Digital Account Opening in Business Banking: Getting It Right

Digital account opening is centerstage today in the banking industry, especially against the backdrop of the Covid-19 pandemic, which made being able to acquire and serve customers remotely a necessity. In retail banking, this capability is nearly ubiquitous, with focus now shifting to optimizing the experience and achieving differentiation to pull in customers. In our recent report, Digital Account Opening in Retail Banking: Competing On First Impression, we explored where banks in the US currently are on this area and how it is evolving. In this second installment, we will tackle digital account opening for business banking — a much tougher and newer frontier.

While efforts to digitalize the retail account opening experience were well underway before the pandemic, most banking institutions in the US gave very little consideration to the business side of the house. This is likely for a few reasons, including a desire to optimize the retail experience first as more consumers moved to digital channels, the complexity involved in business relationships, and ultimately, less innovation generally in business banking, including from fintech players and other pacesetters. That’s all starting to change, though. Spurred in part by the pandemic, as well as the success of transformation initiatives on the retail front, the industry is starting to turn more attention toward business banking, and that includes the ability to open accounts digitally.

This report will explore how exactly banking providers are beginning to implement digital account opening for business deposit accounts, who the key players are shaping this landscape, and what still needs to be solved for to bring this capability into the mainstream in a truly automated way.

Where banks stand on digital account opening for businesses

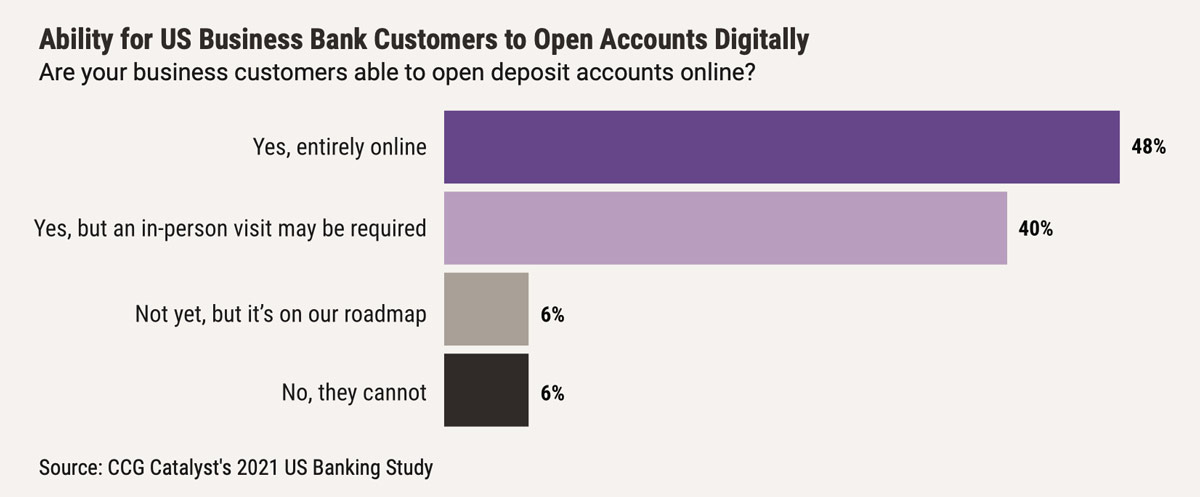

Business banking has long lagged behind retail when it comes to digital account opening. This is largely down to the more complex relationships and workflows involved, which make it difficult to automate key functions like verifying business entities. For example, a business may have a number of beneficial owners (those with more than a 25% stake in the company) who all need to undergo know-your-customer (KYC) due diligence as well as an array of documents that must be verified like tax return documents or articles of incorporation. All of these elements will vary depending on the business — the more complex the entity, the more complex the application — making it hard to create repeatable, digital workflows. As a result of such complexities and the numerous related permutations, there are not many business deposit accounts currently being opened fully digitally. In fact, less than half of respondents to our 2021 US Banking Study, which surveyed 109 C-level bank executives last winter, said their business customers are able to open accounts fully online. And, even among this group, a human element is likely involved, in most cases, for review purposes.

