AI in Banking: Accessible Applications and Use Cases

Big banks in the US have poured billions of dollars into artificial intelligence (AI).1 And with good reason — the technology, which broadly encompasses algorithms designed to mimic the human brain, has numerous applications in banking, from improving customer service to helping to manage risk. However, AI isn’t just for these larger institutions. They may be the pioneers driving adoption, but the rest of the industry can benefit from AI, as well, by making smart investments using targeted approaches. In fact, banks outside of the top tier likely need to leverage AI to modernize their systems and keep up with their larger peers and other competitors. In addition to large institutions, fintech players are adopting AI in areas like loan underwriting, for example,2 putting additional pressure on the broader market to leverage similar capabilities.

Banks have always adapted to the latest technological advancements. They introduced ATMs in the 1960s and electronic, card-based payments a decade later. The 2000s brought the adoption of online banking, followed by the spread of mobile-based “banking on the go” in the 2010s. AI, while it may seem like a mammoth concept, is just another frontier for this evolution. For context, the AI in financial services market globally is expected to reach $22.6 billion by 2025.3 That means we’re probably going to see this technology proliferating in many aspects of banking in the next few years, in all corners of the industry. Institutions of all sizes should be looking at how they can prepare for this reality. As more providers leverage AI to improve in different areas, the goal post will move, and those that haven’t entered the field will be even further behind.

This report will explain what AI is and why it matters for financial institutions, provide an overview of accessible use cases for banks without large budgets, offer examples of AI in the real world to help ground this idea for executives just beginning to explore it, and review key challenges to adopting AI and how they can be overcome.

What is AI — and why does it matter for banks?

Artificial intelligence, or AI, refers to the overall concept of creating processes to stimulate human thinking in computer programs. There are two major subsets of AI: machine learning and natural language processing (NLP):

Machine learning. This subset is focused on algorithms that can process large amounts of data quickly and accurately to drive insights and automate processes through statistical techniques and exposure to patterns in data.4 The goal is to process more data, more accurately, and more efficiently by creating logical rules that allow the machine to think on its own. Machine learning can be further broken down into supervised (uses labeled data to predict outcomes) and unsupervised (uses unlabeled data that the machine analyzes without help to find patterns). Typically, machine learning is used in areas of banking like underwriting and fraud detection.

Natural language processing (NLP). NLP is used to process speech and text. It’s the subset of AI that allows computers to understand language the way a person would.5 NLP can be combined with machine learning or be used separately. In banking, it’s usually used in call centers to respond to users’ requests or in virtual assistants like chatbots.

The difference between AI and traditional software systems is the higher amount of information and data that can be processed at a lower cost. Simply put, computer technicians previously would have to write every line of code telling a computer at every step how to process data. AI gives a machine the tools to process data, which simplifies the amount of coding required. As the name implies, it gives machines the intelligence to learn like humans to discover patterns and meaning, generalize knowledge, employ logical reasoning, and learn from experience. That AI algorithms are self-learning and do not need major software upgrades is a significant benefit and distinction between AI systems and traditional software.

AI is meant to complement face-to-face relationships by making connections through data that a person may otherwise not (or not easily), creating better experiences and driving efficiencies. Because of this, it offers up an answer to a number of challenges facing banks today. For example, the traditional banking service model relies on people to better deepen relationships with customers and tailor services to their needs. However, personalization through human interaction alone can be expensive — the average salary of a customer service representative is $35,800, compared to a chatbot’s cost at $3,000 to $5,000.6 Targeted use cases like this one can make a huge difference to an institution with limited resources looking to improve performance.

In the next section, we explore some of the more accessible applications of AI that can be used to drive results without major investments in this technology. These use cases provide a good starting point for those interested in AI but unsure where to begin.

Accessible AI applications for US banks

As AI becomes more mainstream, it’s also becoming more accessible. This means that, while many institutions do not have large technology budgets, let alone software development teams, they can still benefit from certain AI applications. In particular, these institutions should be looking to make targeted investments in specific use cases that can deliver value. Based on our conversations with banking institutions as well as AI technology providers working to bring these capabilities to more organizations, we’ve distilled three key areas that fit this bill: improving customer service, expanding loan underwriting, and fraud management and identity verification. Below, we take a look at each of these and how AI is being used to deliver benefits and improve performance.

