The Banking Battleground: Views from the C-Suite

It’s been quite a year and a half for the financial services industry. Shifting to remote work, accelerated digital transformation plans, and many other new priorities took the stage. All in all, though, banking institutions in the US did a good job of rising to the occasion, meeting customers where they were (largely at home) and working hard to ensure funding flowed to the country’s businesses. But, now, we are turning toward a new normal. And that means looking to the future and understanding what the field will look like — and what it will take to compete. We’re unlikely to take any major steps back, but who is ready to take another step forward?

This report presents the findings of CCG Catalyst’s 2021 US Banking Study, which asked C-level bank executives in the US about their attitudes and priorities as we emerge from the Covid-19 pandemic. In particular, it focuses on the differences in perspectives between more forward-thinking institutions and those that have generally taken a traditional approach. The following provides lessons for banks that may be lagging behind in their own future-proofing efforts, as well as those interested in better understanding where their peers are headed. Finally, it’s time to think about tomorrow.

Methodology and Purpose

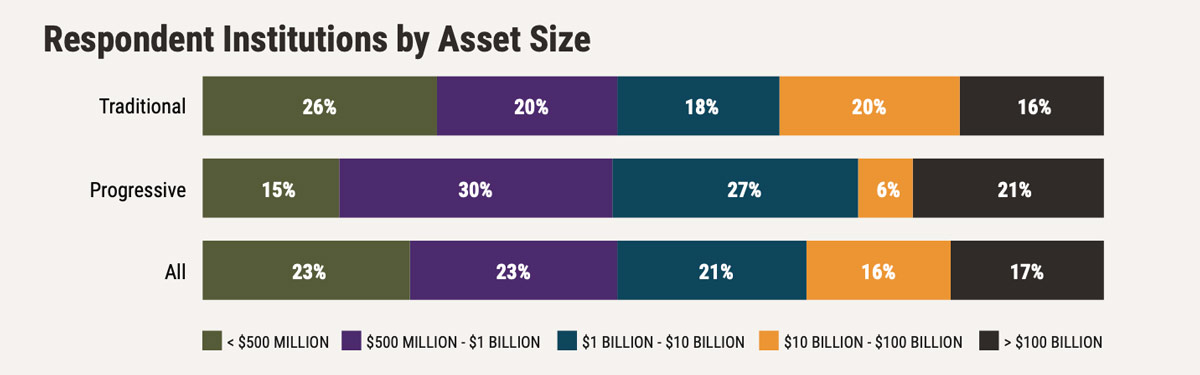

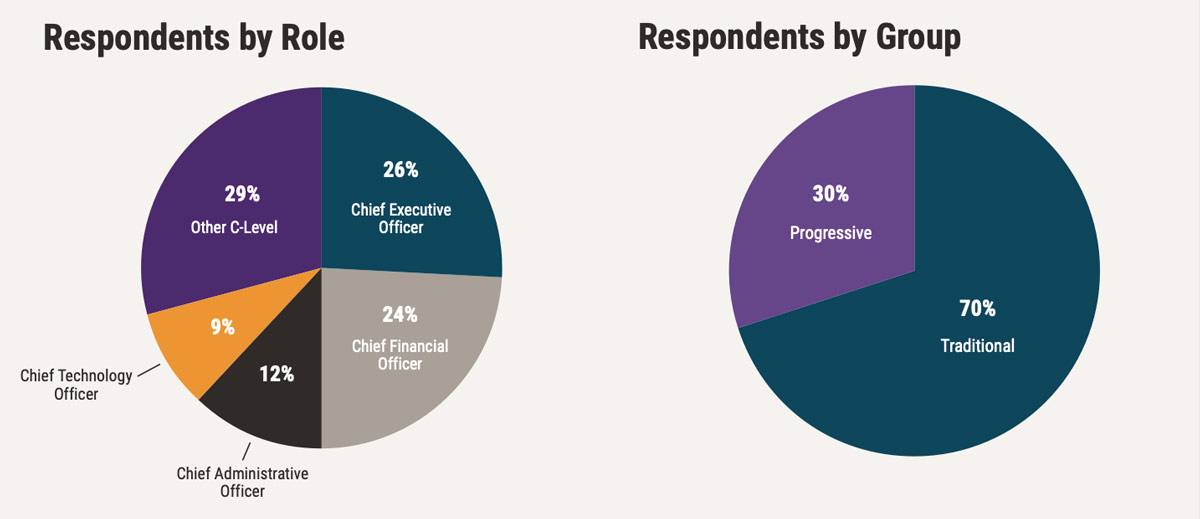

CCG Catalyst surveyed 109 C-level bank executives between December 2020 and February 2021 to gauge their attitudes and perspectives on their businesses and the market. Using specific criteria, we’ve grouped respondents into two categories: traditional and progressive. To be included in the progressive group, a respondent had to report acquiring less than 50% of their technology from a single vendor, working with fintech companies as an integral part of their strategy, and making at least one fintech investment. Based on this segmentation, we conducted an analysis to determine how the different groups approach the market and how prepared each is for the future. We focused on four core areas: retail banking, commercial banking, segmentation/targeting and product development, and technology and innovation. The survey data is unweighted, and the analysis that follows is based on our sample.

