need to go through a real shift in mindset on and understanding of open banking — and quickly.

This concept is really about data-sharing, and that’s probably why many banks don’t like it. Open banking regulation in other jurisdictions like the Second Payment Services Directive (PSD2) (now PSD3) in Europe mandates that financial institutions share data with third parties at a customer’s request. 14 And it requires them to do so via standardized mechanisms like APIs. In the US, it is still unclear exactly what the soon-to-be-proposed open banking rule from the Consumer Financial Protection Bureau (CFPB) will look like, but it probably will draw from these existing frameworks. It’s likely the prospect of sharing their data freely, expectedly via APIs (which they will have to build, despite legacy technology hurdles and, in many cases, reliance on their core provider), coupled with the uncertainty surrounding the details, that’s proving a lot for many US bankers to stomach. However, with this rule set to be released in 2024, institutions need to start making the mental and technological leaps to be prepared.

From a technology standpoint, this really means having a stack that can support data-sharing through APIs with any third party. As such, as banks await formal guidelines, a good way to get a jump on open banking and alleviate some of the potential burden is to start thinking about interoperability (which institutions should be doing anyway for a variety of reasons). Meanwhile, when it comes to getting comfortable with sharing data, it’s important to remember that open banking when implemented formally has safeguards in place. In Europe, for example, third-party providers that want to participate in open banking are required to get licensed, 15 and it’s likely that a similar scheme will emerge here as regulation creeps closer to reality.

Moreover, as far as any potential fears about the competition that data-sharing will create, bank executives should flip that idea on its head and begin thinking about the opportunities their institutions can capitalize on, from building greater loyalty with customers by enabling streamlined use of third-party tools to potentially even ingesting data themselves to improve their own services. As regulation is rolled out, we expect it to become easier for banks to work through these issues and see potential benefits.

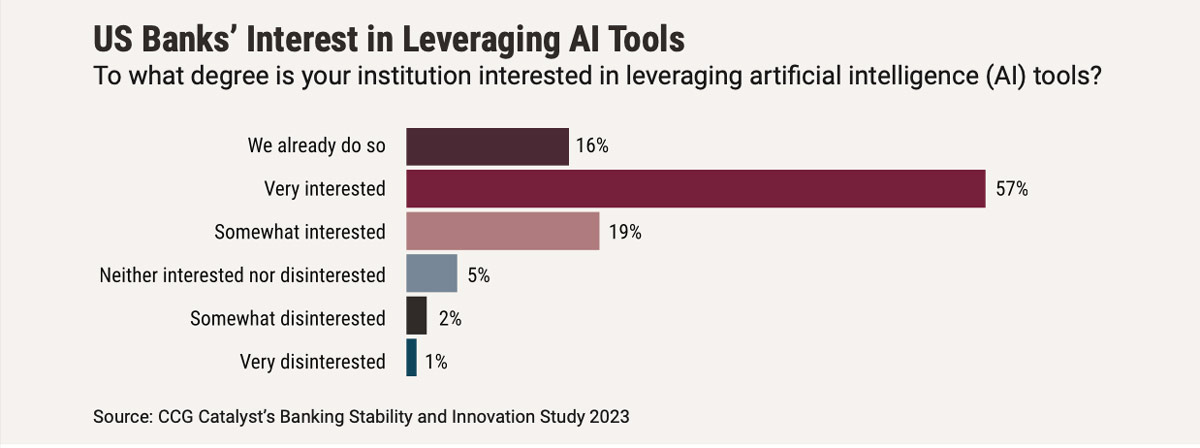

AI

AI is probably the buzziest technology frontier today, supplanting crypto handily in the conversation over the last year or so. And the data supports this buzz: In addition to its triumphant showing on perceived impact and opportunity as covered earlier, 73% of our respondents say they are very interested in (or already are) leveraging AI tools.

There are many applications for AI in banking, but we’ve only just scratched the surface of what this technology is capable of, especially as generative AI comes into play. Leaps and bounds are being made in this area — which is gaining wide attention for its ability to create content, including new text, images, video, audio, code, or even synthetic data, on its own 16 — on the back of the launch of ChatGPT in November 2022. 17 It’s this kind of technology that will set the stage for use cases like chatbot-powered customer service (done well) and higher levels of personalization in marketing and other communications as well as improved fraud prevention and underwriting. 18 In the future, we may even see this technology used in more advanced areas like providing financial advice or even to enhance customer onboarding flows.

However, coming with all of this excitement is also uncertainty, especially in the banking world where data privacy and compliance are so important. We’ve already seen examples of how ChatGPT can be used in nefarious ways — like in malware, for instance. As a result of this, bank executives need to be cautious in their approach to AI, taking time to really understand what it encompasses and its implications. Over time, AI will mature, and the opportunities will become clearer and easier to capitalize on. Additionally, regulation will likely come into play.