Improving customer service

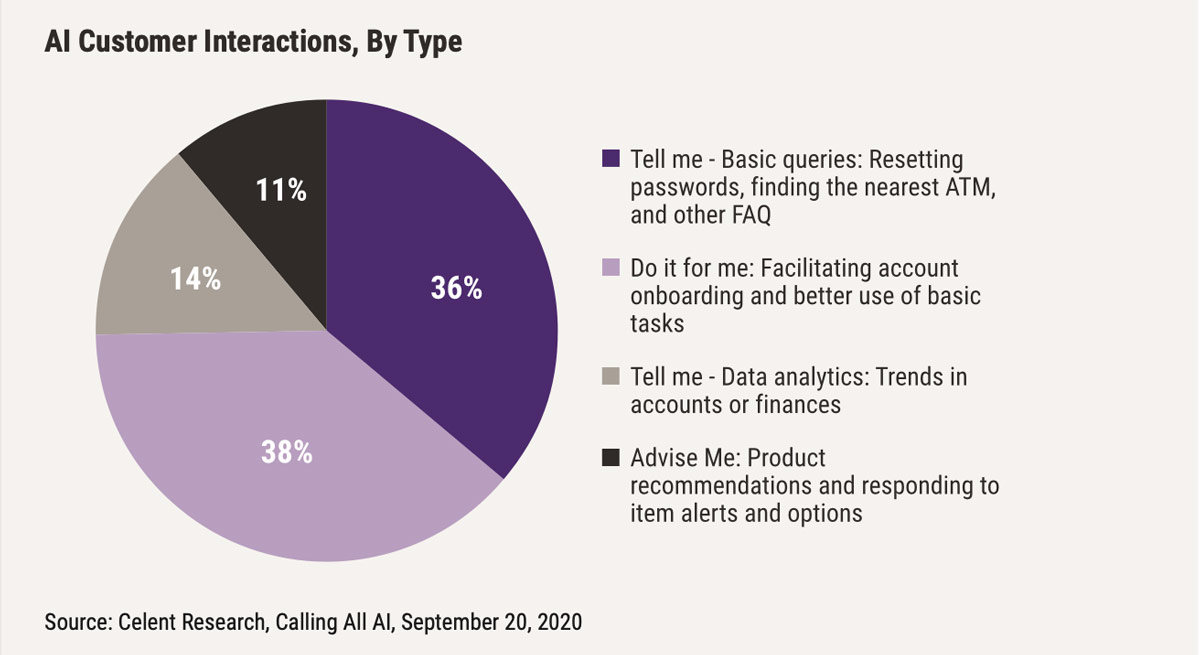

AI can complement a bank’s personal relationships with its clients by providing 24/7 customer service and responding to perfunctory concerns through virtual assistants or chatbots, either over the phone or through an app. Personal, authentic, and efficient customer service is key to driving customer satisfaction and retention, and as mentioned earlier, AI can provide that service at a lower cost. Moreover, it makes it easier to accommodate customers in a digital and distributed world: A customer might move to a different time zone, have an unorthodox work schedule, or be traveling abroad, but they still need to be able to interact with their bank. AI-powered customer service can deliver outside of traditional hours without compromising on personalized touch. In addition, unlike human employees, it doesn’t require extensive training.

Chatbots and virtual assistants are not meant to replace personal relationships between a bank and its customers but augment human actions by acting as a permanent mechanism of institutional knowledge actively and passively. While critical to creating human-to-human experiences, people will often leave an organization for other opportunities, taking their knowledge with them. AI doesn’t pose that problem, and the information it houses can be used to improve the interactions live agents have with customers, especially if they are new. Virtual assistants powered by AI do not need a human operator to record data manually; instead, they will automatically record relevant customer information during conversations. They can then use that information to personalize future interactions the way a human would.

Amelia is one such AI-powered assistant; it responds to customer inquiries over the phone through dialogue. Unlike traditional automated phone systems (IVRs), it doesn’t provide customers with choices, instead talking with them the way a person would and leveraging data on past interactions to tailor the experience and proactively find solutions, explained Allan Andersen, director of enterprise solutions at Amelia. This reduces the number of instances in which a human must get involved. When implemented at Sterling National Bank, for example, Amelia was able to successfully answer questions without bringing in a representative over 50% of the time. Amelia also learns from conversations, and when it hands a call off to a live agent, it analyzes how the representative solves the issue, so it can adapt for the next call. Amelia offers a pay-by-volume approach based on the number of calls per day, and the bank can determine how to route calls to the software to minimize cost and maximize returns. For example, Sterling focused on automating simple queries, such as resetting a password, asking for the location of the nearest bank, or confirming with the customer a charge for fraud. These types of calls are basic and less likely to require human intervention.