Retail Banking

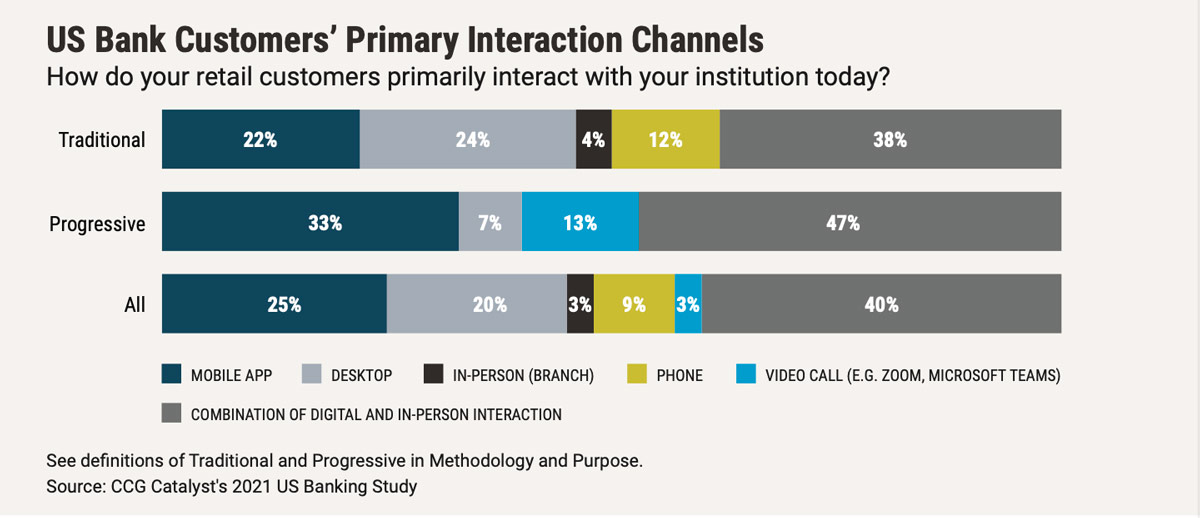

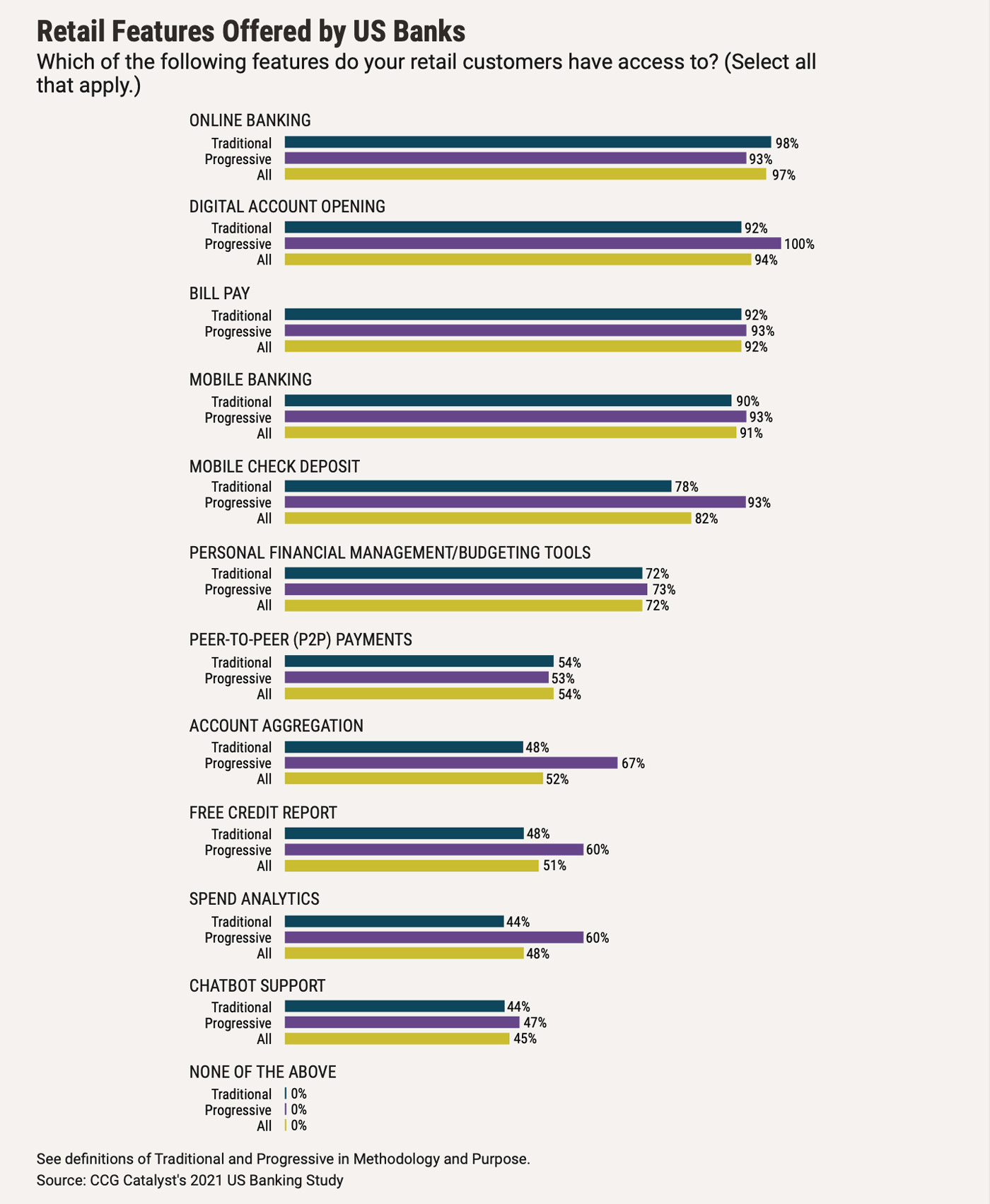

Retail banking is all about digital — that was true before the pandemic. But this era pushed even those furthest behind to up their game. By this point, most respondents to our survey who serve the retail market offer some form of digital banking, be it online, mobile, or both. However, channel use is not uniform across institutions. Customers at banks in our progressive group were much more likely to interact primarily with their bank via mobile than those at traditional institutions, where still nearly a quarter use online banking and a handful remain on analog channels like in-branch. This is interesting because it suggests that the once-key online banking channel may already be fading into the background as mobile takes center stage and other options for interaction become available; 13% of customers at progressive institutions are interacting with their bank primarily by video call today, for example.

Our data indicates that those still focused on the online experience may be missing the mark. And, while it may be tempting to look at this information and think, “I’ve got to get to mobile,” that would be a mistake. There are plenty of new interfaces that will come after mobile — think tablets, smartwatches etc. — that will capture customers’ attention. Banks today should be looking toward this inevitability and making sure to deliver seamless experiences that are device agnostic and can be pulled into any interface a customer may use in the exact same way.

It’s also important to point out that, despite customers’ embrace of digital channels, a combination of digital and in-person interaction is still prevalent across both groups, even against the backdrop of the pandemic. This suggests that the branch isn’t going anywhere, as most customers will still find reason for an in-person visit now and then. Moreover, banks are beginning to think of new and different ways to deliver branch services, like through mobile bank branches that move around to different locations. 1 The key is to understand all of the possible ways a customer might want to interact with your bank, and give them options. In short, put the customer in the driver’s seat.