However, that doesn’t mean there isn’t progress being made — all but 6% of respondents to our survey at a minimum plan to offer some form of digital account opening capabilities for their business clients. This suggests that, in time, this offering will move to the mainstream. As that happens, it’s important to remember that the straight-through processing we’re used to seeing in retail banking isn’t necessarily what we’re after here, or at least not yet. Because business banking is so complex, and therefore carries more risk, the focus is currently (and will likely remain for some time) more on using technology to reduce friction and drive efficiency than on creating truly digital-only workflows. That is why there’s usually still some level of human intervention, whether the customer realizes it or not. We can expect the process to evolve to pull in greater automation as institutions get more comfortable using technology to onboard.

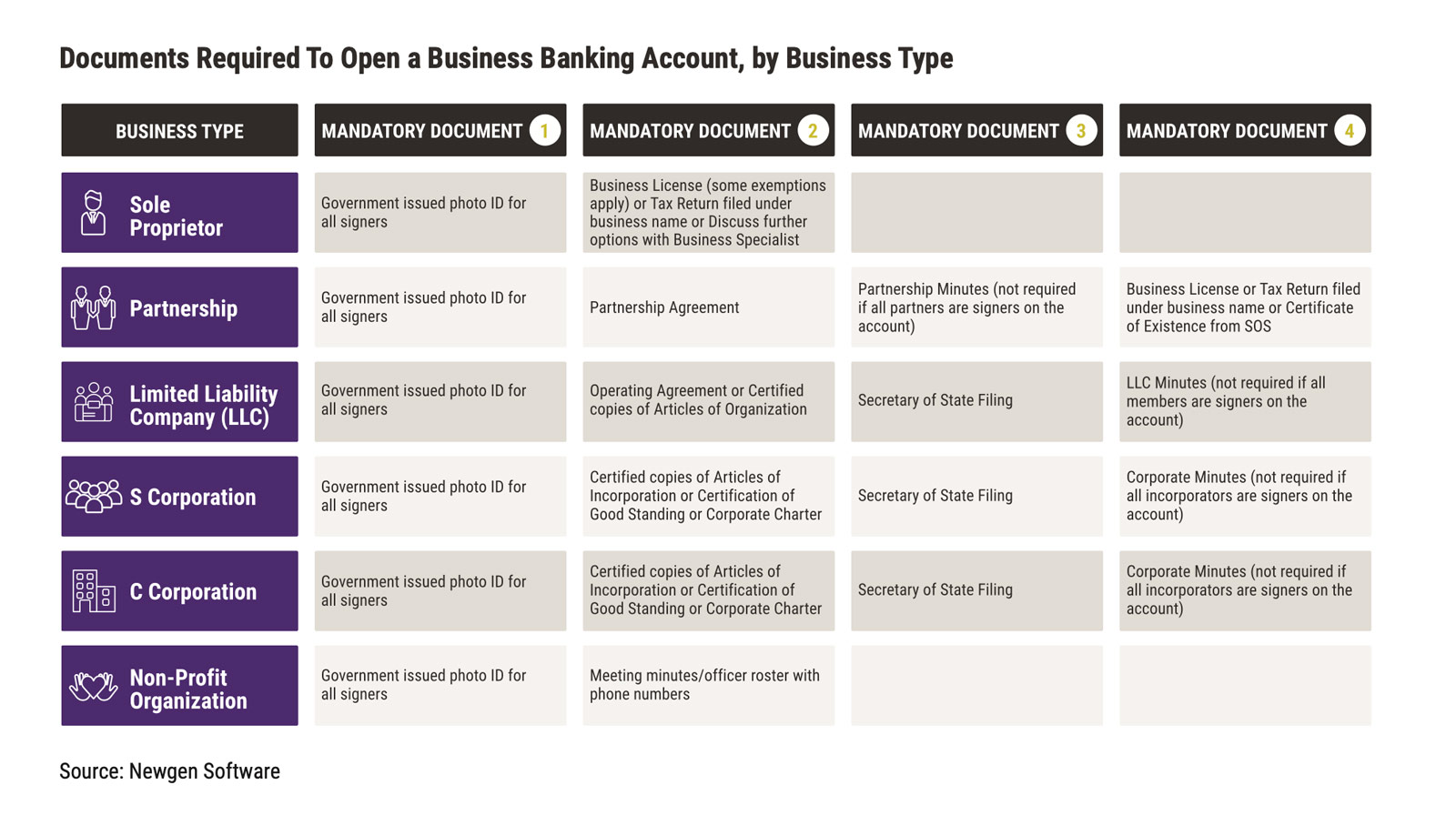

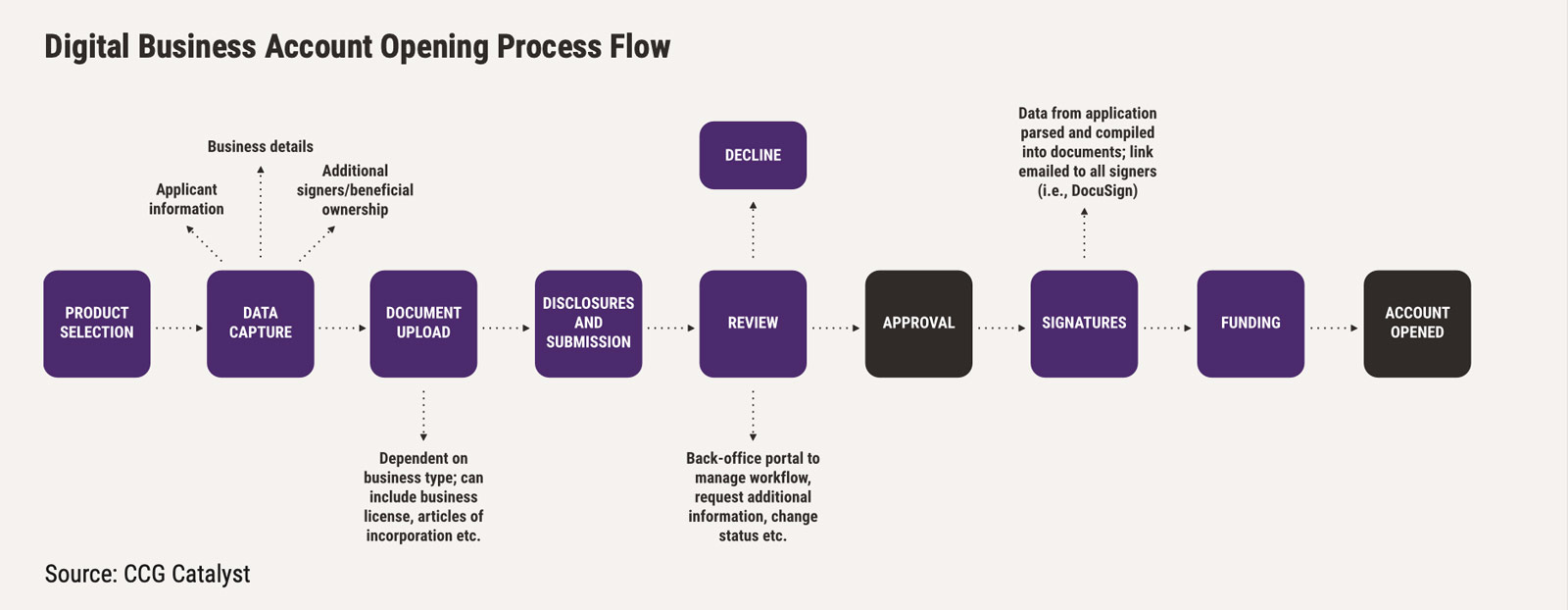

Today, a digital business account opening flow will generally contain nine distinct elements: product selection, data capture, document upload, disclosures and submission, review, approval, signatures (all beneficial owners must sign their own contractual agreements), funding, and finally, opening the account. Typically, an applicant begins by selecting a product to apply for — say, a business checking account. Next, they must enter all of the information needed to verify that business, including their own personal details, information on the beneficial owners of the company, and business details like the legal name of the company and its North American Industry Classification System (NAICS) code. The applicant is then asked to upload relevant documents based on the kind of business in question (see Table below), before moving on to disclosures and submission. Together, these steps encompass the initial user experience and can potentially be done fairly quickly with little friction if the applicant has all of their documents in order.