According to Jason Vazquez, chief information officer at Sterling National Bank, Amelia fits into the bank’s larger modernization goal of embracing digital channels and allows the bank to focus on services that require more extensive human interaction.

Another player in this space is Kasisto, which provides AI-powered virtual assistant solutions that can be embedded into a bank app, taking a text-based approach to customer service, rather than voice. Kasisto CEO Zor Gorelov says its product is meant to augment live agent services to reduce long wait times that cause customer dissatisfaction by delivering personalized virtual assistance. Kasisto’s technology analyzes data on customers like personal transaction history to help tailor interactions and provide advice on how to make financial decisions. On average, banks using Kasisto see a 30-50% reduction in live agent costs. If an agent needs to get involved, instead of providing a long-form transcript that puts stress on the customer service representative to quickly analyze while the customer waits, Kasisto uses AI to think independently and creates a written summary of its interactions outlining the problem.

Customer service is traditionally considered a cost center designed to maintain existing relationships and not increase revenue. As a result, many firms have focused their customer service improvement efforts on reducing costs. The problem with their outlook is that it leads to unhappy clients forced to press a sequence of buttons to speak to a live agent and unhappy customer service representatives who have to answer the same questions over and over. AI-based customer service solutions can lower costs and improve experiences at the same time.

Going forward, we expect to see AI evolve to understand intent better. As algorithms get more effective, virtual assistants and chatbots should be able to understand better what people are looking for before they finish a thought. Even further, AI will likely eventually be used to proactively reach out to customers and prospects to solve problems and drive new business on its own. In some respects, this is already happening — Amelia has a nonbanking client that uses the technology to solicit new business proactively.

Increasing and expanding loan underwriting

Large banks and fintechs are raising the stakes on the lending front by offering customers personal loans 24/7 more quickly and easily than ever before; Marcus by Goldman Sachs, for example, allows customers to apply for a loan in as little as 4 minutes.7 Other institutions need to compete with the flexibility and speed of these pacesetters by improving their underwriting capabilities and ability to deliver to more customers efficiently. AI complements underwriting by increasing the potential number of credible loans with improved accuracy while reducing costs. It does this by leveraging more data points when decisioning an applicant as opposed to relying on simply a FICO score to measure an applicant’s creditworthiness. Marc Stein, CEO and founder of Underwrite.ai, an AI-based underwriting company that uses historical data to mimic the thought-process of a bank’s human underwriters, explains that underwriting consumers is fundamentally a nonlinear problem but that traditional underwriting uses linear approaches and is highly dependent on FICO or Vantage scores. Given that 50% of the population falls outside the prime credit definition of FICO 680, he said, credit approval is highly biased towards that cohort which disadvantages half of the consumer market.

Underwrite.ai essentially builds a digital brain of the bank’s underwriting program since its inception. Each time a customer makes a payment or misses a payment, the algorithm assigns a unique identifier. If there are new underwriters or a sudden change in customers due to population growth, the algorithm learns by itself and adjusts. It requires zero maintenance and continually analyzes data on applicants, customers, and loan decisions to predict credibility better. The technology combines this historical data with external data sources to provide a richer view that can help underwriters make better decisions. The goal is to provide an alternative to FICO for people who may be reliable payers but don’t have a good credit score. The company’s basic model charges roughly $2 per application programming interface (API) transaction, with no minimums.

In addition to widening the applicant pool, this kind of AI can help institutions make their offerings more readily available to avoid missing out on opportunities. For example, if a customer receives preliminary loan approval from a 24/7 fintech at 8:00 P.M., they have the whole night to process that information before the bank opens the next morning. Banks lose the competitive advantage of being able to offer an alternative that night if they don’t offer similar services. AI-based underwriting can be used to handle applications while the bank is closed. It’s not meant to replace humans entirely, however. Underwrite.ai, for instance, is designed to calculate probability not tell the underwriter what to do. It can issue preliminary decisions to customers during off hours, with the parameters for preapproval set by the bank. Generally, a human will still be involved to make the final decision.

