Digital Account Opening in Retail Banking: Competing on First Impression

Digital capabilities are more critical to banks today than ever before. The shift to digital in financial services began years ago, helped along by the rise of tech-savvy fintech competitors, but it made dramatic leaps forward as a result of the Covid-19 pandemic, even in the most analog corners of the industry. And perhaps nowhere is this more apparent than in the rush to implement digital account opening capabilities. With consumers flocking to digital channels faster than ever before, banks of all shapes and sizes had to rethink how they pull customers into the fold and embrace technology as a key means of generating new relationships. Now, as the dust settles, it’s time to look at the progress made and think about how it can be elevated for the long haul.

It’s no longer just about being able to open accounts for consumers through digital channels; we’re quickly moving toward a future where everyone will be able to support those capabilities. The question now is, “Where do we go from here?” And the answer is optimization. With baseline capabilities largely in place, the most forward-thinking institutions are looking to compete on new frontiers like speed and ease, to lower abandonment rates and encourage quality completed applications. This, in turn, is pushing the entire industry forward, as institutions more broadly begin to think about digital account opening as an evolving capability, rather than a static feature one can check a box for. Today, the focus is shifting to aligning to best practices and creating smooth and frictionless journeys that will delight potential new customers.

In this report, we explore where the industry stands overall on digital account opening for retail, (we will cover business and commercial in a subsequent report), who the key players are shaping the landscape, and the ways in which this capability can be taken to the next level to drive completion rates for qualified applicants, lower fraud, increase cross-selling opportunities, and deliver a best-in-class first impression.

Where banks today stand on digital account opening

Covid-19 put a spotlight on the need for digital account opening capabilities across financial institutions, as digital channels became a mainstay for consumers. Because customers were largely at home, and branches were in many cases closed, digital account opening turned into the de facto way to open a bank account. In fact, many banks saw digital account opening activity more than double from pre-pandemic levels, according to the American Bankers Association (ABA). 1 As a result of this new environment, those that did not already offer the option were forced to accelerate plans or get creative to help customers through the process remotely.