The next step in the flow is review, where the human assist comes in — a bank employee will pick up the application on the backend (usually, via a collaboration portal) and begin to work through all of the materials, including verifying documents and requesting any additional necessary information from the applicant and/or signers/beneficial owners. The bank employee will approve or deny applications at this stage. If an application is approved, individual agreements are dispersed digitally for signatures to all beneficial owners. Once all agreements have been signed, the account is funded (details may be collected at an earlier point in the flow) and opened/booked to the core. In limited cases, which usually involve a sole proprietor or single business owner who differs little from a retail client, the applicant may receive approval in real time. However, even in those situations, the account might still be opened or made fully functional later after an employee has had a chance to review the application and related documents.

Overall, these elements represent a typical digital business account opening process, though approaches to each area can vary based on a bank’s strategy, risk appetite, and technology. For example, some institutions may leverage database integrations to conduct KYC and know-your-business (KYB) checks before the application gets to the review stage, creating a lighter lift for the employee, while others do not conduct any form of verification until the application is picked up by a human. As with digital account opening for retail, there are many choices a bank can leverage to optimize the experience; however, in business banking, most of those choices, right now, tend to involve when and how to automate parts of the process. On the retail side, banking providers are competing on things like “time to open,” while, here, they are making choices about where to leverage technology in the first place.

It’s also worth noting that this flow is generally applicable to businesses that fall into the small- and medium-sized business (SMB) category, or those with fewer than around 50 employees. Based on our conversations with technology vendors as well as banking services providers, this is for a number of reasons, including added complexity, but the most pertinent is that businesses larger in size tend to work through relationship managers. Later in this report, we will discuss how technology may be used to streamline the account opening process for larger corporates in the future.

Generally, it is quite clear that digital account opening for businesses is still very much taking shape. The important point here is that things are moving, and business bank executives appear to realize how critical it is to get at least baseline capabilities in place. In fact, when we asked our survey respondents which areas they think will be most important to their business customers in the next five years, digital account opening came out on top across a range of options. That prioritization is encouraging. The key now will be putting this into practice, building on recent progress, and continuing to move toward a fully digital experience.

Key players shaping the digital business account opening landscape

As banks begin to plan their next moves, it’s important to understand the key forces shaping the digital business account opening landscape and setting standards for the industry. These include leading banking providers, enabling technology vendors, and, of course, digital account opening solution providers. Below, we explore exactly who these groups are and how they are driving the evolution of this capability.

Leading banking providers

As with most new frontiers in financial services, digital account opening for businesses is being pushed forward by a few particularly progressive players, including fintech providers and leading-edge banks. These companies tout streamlined experiences that include the ability to apply for a business checking account in only a few minutes, entirely online. Neobank Novo, for example, puts its time to complete an application on the device of your choosing at under 10 minutes. 1 Its flow includes typical capture of personal and business details as well as document upload across just a handful of screens, and the company will provide the user with a timeline and estimated time to receive a response once an application has been submitted. 2 The company has no branches, so all of its applications are ushered through digital channels.

Meanwhile, American Express announced the launch of checking accounts aimed at SMBs late last year and says it can issue a decision online in as little as 10 minutes in certain cases. 3 The company told CCG Catalyst that it leverages a combination of internal and external tools for verification and includes a manual review element post-application for those auto-approved. It declined to share information on its auto-approval rates or to what extent those customers have existing relationships with the organization. However, that large companies like Amex and others are even dipping a toe in the auto-decisioning realm is a promising sign for the future.