Zest AI is another active player on the underwriting scene that uses a combination of historical data and external sources to approve more applicants with greater accuracy. To get started, Zest AI provides a holistic analysis of a bank’s performance within the first 60 days by combining its own algorithm with the bank’s data and comparing against industry benchmarks. This can help give the bank a starting point from which to improve. Once implemented, every single feature of Zest AI’s automated decision is plotted on a table in an easy-to-read format that includes what modifiers could be changed for approval, enabling the bank to potentially market a new loan to the customer, while keeping within the bank’s standards for risk. Additionally, Zest AI’s models can be broken down to show which factors led to a previous applicant’s denial. On average, assuming a bank takes in around 100,000 applications a year, it can see a 15% increase in approvals, according to Sean McCarron, VP of marketing at Zest AI.

The company’s software also comes with AI monitoring tools that analyze the system for application volume and other inputs to detect subtle changes that may impact your business before it’s too late. In one instance, Zest AI picked up warning indicators early that the country of one of its clients was headed for recession. As a result, the bank was able to adjust and protect itself from millions in losses, McCarron explained. The program was also able to automatically detect that the stimulus program from the US government during the Covid-19 pandemic meant people were able to pay off their current debt, while determining this as an outlier and not a good indicator of their long-term reliability to pay off loans. FICO does not have that level of analysis and flexibility.

The value in AI for underwriting comes from its ability to pull in more data and analyze it efficiently to deliver more accurate decisions. By using open source data and combining it with bank data, AI solutions like Zest AI and Underwrite.ai can access and process more information than traditional computers. For example, if a bank wanted to increase its mortgage portfolio, AI could take publicly available records on when a house was bought and compare interest rates then to interest rates now. If the interest rate on the current loan is higher than options now, the customer might be persuaded into refinancing. Traditional programming isn’t able to handle this type of data processing at scale nor as efficiently as it would have to be programmed line by line. AI is able to take different types of data and use it when traditional software can’t through logical models relevant to the bank. In the future, AI companies will likely get savvier about which data sources they use and how they combine them to deliver better results.

Fraud management and identity verification

AI can improve fraud management by better aggregating data to identify trends and reduce false positives related to potential fraud incidents. Traditional fraud management practices are designed to use historical bank data to identify potential fraud incidents. Issues with this approach include lack of clean, useable data, processing constraints of legacy systems, and/or a failure to adapt to new practices by malign actors. AI is able to crunch larger amounts of data (both from the bank and external sources) and better understand patterns not only in transactions but also related to the actors themselves. It can also be used to better authenticate users through the use of biometrics like voice.

AyasdiAI is an anti-money laundering and fraud detection solution that looks beyond transactions and examines actors involved to determine potential fraud incidents while avoiding false positives. The company collaborated with academics to discover that money laundering schemes tend to be long-range plays with incremental changes to avoid most detection systems. It improves on traditional fraud management software by pulling in more data on transactions, including vendor information, persons associated with the vendor etc., to provide a more accurate view of potential risks. According to the company, clients often see a return on investment (ROI) almost immediately, as AyasdiAI can quickly clean up their backlog of cases and false positives. AI-based fraud tools like AyasdiAI drive value by bringing in new data sources that present a fuller picture of activity for transaction monitoring, enabling the bank to identify risks better.

In addition to transaction monitoring, AI can be used to reduce fraud in areas like new account openings. BioCatch, for example, can track how data is being entered during an application, looking at things like: Does the user type fast or slow? Is the data being entered using one finger or all five, or even just being copy and pasted? How much time is spent reading a screen? The company’s technology analyzes physical and cognitive digital behavior to distinguish between genuine users and criminals attempting fraud and identity theft. Their newest capability, Age Analysis, focuses on reducing fraud among senior citizens, a group that is often targeted in identity theft schemes: According to the Federal Bureau of Investigation, senior citizens see more than $3 billion in losses annually because they tend to be more trusting but also have financial savings, own a home, and have good credit, allowing easier account openings.8

The company’s account opening protection continuously monitors new account flows, and account takeover protection ensures the security of customers’ assets by flagging irregular account activity. If a session classified as high risk, the bank is notified immediately, and the transaction is flagged for human review. Banks have seen an ROI before the end of their proof of concept.

Fraud management is an area that is especially important for smaller institutions and federal regulators. As senior vice president at BioCatch Ayelet Biger-Levin explains, criminals are increasingly targeting smaller banks because larger ones have started increasing their fraud prevention capabilities. That means that beefing up capabilities around transaction monitoring and fraudulent account activity is key.