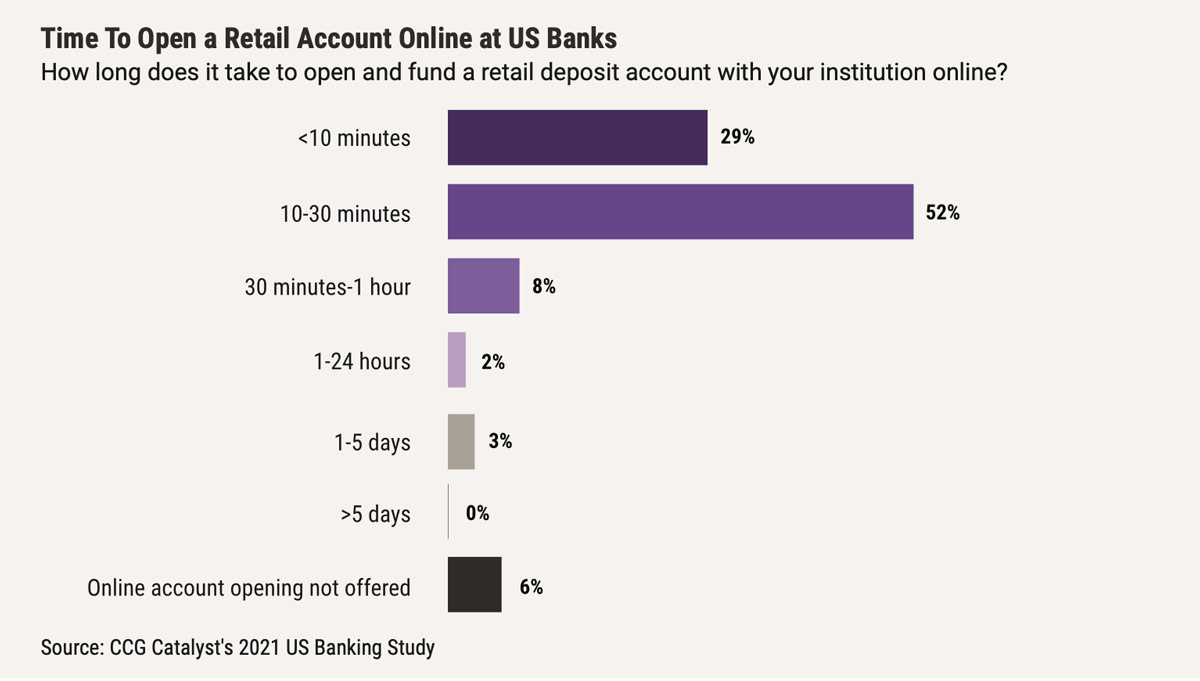

Overall, banking institutions in the US made tremendous progress in implementing digital account opening capabilities during the pandemic, building on years of work toward creating digital experiences for customers as part of overall transformation efforts. In fact, a majority of respondents to CCG Catalyst’s 2021 US Banking Study, which surveyed 109 C-level bank executives this past winter, said they offered some form of the service to their retail clients, while just 6% reported not offering digital account opening at all. 2 It is worth noting that this survey was conducted during Covid-19 when banks were using creative ways to open accounts, but this data is still quite impressive and represents a real embracing of this capability by the industry. Now, the challenge for institutions is going to be thinking beyond simply “getting a solution in place” and building on these initial efforts to improve the experience for customers and create differentiation within the process itself.

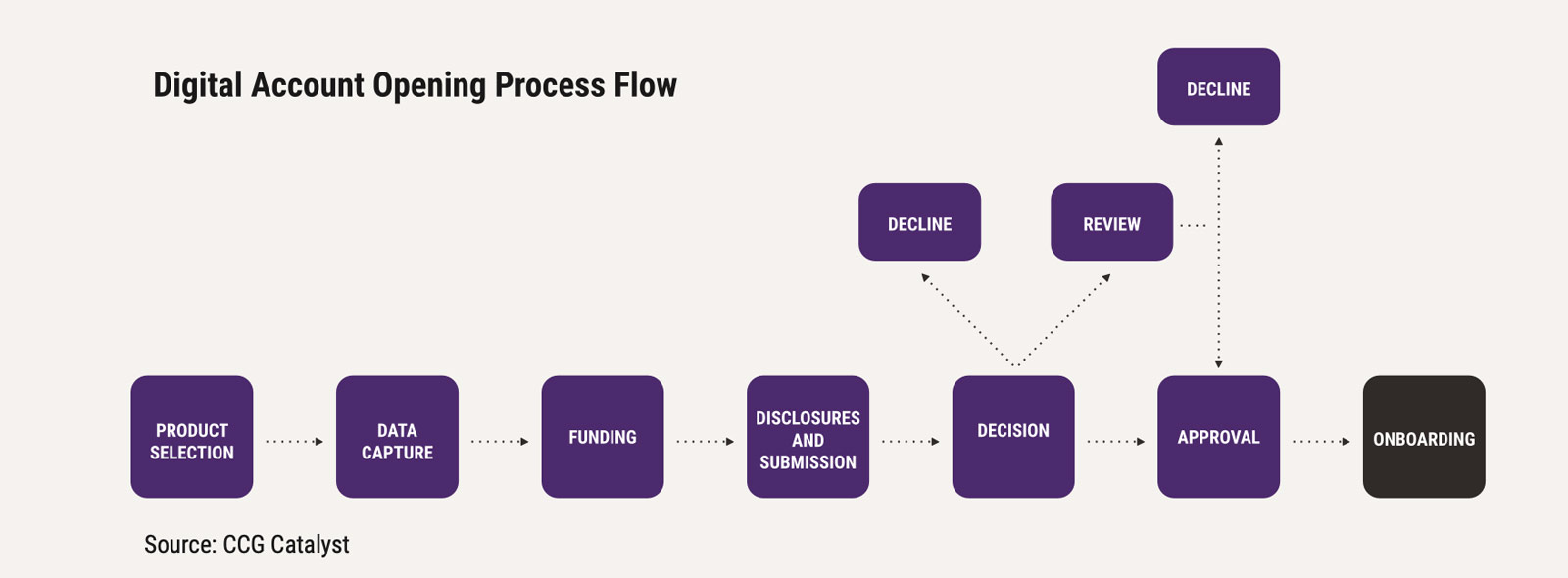

A typical digital account opening flow includes five key elements: product selection, data capture, funding, disclosures and submission, and decisioning. A customer begins by selecting the product they would like to apply for — a checking account, for example. Next, they are asked to provide all of the information needed to validate who they are under the bank’s customer identification program (CIP), including things like their full name, address, social security number, and traditionally, an upload of an identity document like a driver’s license. The customer is then given the option to fund the account by connecting another bank account or using a debit or credit card before moving on to disclosures and submission. (Note: Funding can also occur outside of this flow once the account is already opened.) Once submitted, applications typically fall into one of three major buckets for decisioning, based on the bank’s risk preferences: auto-approved, held for manual review, or declined. If an applicant is auto-approved, the account is created and booked to the core as part of the flow.