Additionally, a number of large incumbent institutions are experimenting with new and creative ways to automate their offerings, including teaming up with technology firms — for instance, a group of banks including Goldman Sachs and Citi are partnered with Stripe to open business accounts through a single application programming interface (API) request. 4 Stripe handles identity verification and account provisioning on behalf of its bank partners, which ultimately enables the company to give its own clients the ability to easily offer banking services to their end customers. The service, dubbed Stripe Treasury, is already being used by Shopify for its Shopify Balance banking product provided to merchants on its e-commerce platform. Existing merchants can reportedly set up an account in minutes from within the platform itself. 5

All of the providers at the forefront of this space have a few things in common: a commitment to fast, frictionless user journeys, the use of technology to automate key portions of the process, and a thoughtful approach to design and delivery. Over time, the standards they are setting, especially when it comes to time to complete an application and receive a response, will become an important part of implementation broadly, which means watching their choices now is key. In particular, while many have the luxury of building quite a lot in-house, paying attention to how and where they are using technology can shed real light on where we are headed and the capabilities that will likely trickle out to the mainstream in the future. Additionally, understanding the value in small but intentional elements — like Novo’s estimated wait time feature — can go a long way in improving the user experience.

Enabling technology vendors

As activity around this space intensifies, advanced technologies are beginning to emerge that promise to make major strides in digital account opening. And a handful of these are already gaining popularity in the market, even among those with hefty development resources. These tools are mainly focused on streamlining KYC and KYB processes for institutions, enabling banking providers to reduce their reliance on human intervention and introduce more automation into the process. Here’s a look at a couple of key technology players and how they are working to change the game:

Alloy. Alloy is an identity decisioning platform that can be integrated with an account opening solution to run validation checks across a range of data sources, in real time, via API. Alloy ingests data from the bank’s account opening solution as a user moves through the application process, automatically validates those inputs using data sources selected by the institution, (it offers 120+ options across retail and business banking), and decisions the application using the bank’s parameters. Its core business is KYC verification on individuals, but it’s become a larger player in the KYB space in the last couple of years, according to Tommy Nicholas, CEO at Alloy.

On the business front, the company provides the ability to tap an array of data sources at once that can verify a business entity and related persons as well as handle fraud prevention checks like sanctions screening. The system will then use those inputs to decision an application (approve, deny, hold for review etc.) based on specific criteria laid out by the bank during implementation. As Nicholas explained, the trickiest part on the business side is creating rules in the system for all of the different permutations possible in a business banking scenario, which can result in longer implementations at times. However, once up and running, Alloy is able to achieve full automation 60-80% of the time on simple deposit products like a business checking account with its more progressive clients.

Middesk. Middesk is one of the vendors Alloy uses in its KYB offering. It is a KYB solution provider focused on verifying business entities using Secretary of State data. The company’s solution pulls data from all 50 Secretary of State offices in the US and refreshes that data either in real time via an API integration or at most on a weekly basis, according to Kyle Mack, CEO at Middesk. As a result, it is able to verify any business registered with any Secretary of State in the US using only two inputs: legal entity name and legal entity address. This enables banking clients to automate the KYB process through non-documentary verification, minimizing reliance on manual processes. The company can auto-resolve and deliver a response in seconds about 80% of the time, and it employs a 24/7 audit team that handles exceptions. Middesk can also pull documents such as articles of incorporation that a bank needs for supporting evidence automatically, helping to eliminate friction and stress on the applicant related to collating and uploading their documentation. In addition to its identity verification services, Middesk also provides watchlist screening and people matching services to help model beneficial ownership structure.

While technology on the retail side is fairly well established — on average, 63,013 applicants are auto-decisioned daily with Alloy, and most of those are retail customers — the business side is just beginning to see these truly transformative tools come into play. According to Nicholas, the ability to fully automate the KYB process simply didn’t exist a year or two ago, and it’s now being made possible by the introduction of new vendors like Middesk focused on solving for the unique complexities involved. Today, such solutions are generally used in conjunction with manual effort, but, in time, as they become more well-known and adopted, the human component will likely become further and further reduced as the industry embraces greater automation and efficiency.

Account opening solution providers

A number of digital account opening solution providers in the market are now turning their attention to business banking after building out their retail experiences. These companies are focused on bringing successful elements from the retail side into business banking and using advanced technologies to manage complexity and drive efficiency. Below, we take a look at a few of these vendors (in alphabetical order) and how they’re approaching this critical area. The following is a sample and in no way serves as a set of recommendations by CCG Catalyst.