Until then, though, it’s important to acknowledge that this is very much the beginning of the beginning. Executives seem to have a good handle on this, given AI’s positioning on the risk spectrum as detailed above (though, as noted, fewer respondents ranked AI in their top three for risk than for impact and opportunity, indicating an overall more positive view). In the end, our respondents seem to be hitting the nail on the head when it comes to AI; they are clearly excited about the possibilities, but they are also showing a reasonable amount of caution. That’s likely the right approach for anyone considering leveraging this complex tech, even from an industry-agnostic perspective.

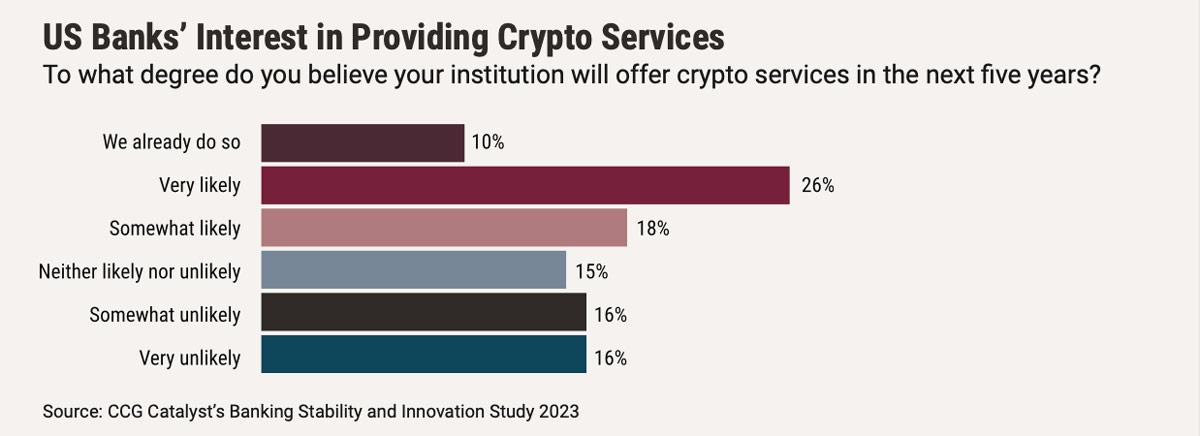

Cryptocurrency

After a massive fall from grace (again) in the last year or so, interest in the cryptocurrency space has seriously dampened. Just 36% of respondents think they will very likely offer crypto services in the next five years (or already do so), which is down from 42% in our 2023 US Banking Study, and that already represented a steep decline from the prior year. This pullback is undoubtedly tied to the incredible failures plaguing the cryptocurrency arena recently, 19 including the spectacular demise of FTX, the collapse of crypto investment firm Voyager Digital, exchange BlockFi’s bankruptcy, and the downfall of New York-based Signature Bank, which had considerable crypto operations. 20 Such failures exposed systemic issues within the crypto sphere that’ve led to amped up regulatory scrutiny 21 and sent many banks heading for the hills, with a number previously involved in digital assets taking a step back. 22

However, over time, it’s not out of the question that things will change; as noted above, this space is known for its boom and bust cycles, and that causes feelings toward it to oscillate between excitement and fear. The major driver of any comeback, though, will likely have to be regulation and government support. Regulatory clarity is needed to protect market participants and ensure companies can operate safely. And that will take a while to form, especially as numerous regulators claim jurisdiction, and there is far from a cohesive framework even up for debate. 23