Together, these steps represent a generic digital account opening process, but approaches can vary across institutions as they look to optimize the experience. For example, while some institutions will require customers to manually enter their data for identity verification, others use prefill capabilities to help streamline the process by integrating with Google Maps or other tools. There are many, many choices like this one that can be leveraged to deliver a better experience. (Later in this report, we will discuss emerging best practices that can help institutions ensure they’re making the right decisions.)

Overall, though, bank executives should be looking to find ways to reduce friction and increase speed. Dropoff rates for online applications for financial products can hover around 60%, and length of time is often cited as a top reason by consumers who decline to finish the process, according to Signicat data. 3 In our survey, 52% of respondents said they can open and fund a retail deposit account online in 10 to 30 minutes, and a little over a quarter can do it in less than 10. Truthfully, digital-savvy providers are already pushing time to open to just a few minutes, 4 which means we are probably not that far off from a future where 30 minutes, or even 10, is no longer sufficient. As such, despite the clear progress made on implementation, many banks still appear to have some work to do to stay on par from a capabilities standpoint.

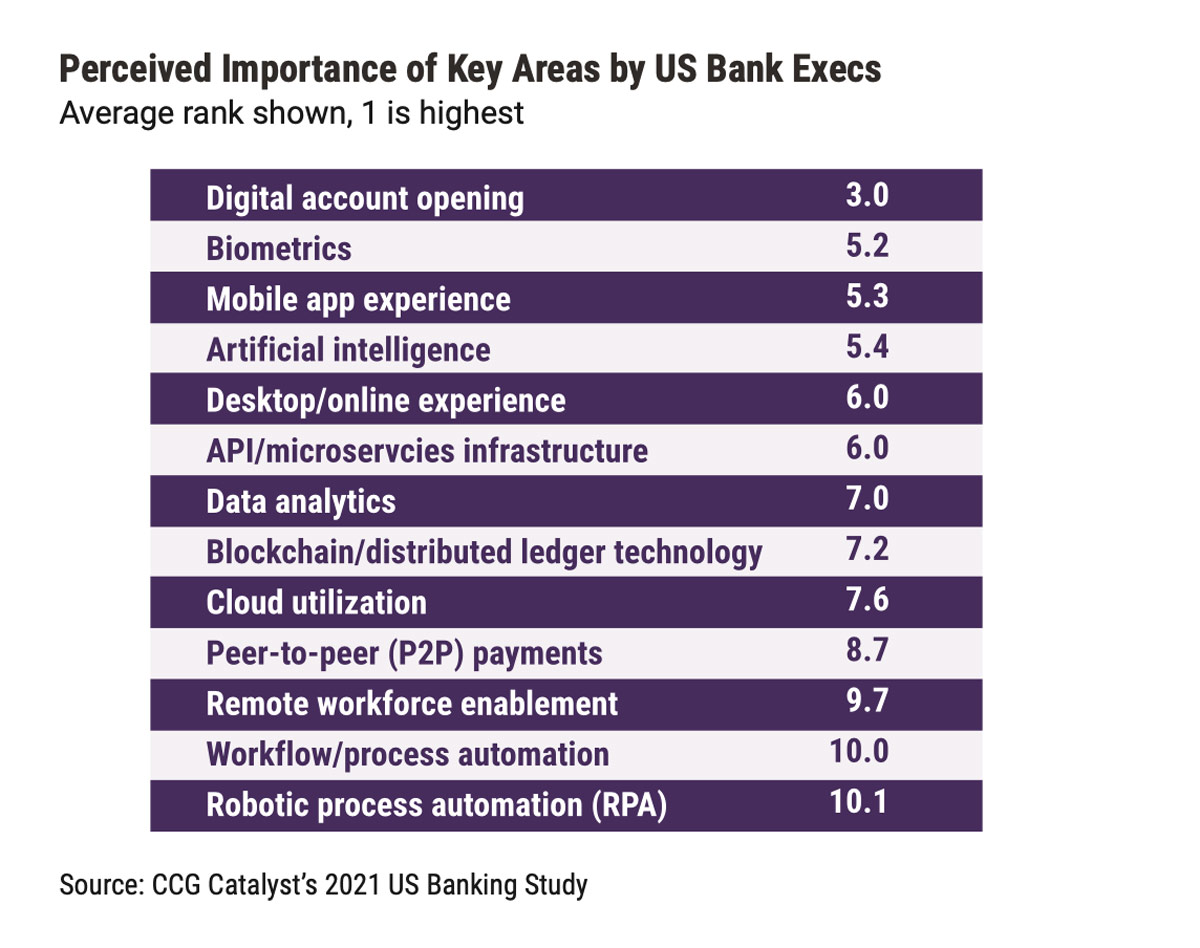

Promisingly, it seems organizations largely realize this. In fact, digital account opening received the top rank in our survey across an array of features that we asked respondents to order based on their importance to the bank in the next five years.

This data suggests that bank execs understand the value in continuing to invest in digital account opening beyond initial deployment and will likely put further emphasis on the process in the years ahead. Given this, institutions that have yet to get a solution in place for digital account opening risk falling far behind their peers as the industry further hones its capabilities and customer expectations grow.

The digital account opening ecosystem

As banks begin to plan their next moves, regardless of where they are on the journey today, it’s important to understand the key forces shaping the digital account opening landscape and setting new standards for the industry as a whole. These include fintech competitors and leading incumbents, enabling technology vendors, and, of course, digital account opening solution providers. Below, we take a look at exactly who these groups are and how they are driving the evolution of this capability.

Fintech competitors and leading incumbents

Fintech startups set the stage for digital account opening long before the pandemic. These tech-savvy players are known not only for offering the feature as part of their initial value propositions, but also for making the experience seamless and easy; neobanks like Chime can open an account on mobile in under 5 minutes. 5 The popularity of such companies — Chime alone boasts user numbers well into the millions 6 — has put pressure on traditional institutions to raise the bar on their own capabilities and user experience.