Newgen. Newgen is a low-code automation platform that offers a digital account opening solution for businesses. It provides a single solution for consumers and business entities, with varying pricing based on added functionality. Newgen’s solution automates data capture and document upload and includes a back-office collaboration portal for review and decisioning. An applicant begins by selecting a product and entering their own personal information. Next, they enter details on beneficial owners/signers as well as business details and move on to document upload. Once an application is submitted, a bank employee picks it up in the portal and essentially moves through a digital version of the bank’s existing workflow for approvals. (Sole proprietors may be auto-approved in certain cases, depending on the bank’s risk appetite.) KYC and KYB verifications are conducted using the bank’s existing database connections, which Newgen will integrate to. Right now, that typically includes traditional solutions like FIS BizChex and ChexSystems. However, Newgen is working to pre-integrate with more novel technologies like Alloy. Once an application is reviewed and decisioned by the back office, it is sent for signatures and funding details, before being opened and booked to the core. The company’s solution is also integrated with Google Analytics, which enables banking clients to track things like how long users take to go from one field to another and how much time they spend on a specific page. Such insights can help to inform choices and reduce abandonment rates, according to Ankur Rawat, director of products and solutions at Newgen. Additionally, it offers an account maintenance module that allows institutions to go beyond account opening with the ability to add supporting features like servicing for certificates of deposit (CDs). Newgen’s offering is currently configured primarily for SMBs.

Q2. Q2 offers digital account opening for business clients through its Gro portfolio, which it acquired in 2018 to serve as the backbone for its overall online account opening capabilities. Like most solutions in the market today, it is mainly catering to SMBs with 50 employees or less on the business side. Applicants begin by creating credentials that they will use to access their application through a collaboration portal. Each beneficial owner is sent an email with a link to create their own credentials based on the information provided by the applicant. While waiting for those parties to begin the process and enter their information, the applicant can continue to move through the flow, entering their own personal and business details. After that, they move on to document upload and complete the application. At that point, a bank employee picks up the application on the backend to review the documents and ultimately issue a decision. (Auto-approvals are possible, but, again, rare and based on the bank’s preferences.)

Q2 is preintegrated with database solutions like LexisNexis and Socure for KYC and KYB purposes, and it is currently working on integrating with Alloy. (Verification checks are also run on each relevant business party as they enter their information, so the time to issue a decision can vary depending on their speed.) According to Joe Phalen, director of off-platform solutions at Q2, the company puts an emphasis on user research and A/B testing in development, which helps to inform many of its choices when it comes to flow and design. For example, Q2 collects driver’s license information manually rather than via photo capture and upload, as it’s found desktops tend to be the device of choice for these applications and often lack a camera. This approach allows the company to adjust to reduce friction and drive completion rates — while Q2 could not provide exact figures, completion rates on the retail side hover around 70-80%, and early data suggests similar results for business applications, Phalen explained. The Gro business account opening solution is powered by Salesforce and hosted by Q2.

Temenos. Temenos provides a single platform with modular account opening solutions designed to be configured based on a bank’s preferences. That means, while its digital business account opening offering currently serves primarily as a sales-assisted solution for the SMB market, the goal is to enable institutions to build on that functionality to add more automation and support larger businesses over time, according to Luis Landivar, vice president, digital architects at Temenos. Temenos’ out-of-the-box flow begins with the typical data capture and document upload requirements, dynamically adjusted based on the product an applicant is applying for. For KYC and KYB processes, the company will integrate to whichever vendors the bank is already using, though it does plan to bake in a solution by Q2 2022. Once an application is submitted, the company’s rules engine powered by RedHat’s Process Automation Manager (PAM) does much of the heavy lifting in pushing the process forward. For example, the rules engine can be configured to determine if an application should be auto-decisioned. All of the criteria for such choices are made by the bank and configured by Temenos to automate the workflow. Except in limited cases that meet the criteria for auto-approval, completed applications are sent into a back-office queue, where a bank employee will pick it up for review. Temenos’ relationship manager portal is set up almost like a lead generation system, where an employee can not only view, decision, or refer applications to a higher manager but also look at declined applications that could be revisited or explore partial completes. Once an application is approved, it is dispatched for signatures and funding details, then opened for client use. Temenos’ offering is prebuilt to provide a set of baseline capabilities but is flexible and configured many different ways in practice, depending on the bank and its risk appetite.