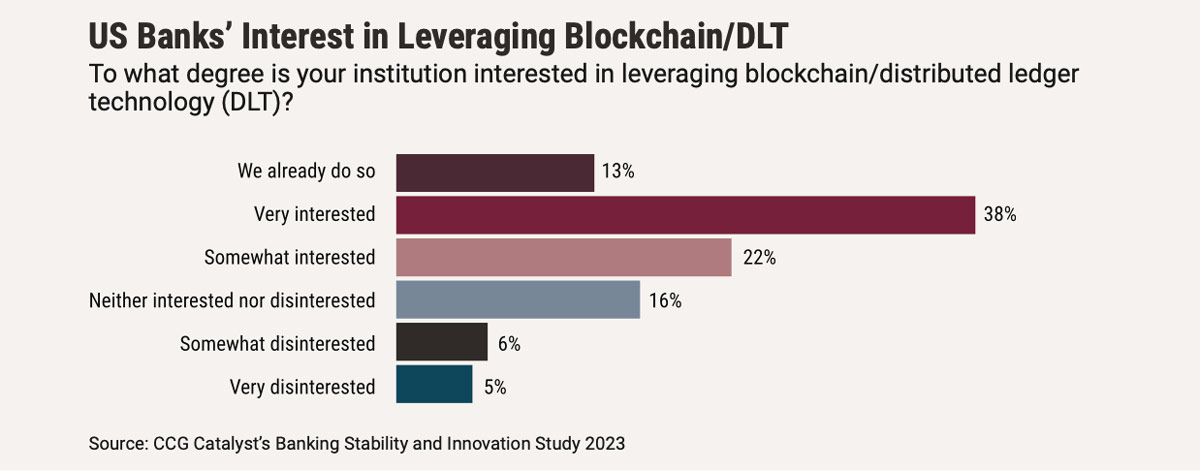

Blockchain/DLT

Blockchain/DLT is often grouped together with cryptocurrency, but it shouldn’t be. The technology in its own right presents an alternative to record keeping and data verification that is secure and difficult to tamper with. As a result, many institutions working in the space are experimenting with private blockchains that are not tied to a public token like Bitcoin. 24 For example, J.P. Morgan’s Onyx built a blockchain-based platform for streamlining payments transactions, called Liink, 25 which currently has 25+ banks around the world on its network. 26 (For context, DLT refers to technology that enables ledgers to be stored on separate devices in a network to ensure data accuracy and security, and blockchain is a specific type of DLT that leverages a linear system of blocks to record and verify information.) 27 All told, 51% of respondents to our survey say they are very interested in leveraging blockchain/DLT (or already do so).

There are many different applications for blockchain/DLT in financial services, from streamlining cross-border payments by alleviating the need for intermediaries 28 to improving know-your-customer (KYC) and anti-money laundering (AML) processes through its ability to secure and verify data in real time. And, according to data from Statista, the global market for blockchain in banking and financial services is expected to reach about $22.5 billion by 2026. 29 However, it is worth noting that, at least for now, much of this activity is concentrated among the largest banks.

In our survey, for instance, those with over $25 billion in assets were the most likely to already be utilizing blockchain/DLT, and a majority of those demonstrating strong interest hail from institutions with $5 billion in assets and up. This is probably due to the knowledge and investment required. 30 Moreover, in order for this technology to reach its potential, network effects need to be achieved — the value is in being able to verify information across many disparate parties. This will take time and require different networks to work together to achieve interoperability. 31 Given these constraints, and while there is a lot of promise for this realm, it’s ultimately an area that will probably fall into the wait-and-see bucket for the average US bank in the near- to medium-term.

In general, when it comes to novel technology concepts, it can be hard to determine what to leverage. New technology is often scary, unproven, and full of promise. And that creates a conundrum for many institutions. The purpose of the above material is to help executives grasp how their peers are thinking about these areas and make it all more digestible for those considering their own position. In the end, each bank will need to decide for itself which opportunities make the most sense. Not everyone needs to leverage AI or blockchain, for example. But knowing where such technologies are permeating from an industry view and how is key to informing those decisions. That’s true for the topics discussed here, and it’s true for other possibilities. Moreover, it is essential to remember that the ability to play on new frontiers requires flexible underlying infrastructure, making broader technology modernization a necessary precursor to getting involved in any of these initiatives.

Final thoughts

The goal of this report is to give bank executives a better understanding of where others are today and how they are defining and responding to the hottest pockets of innovation and technology in financial services. As always, take these insights as they make sense for you. The data from our study is meant to show how institutions are approaching the future and identify key areas for industry leaders. Those areas may or may not be applicable to your bank. The objective is to look at this analysis and take from it lessons that can inform your perspective and strategy.

Overall, the outlook for progress is quite good from our standpoint. Indeed, despite some shaken confidence and pullback in certain places, interest in innovation and new frontiers appears to be surviving the current chaos. In particular, enthusiasm for advanced technologies like AI and new delivery models like BaaS and embedded finance illustrate a commitment to cutting-edge ideas and experimentation that is quite refreshing, in our view. Of course, prioritization will be a key factor moving forward, but that executives generally seem receptive to many of the areas and concepts covered here is a positive signal for the future. As far as we can tell, at a time when irrational behavior could very well be taking hold, the industry by and large seems to be reacting reasonably. And that is very, very promising.

Survey Respondent Demographics

©CCG Catalyst 2025 – All Rights Reserved

No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording or any information storage and retrieval system, without prior permission in writing from the publisher.

Read New Frontiers in Banking 2024: Balancing Caution and Excitement

Download a PDF of this article