These upstarts have crafted their journeys using extensive user research and testing, enabling them to pare down screens and eliminate friction points. That’s resulted in much faster digital account opening experiences than many incumbent institutions currently offer — in fact, traditional bank onboarding processes have been found to include up to five times as many clicks as their neobank counterparts. 7 Current, another neobank with over 3 million members, A/B tests pretty much everything, according to Josh Stephens, the company’s VP of product, including even granular choices like placement of buttons and colors of buttons. Additionally, the company’s product managers speak with customers on a regular basis to gather feedback. This emphasis on incorporating the voice of the customer into the development process allows companies like Current to continuously improve the user experience through hundreds, if not thousands, of tiny tweaks.

Additionally, fintechs tend to leverage more advanced technologies in their digital account opening processes than traditional institutions. Current, for instance, is integrated with an array of data sources that it uses to validate the information a customer is entering automatically, in real time, as they move through the flow. It’s also built a decision tree that’s layered on top, which takes all of the information being validated, maps it to the startup’s parameters, and can decision an applicant instantaneously. The company puts a lot of emphasis on selecting the right data sources and combining those datasets intelligently to create an accurate picture of someone’s identity, Stephens explained. This approach not only allows Current to streamline data collection, but it also enables the banking provider to ultimately verify and say “yes” to more applicants. An account can be opened with Current in 2 minutes.

While neobanks deserve the glory they tend to get here, there are a few incumbent institutions also at the forefront of digital account opening. Marcus by Goldman Sachs is one good example; customers can open and fund an account in just a few minutes, with only a handful of screens. 8 Marcus, for short, is the bank’s digital-only consumer arm, which means the online channel is key to its customer acquisition. And its investment in the experience seems to be paying off — the company recently announced that Marcus had reached $100 billion in deposits. 9

To be fair, the banking providers leading on this front today are largely building in-house; a luxury most institutions will not have due to resource constraints. However, a good understanding of the standards being set by these players can help decision makers identify digital account opening solution providers that are working to meet those standards. In addition, even with the right technology in place, a bank will ultimately have to define its own specific flow and customer journey. From this standpoint, watching the choices others make is invaluable.