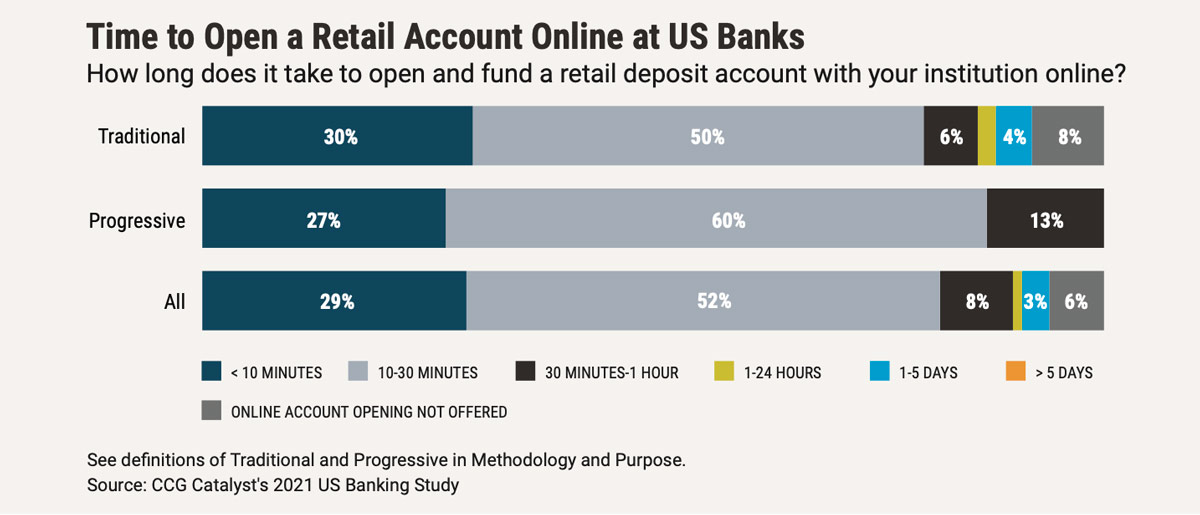

Unsurprisingly, with this focus on more options and channels for interaction, digital account opening is also becoming more important. Our data shows that, by this point, most institutions are embracing this trend, though there are a few laggards in the traditional category (8%) that don’t provide the option. (Note: this survey was conducted during the Covid-19 pandemic when banks were using creative ways to open accounts, and therefore definitions of this capability may vary.) Additionally, a majority can open an account in 30 minutes or less, and more than a quarter can do it in less than 10. As digital account opening cements its position as a must-have proposition for retail customers, the competitive battleground is likely to shift to how fast you can do it and how seamless the experience is. Dropoff rates for online applications for financial products can hover around 60%, and length of time is often cited as a top reason by consumers who decline to finish the process, according to Signicat data. 2 That means providing a fast, frictionless process is apt to translate into more completes, and therefore more customers.

The truth is we’re probably not far off from a future where 30 minutes simply doesn’t cut it. In fact, we may already be there — per our survey data, the top complaint among respondents’ retail customers is that access to services (like account opening) takes too long. So, if you’re a bank in that bucket, you’re likely to be — or should be — angling to move up into the less than 10 minutes slot.

When it comes to other features across institutions, the biggest gaps exist when you look at more advanced offerings, such as spend analytics, free credit reports, mobile check deposit, and account aggregation. For example, 60% of progressive institutions provide their customers with spend analytics, compared with just 44% of traditionalists. Meanwhile, nearly all (93%) in the progressive group offer mobile check deposit, versus 78% in the traditional category. For traditional players, these areas represent opportunities for improvement and potential future must-haves. That’s likely to be especially true for areas that address financial wellness and help users get a fuller picture of their financial life, such as spend analytics and account aggregation. According to data from The Harris Poll, 3 half of US consumers are interested in tools to help them track spending, and 44% want to be able to consolidate account information from multiple organizations. Additionally, just over a third would like to manage all their financial accounts in a single, online location or app.

Overall, while traditional institutions appear focused on their baseline digital shifts, progressives are already moving to the next phase where more advanced capabilities come into play. Rather than take the contrast as a worrisome sign, those earlier in their journeys should be thinking about how to capitalize on this peek into the future. These more progressive institutions are creating a blueprint for everyone else. Where they are today is where we should all be looking to understand which features and offerings are gearing up to be table stakes down the line.