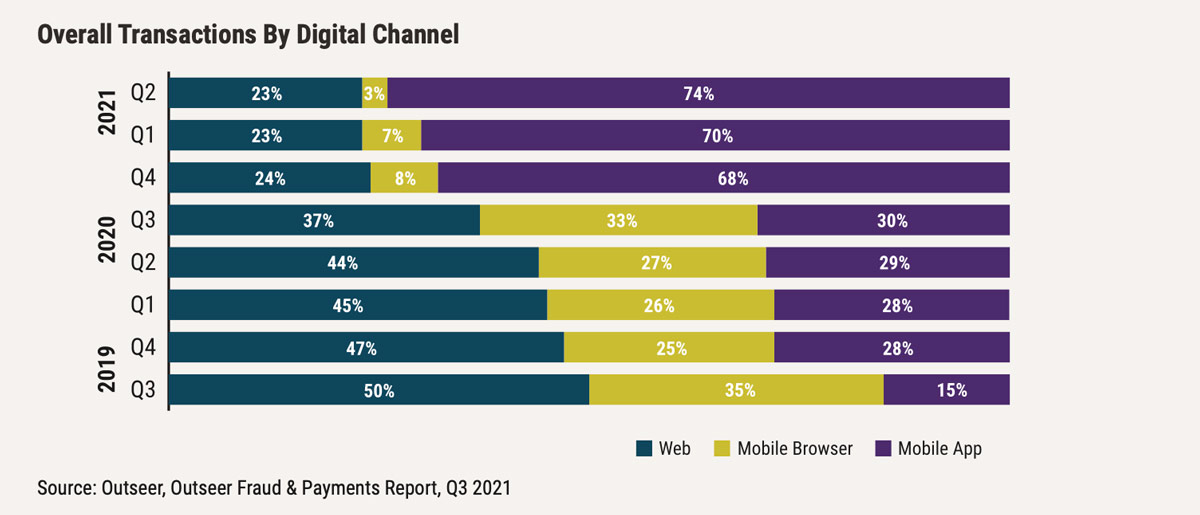

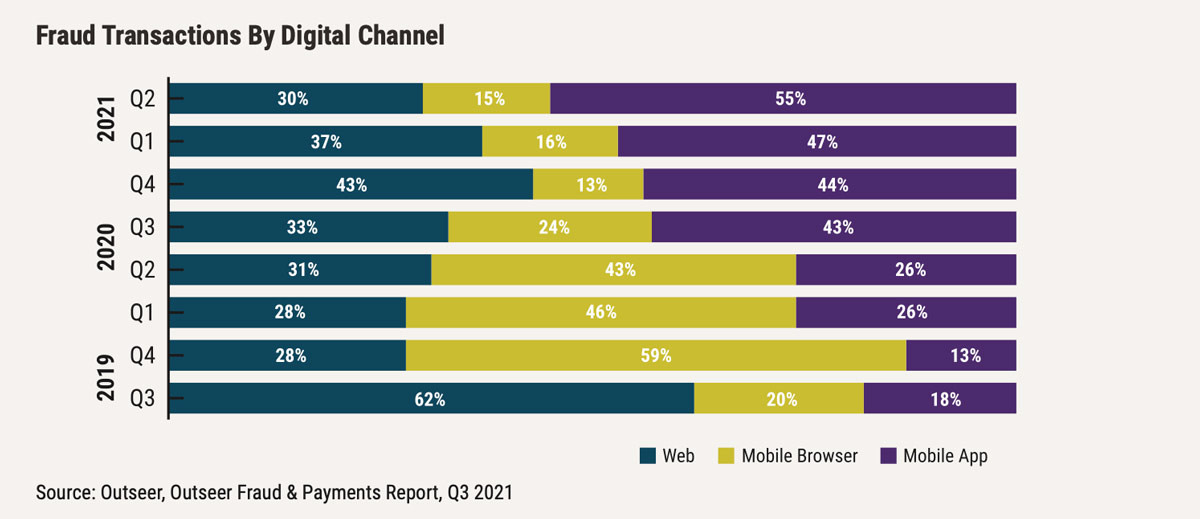

Additionally, as mentioned, AI can also be used to better authenticate users through biometrics. This is especially pertinent in a world that is moving quickly toward mobile, as these devices do not have the same security measures as traditional computers. In fact, in its Q3 2021 quarterly fraud report, Outseer reported that across web, mobile browsers, and mobile apps, apps counted for 55% of fraud cases in the second quarter of 2021.9 Sensory is one player in this space that is embedding voice recognition capabilities into banking apps and leveraging NLP to improve accuracy over traditional computer programs. A representative for Sensory explained that AI voice biometrics used in tandem with facial recognition biometrics is more secure and reliable than facial recognition alone because of the rise of sophisticated techniques used in spoofing, i.e. 3D printing. In addition, voice changes much slower than physical appearance as a person ages, so AI can more accurately adapt to the customer. Sensory also offers the same capabilities for use in call centers. Using biometrics to authenticate users is more secure than security questions or even device verification because it is focused on specific attributes tied to a person. Over time, we can expect to see the use of biometrics more widely used for authentication across a broad range of identity verification use cases.