Enabling technology vendors

Advanced technologies that can streamline parts of the account opening process, especially in areas like data capture and funding, are helping to remove friction and deliver better customer journeys. With growing frequency, these tools are being embedded by digital account opening solution providers, which means a bank working with one of these vendors may not need to worry about evaluating the technology separately, or more critically, integration. In particular, a couple of key technology players are quickly headed for ubiquity:

Alloy. Alloy is an identity decisioning platform that can be integrated with an account opening solution to validate an applicant’s identity across a range of data sources, in real time, via application programming interface (API). The platform brings the kind of decisioning technology that Current built in-house to the mass market. Alloy ingests data from the bank’s account opening solution as a user moves through the application process, automatically validates those inputs using data sources selected by the institution, (it offers 85+ options), and decisions the applicant using the bank’s parameters. Its array of data sources includes traditional databases like LexisNexis, but it can also pull in more unique inputs, such as the IP address of the device being used. By this point, Alloy is fairly widespread among account opening solution providers — according to Alloy CEO Tommy Nicholas, the platform is already integrated with most dedicated digital account opening solutions as well as a few offerings from core providers. Alloy can be brought in either by the bank or through a solution provider, (some vendors make it an option and others include it automatically), but, in all cases, the company works directly with the financial institution to set parameters and build the decisioning flow. On average, 33,236 applicants are auto-decisioned daily with Alloy. 10

Plaid. Plaid is well-known as the data-sharing enabler often touted in the US open banking conversation.11 But, in addition to making it easier for consumers to share bank data with third-party apps, the company is also an active player in account opening. In particular, account opening solution providers are using its APIs to authenticate external accounts during the funding part of the process, enabling banks to provide instant account verification as an option to clients. Using Plaid, applicants are able to enter their login credentials and connect their accounts instantly without leaving the flow. 12 Plaid can also be used to display balances back to the user, as well as to prefill forms and/or help validate identities using bank data. While not all vendors use Plaid in the same way, it’s widely used in some capacity, especially for its account authentication capabilities.

Technology is moving quickly in this space — Alloy, for example, was founded only in 2015, and its tech is already nearing must-have status. By this point, many such elements that might seem cutting edge are actually evolving into more basic functionality. Soon, the ability to instantly decision an applicant, for instance, may no longer be considered an advantage. As a result, it’s important to consider these capabilities when building account opening functionality or evaluating solution providers.

Account opening solution providers

There are dozens of providers that we monitor today that specialize in digital account opening. These companies tend to focus heavily on increasing speed, reducing friction, and maximizing quality completes. Below, we take a look at a few of these vendors (in alphabetical order) and how they’re approaching this critical area. The following is a sample and in no way serves as a set of recommendations by CCG Catalyst.

MANTL. MANTL, founded in 2016, focuses on streamlining account opening for community banks and credit unions. It provides clients with a white-labeled account opening solution that lives behind their own domain and is pre-integrated with the major core providers in the US. Like neobanks, MANTL puts a lot of emphasis on end-user research and testing in product development, which helps to inform everything from which pieces of information to collect from a user to verify them most accurately to the wording of the questions asked, according to Mike Bosserman, VP of growth at MANTL. While the flow is customizable, MANTL encourages clients to implement these best practices to improve their metrics. It uses Alloy to automate identity verification and decisioning, as well as Plaid for instant account verification. MANTL’s research extends to its use of these products — for example, it leverages testing and insights to help clients select the right data sources through Alloy to optimize completes and minimize fraud. On average, MANTL’s customers grow deposits 78% faster than they did with their prior provider and can automate 92% of know-your-customer (KYC) decisions. 13 It can also typically open a consumer deposit account in 2 minutes and 37 seconds.