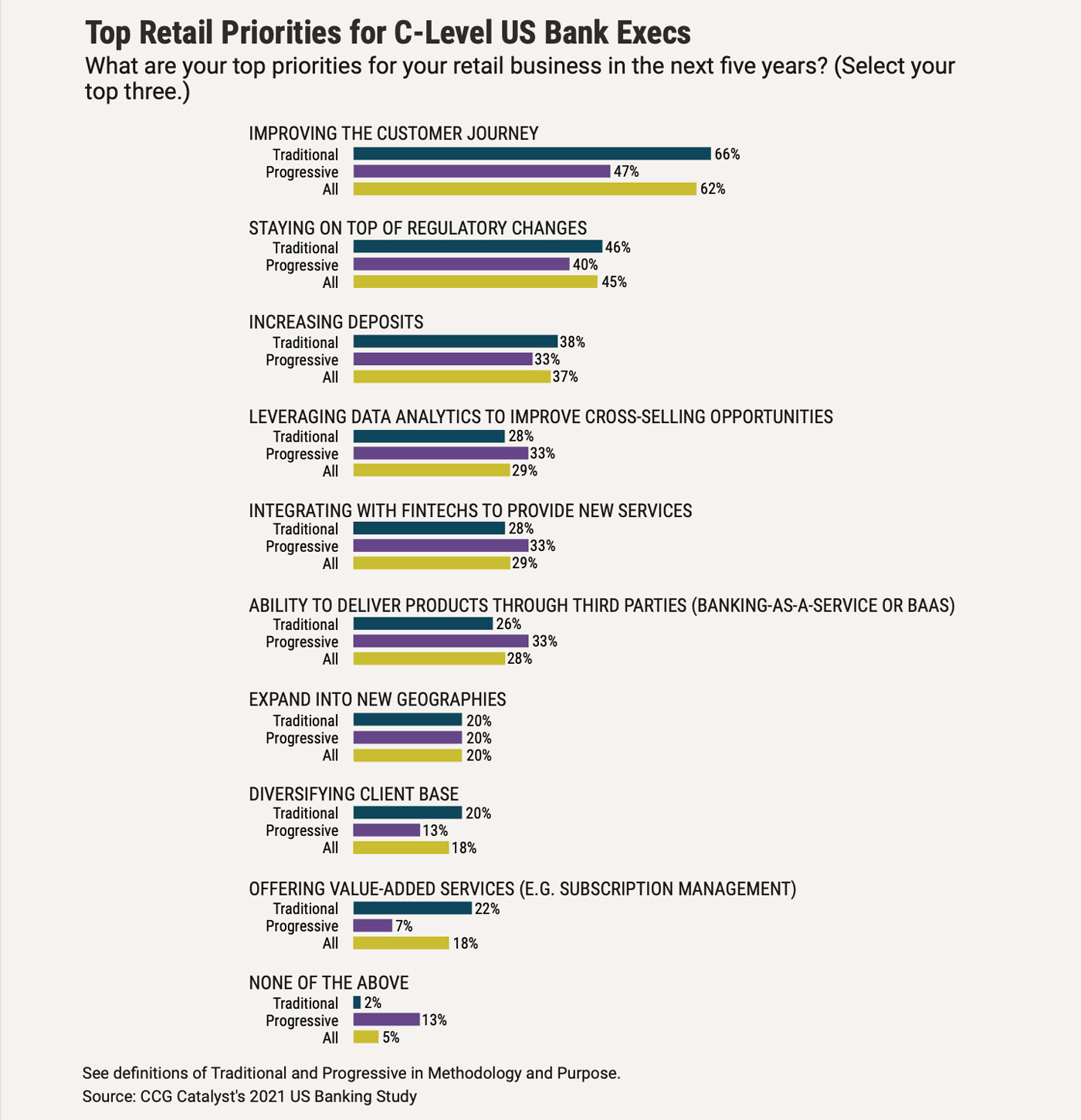

As for planning for the future, improving the customer journey was the most-cited priority by all of the executives we surveyed. However, different institutions vary when it comes to what they prioritize alongside that. For example, progressive players show more interest than their traditional peers in new frontiers like integrating with fintechs, banking-as-a-service (BaaS), and making better use of data.