NCR Terafina. NCR-owned Terafina is one vendor attempting to serve both the SMB and commercial market. It provides a single solution that is licensed differently based on functionality, allowing banking clients to originate accounts from businesses of varying sizes and complexity. While the flow is generally similar to other providers, a key difference is the company’s data model, which allows it to map relationships between parties (either people or businesses) and therefore handle more complex applications. All of its business banking clients for digital account opening are currently on its small business module, and about half of those also use the commercial application. Today, the small business module handles mainly very simple applications like sole proprietors and single- or dual-member limited liability corporations (LLCs), while the commercial module handles corporations, S corporations, nonprofits, larger LLCs, limited liability partnerships (LLPs), and joint ventures, according to Jason Hillner, VP of sales at NCR Terafina. Similarly to its peers, while NCR Terafina supports auto-approvals, its clients still tend to rely on human assistance for the majority of applications, with more emphasis put on streamlining the overall process. For KYC and KYB verifications, it is preintegrated with newer solutions like Middesk and Alloy but can also leverage a bank’s existing relationships. (Applicants not present are sent a link via email to complete their portion, and verification is run on them as they submit.) The company provides a collaboration portal that allows applicants to track their status and a back-office dashboard that enables employees to review, collaborate on, and decision applications.

All of these vendors are working to automate the digital account opening process for businesses by streamlining key parts of the flow and introducing manual touches where it makes sense. Critically, however, while they all provide best practices for their products, they ultimately defer to their clients when it comes to implementation. As such, in many cases, they offer features that aren’t being used yet — especially when it comes to auto-approval capabilities. This mirrors what we are seeing on the enabling technology side. As we move forward, much of the progress we expect will likely come from account opening solution providers and other technology vendors working hard to get bank executives comfortable using their offerings in more advanced ways.

Areas of focus and development

On the road to true automation, there are a couple of key areas that should be on a bank’s radar when it comes to digital business account opening. These relate both to technological advancements as well as banking providers’ habits and practices. In this section, we explore a few of these areas and their impact on this capability as well as how digital account opening for businesses is likely to evolve as we forge ahead.

KYC and KYB automation

The rise of solutions like Alloy and Middesk are making KYC and KYB processes much easier to automate than ever before. Even the use of more traditional database products can go a long way in streamlining the process. However, a major sticking point remains when to run these checks. For a retail customer, KYC is fairly straightforward — it’s usually one API call and relatively cheap to run. On the business side, you’re typically looking at a number of API calls, which can get expensive if run on every single application. As a result, a bank’s attitude toward costs plays a major role in when they decide to run those checks. From a technology standpoint, these processes could be run in real time, according to Sumit Kumar, lead business analyst at Newgen, but, because such solutions tend to be priced per API call, many clients today choose to wait until an employee has had a chance to take a look. Such a practice can slow down the process and create undue reliance on human help.

The goal should be to find the right point to run those checks without throwing money away or holding things up. Technology can help here — for example, Temenos’ rules engine can be configured to decide whether to run KYC and KYB verifications automatically or to send an application first for manual review, based on a bank’s preferences. In most cases, the company’s clients are using the rules engine to trigger KYC and KYB checks automatically on submission, without bringing in a human to make that decision, Landivar explained. While not exactly real time, such a setup allows a bank to at least automate the decision to run the necessary checks, eliminating manual intervention from this point in the process and helping to get more applications validated before they get to a bank employee for review.

When to run KYC and KYB verification is a prime example of a choice a bank must make that can result in a less efficient use of technology. Thinking through how to streamline this piece of the process is important to reducing friction and creating a digital-first experience. At the very least, institutions should be thinking about how to ensure a human in the back office is simply completing a review of the KYC and KYB reports, rather than manually triggering those processes in the first place.