Narmi. Narmi was also founded in 2016 and is similar to MANTL is a number of ways, including in its commitment to user research. One key difference, however, is that Narmi is less customizable, and intentionally so. According to Audrey Song, product marketing specialist at Narmi, the input fields are designed purposefully by the provider to capture only the most critical information from applicants in order to maximize speed and encourage higher completion rates. Narmi can open consumer accounts in 2 minutes and 13 seconds, which it claims is the fastest in the industry. The company also uses Alloy for decisioning, with most clients leveraging around 50 data sources, and it integrates with Plaid to connect to an applicant’s external accounts. Financial institutions using Narmi boast completion rates of 83%, on average, and, in some cases, have been able to increase new account growth by 4x.

NCR Terafina. NCR-owned Terafina, which has been around since 2014, bills itself as more than an account opening solution, putting considerable focus on sales enablement. While like its peers NCR Terafina is designed to reduce friction and drive completion rates by minimizing data capture and employing research-based design practices, (Alloy and Plaid are used here, as well), it’s also built to function outside the digital channel, in the call center or branch, for example. All interactions across channels are managed through a single platform. Additionally, NCR Terafina’s needs analysis tool can help identify cross-selling opportunities within the process and dynamically recommend products to applicants. Users are able to apply for multiple products at once using the same application form; fields and disclosures are adjusted based on the offerings selected by the customer. The provider boasts an average time to open and fund a consumer deposit account of 4 to 5 minutes for new customers, but that includes specific points within the flow to add additional products, emphasizing opportunities to cross-sell as opposed to focusing only on the application process, explained Kranthi Palreddy Syphax, director of marketing and business development at NCR Terafina. NCR Terafina’s customers experience a boost in sales conversion of 18%-35%, on average, across their product lines after deploying its platform. 14

These providers share some key attributes that illustrate the current state of the market: a focus on thoughtful, intelligent data capture, research-based design, and data-based success metrics. Additionally, they all make use of market-leading technology providers like Alloy and Plaid that are shaping this space in their own right. It’s worth noting that the major core providers all provide digital account opening solutions, as well, though their offerings tend to serve as ancillary services. Other solution providers contributing to this landscape that we did not speak with for this report include Bottomline Technologies, MeridianLink, and OneSpan.

Getting digital account opening right

There are so many choices a bank must make when it comes to the digital account opening process, from which technologies or solutions they will use to how to define the flow. Even with a good understanding of the market, it can be difficult to craft the right path for your potential customers. To aid institutions in this feat, we have identified several key focus areas and best practices for creating optimal journeys, based on our conversations with digital account opening vendors as well as banking services providers that have made this feature a priority.

Data collection

Collection of CIP data is one of the most critical components of the digital account opening process. It can also be one of the most cumbersome. This step requires the bank to acquire enough information about a potential customer to be effective in KYC and fraud prevention, without putting them off. That means striking a delicate balance between stringency and ease. While specific approaches will vary from bank to bank, there are a couple of things to keep in mind.