For those looking to catch up, these areas offer lessons for how to get there. For instance, many of the features on which progressive institutions are ahead, including spend analytics and account aggregation, can be supplied by a fintech vendor. Being able to integrate with fintechs and other solution providers easily can help those looking to add some of these more advanced capabilities quickly, narrowing the gap on the competitive field.

Commercial Banking

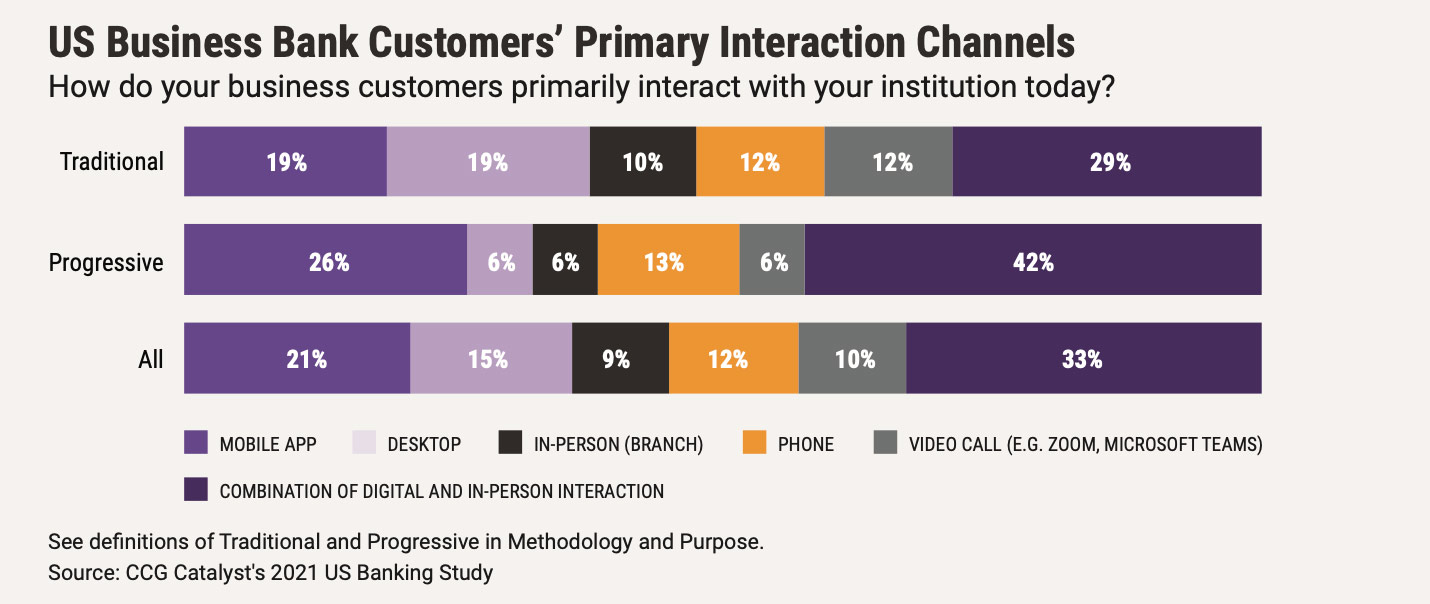

Commercial banking still lags behind retail on the digital front. Even among progressive institutions, there’s still a handful primarily interacting with customers in branch. However, progress is being made — a third of institutions across groups said their customers employ a mix of digital and in-person interaction, and progressives seem to be shifting closer to mobile. Business relationships are much more complex than on the retail side, and they can vary widely depending on the size of the client, making serving this group digitally exceedingly difficult.