Document verification

Document verification is probably the most difficult piece of account opening for businesses. That’s because those documents are hard to validate using technology and generally require a human to intervene for review. They are also a major requirement for opening a business account, both for validation as well as filing purposes. As such, this represents a key area to solve for on the road to true automation. Companies like Middesk are leading the charge here by finding ways to not only validate businesses but also pull documents needed from relevant entities as part of the flow. Once such solutions become a trusted part of the vendor landscape, it will pave the way to greater auto-approvals, as banks will be able to verify businesses and collect everything they need automatically. With proper identity decisioning layered on top, through a company like Alloy, for example, the entire process could be automated. In fact, we’re starting to see the early stages of this adoption among especially forward-thinking providers — Novo, for instance, which uses both Alloy and Middesk, makes document upload optional for clients and is able to auto-decision a significant number of its applications, Anthony Jerkovic, head of data and risk at Novo, told CCG Catalyst. To be fair, this scenario is still quite a long way off for most institutions and certainly points to an area where the technology appears to be ahead of the industry’s overall comfort level. According to Mack, banking providers need to be willing to update their policies to reflect the availability of better quality data in order to fully take advantage of solutions like Middesk. Right now, that applies to only the most progressive institutions. But, that the ability to automate what has long been the most manual part of the flow is arriving speaks volumes for where digital business account opening is headed in the future.

Auto-approval

Auto-approval is the holy grail — extremely elusive and the ultimate ambition. While digital business account opening solutions are currently certainly set up to trigger auto-approvals, as we’ve discussed, most banking providers are reluctant to leverage those capabilities widely due to risk, and it will likely take time for them to come on board as the technology matures. In the meantime, however, some are using more creative ways to crack the process — for example, some of Alloy’s clients will open accounts automatically with holds or restrictions, which are removed after a human has had a chance to review. Approving an account and then opening it later, once reviewed, is another thoughtful way to accomplish the same outcome. According to Alloy’s Nicholas, applicants are much more likely to activate their account if they are provided with next steps on submission, which means it’s important to find ways to give them some sort of decision or feedback. Institutions should be looking for opportunities to get around their fears strategically, and, in the process, they may get more comfortable with the idea of auto-approval overall. This is an area where baby steps are extremely vital to pushing the industry forward broadly.

Looking ahead: commercial

For the most part, this report has focused on business account opening for SMBs. That’s because that is what the market is largely focused on. Eventually, though, attention will likely turn to bigger and more complex businesses, with some providers like NCR Terafina already working to solve for those entities. Undoubtedly, this process is unlikely to be fully automated anytime soon. And that’s for various reasons, including the complexity involved as well as the importance of relationship managers in those dealings. Additionally, many of these customers start out on the lending side and add deposit accounts later, which means they are often existing customers and working with a person they know very well. However, none of this means there isn’t an opportunity for technology here. All of the digital account opening solutions we’ve profiled have a back-office function and all of them work across channels (i.e. branch, call center etc.), which means they could reasonably be used to streamline the process for a bank employee working with a large client. Newgen, for example, offers remote account opening, which is designed to be used by a relationship manager/bank employee on behalf of a customer, especially while visiting the client’s premises. Over time, we expect to see greater integration between the back office on the corporate side and digital account opening solutions, enabling not necessarily full automation but a much more streamlined and efficient process.

Moving forward

Perhaps the most important thing to take away from this report is that there are two major elements at play when it comes to digital account opening for businesses: where the technology is currently and where banks are comfortable using it. Those two elements often do not line up with each other, which means the industry is in essence a bit further behind than it could be. The good news, though, is that the technology exists and will expectedly be proven over time by forward-thinking institutions intent on getting to the next level. As that happens, we will likely see the dominoes begin to fall, with more banks coming on board and moving the needle for the whole industry.

It’s this reality that banking executives should be getting ready for. While not everyone needs to be auto-decisioning business applicants in droves right now, getting to know the technology out there that will allow you to do so is crucial. Remember, small wins are not only fine but key here. You may not be at the forefront, but knowledge is power, and the imperative is to be prepared. Be prepared for a future where automation is happening in places you can’t imagine today. Going forward, we expect the industry to continue to creep closer and closer to truly digital experiences when it comes to business account opening, and those institutions that keep a close eye on this evolution will likely be those best positioned for success.

©CCG Catalyst 2025 – All Rights Reserved

No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording or any information storage and retrieval system, without prior permission in writing from the publisher.

Read Digital Account Opening in Retail Banking: Competing on First Impression

Download a PDF of this article