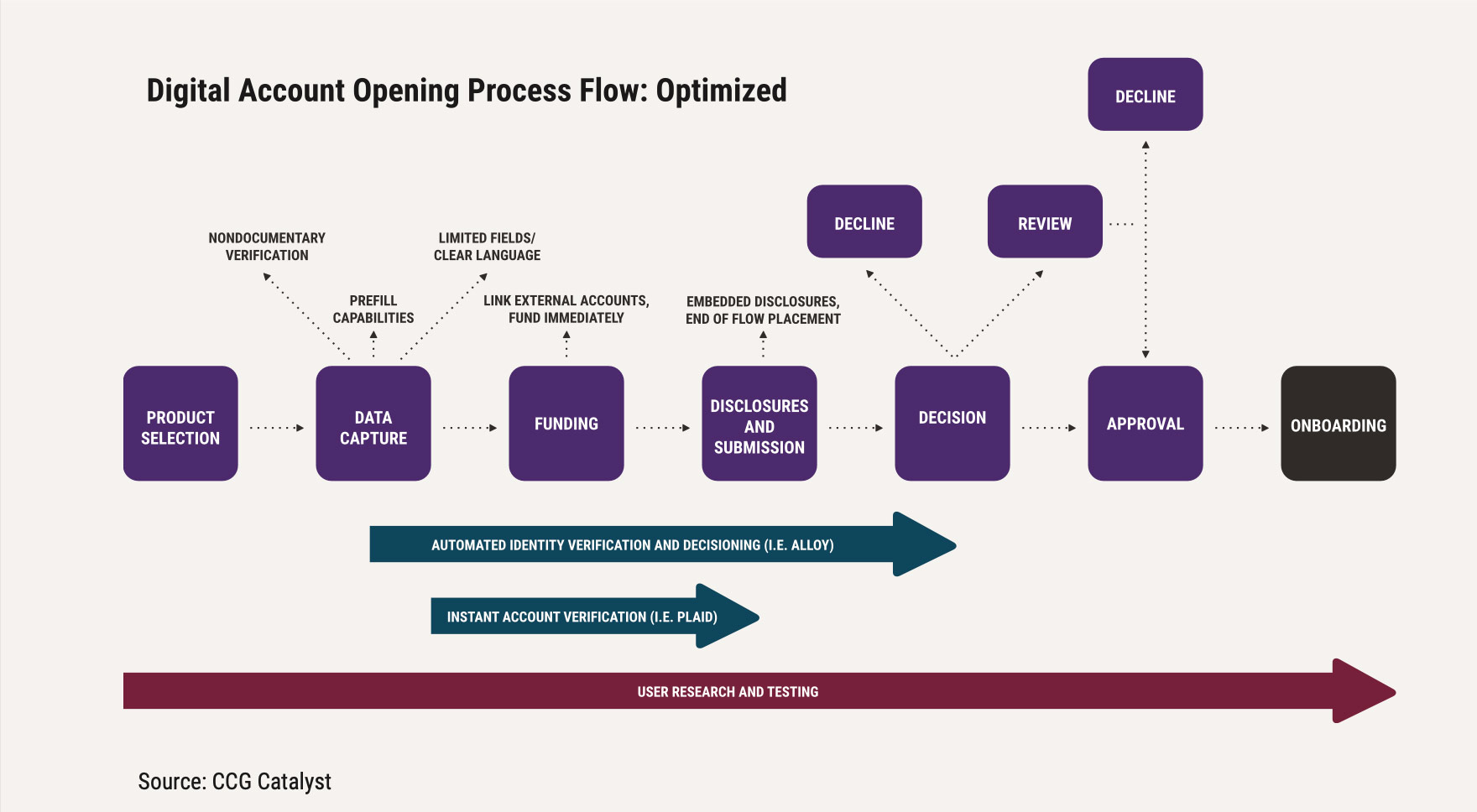

First, ask only for the information you need to decision an applicant, being sure to think through why you are asking for that information. Limiting the number of fields can go a long way to smoothing and speeding up the process. One critical way banks today are making progress in this area is through non-documentary verification of identity. While many still prefer to require an upload of a driver’s license or other form of identification, the most progressive institutions are handling verification using only tools like Alloy that can validate information against integrated databases. Leveraging non-documentary identity verification removes a major friction point for users by eliminating the need to upload any documents, which can help to encourage completes. For those institutions that insist on including a documentary component, experts we talked to recommend putting that step at the end of the flow, once a user is close to finished and likely committed to the process, to minimize drop-off.

And second, it matters how you are collecting the information you need. In addition to limiting the number of fields to only items truly necessary, leveraging prefill capabilities where possible is wise. Additionally, a bank should use clear language that explains why it is asking for the information it is and consider providing answers to common questions proactively within the experience. “Think about designing for someone who doesn’t understand banking,” explained Raj Bandaru, a longtime bank exec and currently CIO at Gesa Credit Union. “If he or she can open an account, that’s a huge success. It has to be very simple, self-explanatory, and almost guided.” This is where a commitment to user research and testing can play a major role in crafting an optimal experience. For instance, A/B testing can be used to determine if one way to ask a question yields a better result than another.

Overall, data capture and identity verification are probably where most innovation is happening today. That’s because institutions are learning that they can use new tools and techniques to pare down this area without sacrificing security. The use of new technology like Alloy’s is extremely important here because it enables banks to safely open more accounts with less friction by validating information across a selection of reliable data sources. The trick is to find the right combination of pieces of information and quality data to pull the most high-quality customers into the fold. This makes it easier to widen the pool of approved applicants, without manual intervention. Berkshire Bank, for example, saw 55% of its applications going through a manual fraud process prior to implementing Narmi’s digital account opening solution (integrated with Alloy); that’s now down to less than 1%. Radius Bank, meanwhile, was able to decrease fraud by 67% by implementing MANTL — also integrated with Alloy.