As this decade progresses, advancements in cognitive technologies, AI, and data analytics will help organizations broadly go even further beyond traditional ways of managing risks. These algorithms will get more advanced to better process data and deliver more accurate results. This is critical, as improper risk management, especially in areas like fraud and identity theft, can not only cost a bank money but also drive away customers. Over time, AI will continue to advance to the point where traditional systems may become obsolete, making investments in this area not only valuable but necessary.

Challenges in implementing AI

As with any novel technology, there can be challenges when getting new projects underway. The trick is to prepare early for such issues, so that they can be overcome. Below, we outline a couple of key challenges and how to stay ahead of them.

Data acquisition and cleansing. AI requires data to run — huge amounts of it. And that data has to be formatted in a certain way for the machine to be able to process it. This can seem like a major hurdle for many banks that do not have data scientists on staff and lack a robust data strategy. Long term, getting your data in order is important, for many reasons. However, when it comes to initial implementation of AI, this problem can be mitigated pretty easily as long as you find the right partners. Many vendors will typically clean and format the data for you as part of implementation, alleviating this burden. They also tend to bring additional data sources to the table that can be used to enrich the bank’s internal stores and expand prediction capabilities.

Achieving buy-in. Achieving buy-in can be difficult, especially if a bank’s management team or board of directors doesn’t warm easily to new technology. As such, it’s important to make sure the business case is very clear and manageable. As Sterling’s Vazquez put it, it’s important to succeed fast and demonstrate an ROI as quickly as possible. That means resisting the urge to boil the ocean, not only in the use cases you select but also in how you design the strategy around them. Focusing on simple calls with little room for error helped the bank to demonstrate value more quickly in the technology and win over skeptics. As banks get started on this journey, it’s important to prepare early for difficult questions; keep the scope focused and outline your goals clearly. If you can show value in small ways early, it can help build support internally.

Avoiding bias. Avoiding bias in algorithms is top of mind for any banking institution thinking about AI, as mistakes here can draw the attention of regulators. In fact, as this technology becomes more widely used, regulatory agencies are taking a greater interest in ensuring that algorithms are fair. For example, in March 2021, the Federal Reserve Board of Governors issued a request for comment on adopting AI in compliance with consumer protection laws.10 This highlights the importance of introducing AI responsibly. Banks can avoid problems here by making sure to understand how things work as they are being implemented and confirming the technology they’re using is explainable. The benefits of AI are clear, and many banks today are using it without issue, but due diligence has a major role to play here for anyone considering embarking on this journey.

Selecting a strategy

Getting started with AI can seem like a huge undertaking for all but the largest institutions — but it doesn’t have to be. Banking providers of all sizes are using AI today; the key is to identify applications and use cases that make sense for your bank and set goals that are achievable. It’s quite possible that the best AI strategy for your bank today isn’t all that complex. Not every institution needs to integrate widely with an array of vendors, or even pursue all of the applications laid out in this report. Rather, when determining your approach, it’s important to understand what your goals are now and for the future. For example, Sterling National Bank’s narrow approach to bring immediate ROI was the right one for its business and to demonstrate AI’s potential to key stakeholders. As a result, the bank is now looking at additional opportunities.

An important point to note here is that there is help out there if you know what you want to do. Many of the AI vendors we talked to will work with a bank to offer on-demand pricing or implement more targeted solutions, and, in many cases, they will provide some assistance, either in the form of training, a dedicated account manager, and/or designing their system to create easy-to-read reports. The bank, though, needs to be able to articulate what exactly it is trying to achieve.

At the end of the day, each bank needs to develop a plan that fits its resources and needs. However, failing to upgrade your technology because of a fear of losing out on personal relationships should not be an option, either. AI isn’t fully mainstream yet, but it likely will be. And getting comfortable with it today, in ways that complement rather than replace the human touch, will go a long way in preparing for that future.

©CCG Catalyst 2025 – All Rights Reserved

No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording or any information storage and retrieval system, without prior permission in writing from the publisher.

Read Generative AI in Banking: Today, Tomorrow, and Beyond

Download a PDF of this article