Funding

Traditional methods of funding a new account, like using microdeposits, are on their way out. While they’re still largely an option in most journeys, as is funding with a credit or debit card, instant account verification, (typically done via an integration with Plaid, as mentioned earlier), is taking the spotlight. Because this approach allows customers to connect their external accounts in seconds, it shaves precious time off of the overall process. Additionally, Plaid’s capabilities leave a lot of room for choices to create better experiences, and ultimately, drive results for the bank. For example, when Plaid pulls information to link a bank account, some providers like MANTL will display the balance as part of the journey. According to Bosserman, moves like this increase the likelihood that the customer will fund the account with a materially larger amount.

Disclosures

Disclosures can be a major source of friction in the account opening process because they require a user to read and acknowledge wordy material, while creating a sense of commitment that people can find uncomfortable. They are also required by regulators. Because there is not a ton of flexibility in the content or length of the disclosures, the goal is to optimize delivery. For instance, experts we spoke with recommend using HTML-based disclosures versus PDFs, as not all users will be able to access PDF documents. Additionally, placement of disclosures is very important, with most suggesting the end of the flow is ideal.

Looking ahead: multichannel and multiproduct

As institutions begin to think about what is next for digital account opening, multichannel capabilities are emerging at the top of the list. Most of the institutions we talked to mentioned this as a key area, and all of the digital account opening solution providers we spoke with say it’s an important priority. A multichannel approach means being able to take a digital account opening experience that customers start online or via mobile and pull it through to other channels like the branch and/or call center. The goal is to enable customers to start an application in one place, say via their mobile device, and finish it seamlessly somewhere else, for example, in the branch.

Being able to do this well not only improves the customer experience but also increases employee efficiency. To be fair, we are at the very beginning of this frontier — most digital account opening solutions can be configured for additional channels but are built for digital, though there are a few exceptions, like NCR Terafina. Institutions should be looking to a future, though, where multichannel is no longer a competitive battleground but an expected component. Important considerations for multichannel include consistency across channels, encompassing the same flow and interface, the ability to pick up where a customer may have left off elsewhere, as well as employee training to ensure that the bank can deliver a seamless experience once a customer reaches out.

In addition to multichannel, we’re also seeing a move toward multiproduct. For instance, the ability to open a consumer account and a small business account using the same solution. While it’s still very early days for these capabilities, it’s important to keep in mind that, as the industry continues to move forward, a consistent experience across channels and products is likely where we’re headed. Looking even further into the future, Bandaru envisions institutions leveraging a single platform integrated across systems that can handle not only account opening but also sales and servicing. That would mean using one solution with integrated data capabilities that can provide a 360-degree view of the customer, and ultimately, enable the bank to drive new business, deepen relationships, and propel cross-selling opportunities in a unified loop.

Moving forward

Digital account opening is not a static feature; it’s an evolving capability that will continue to advance over time — and quickly. To stay ahead, institutions will need to be thinking toward new frontiers — like delivering a multichannel experience. Additionally, use case expansion into small business and commercial banking will likely grow in importance, forcing banks to think about how they can reimagine flows and processes for increasingly more complex clients.

Now, surely, not all banks will be looking to stay ahead of the pack. For some, remaining current may very well be sufficient. Those institutions should be looking at the capabilities within digital account opening that are cementing their positions as baseline, (think, those of Alloy and Plaid), and make sure to seek them out when considering digital account opening solution providers. While it is fair to say that not everyone needs to be at the forefront of innovation, this is a particularly fast-moving area, which makes even keeping up tricky. Maintaining a close eye on key trends spreading throughout the industry will be critical to maintaining a good position.

A final note to all those bank execs on this journey is to remember who your target customers are. Think about what they want — and ask them. What is their level of comfort with digital? How much do they value convenience? Digital account opening is itself a customer journey and should be designed as such. Because there are so many small ways to influence a digital account opening flow, it’s necessary to bring in the voice of the customer at some stage. And that’s exactly what the leaders in this space are doing on a regular basis. This is where you hook the customer; the first step is to find out what exactly is going to make them bite.

©CCG Catalyst 2025 – All Rights Reserved

No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording or any information storage and retrieval system, without prior permission in writing from the publisher.

Read Digital Account Opening in Business Banking: Getting It Right

Download a PDF of this article