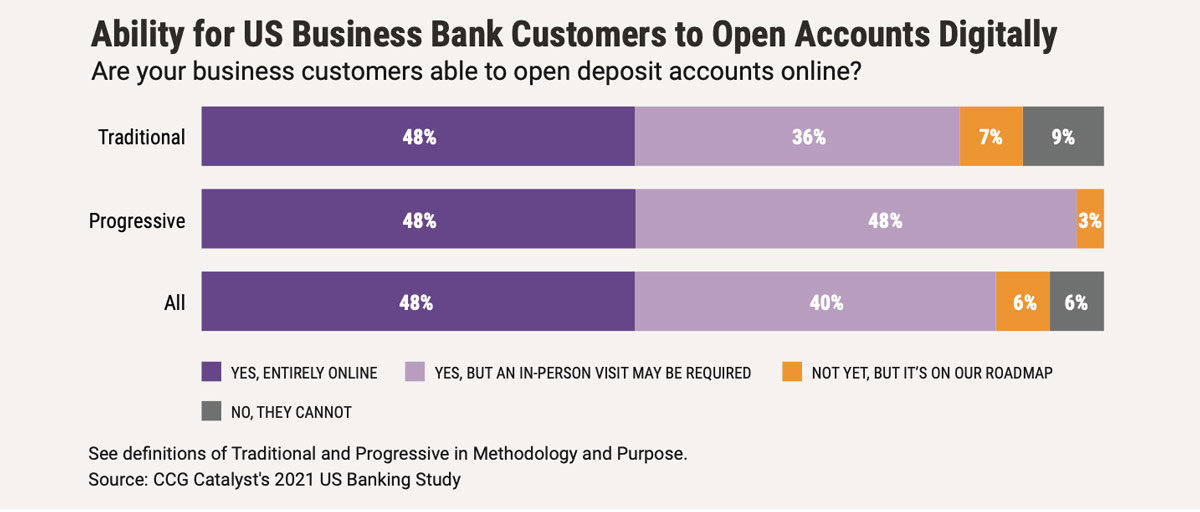

Likely in response to the pandemic, commercial banks have made real strides in implementing digital onboarding capabilities. However, still fewer than half of all institutions are able to open accounts fully online. Progressives are closer to achieving this end, with nearly all offering at least partial online account opening (OAO), while 16% of traditionalists still don’t. The lag here compared with the retail side likely has to do with the complexity of these relationships and often more stringent due diligence processes that many banks have struggled to transition to the digital channel. Digital onboarding capabilities are expected to continue to grow in importance for business customers, though, especially as fintechs and other solution providers make this feature more common. Stripe Treasury, for example, will allow its clients to create accounts at its bank partners within minutes. 4 Banks across groups will need to make building on their recent efforts a priority and continue moving toward a fully digital experience.

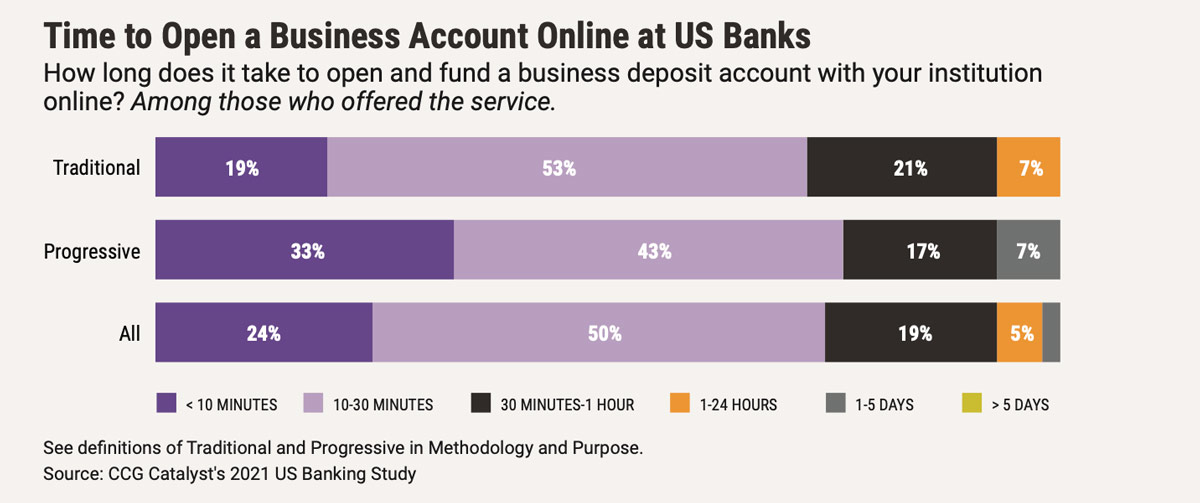

Meanwhile, among those who offer some form of OAO, progressives are generally faster, with a third able to do it in less than 10 minutes, compared with 19% for traditionalists. Speed is unlikely to be a major battleground here just yet, especially as even progressive institutions are still largely working to remove analog elements from their processes. But, it is an area to consider for the future, as business customers’ expectations are likely to rise to meet those on the retail side in time.

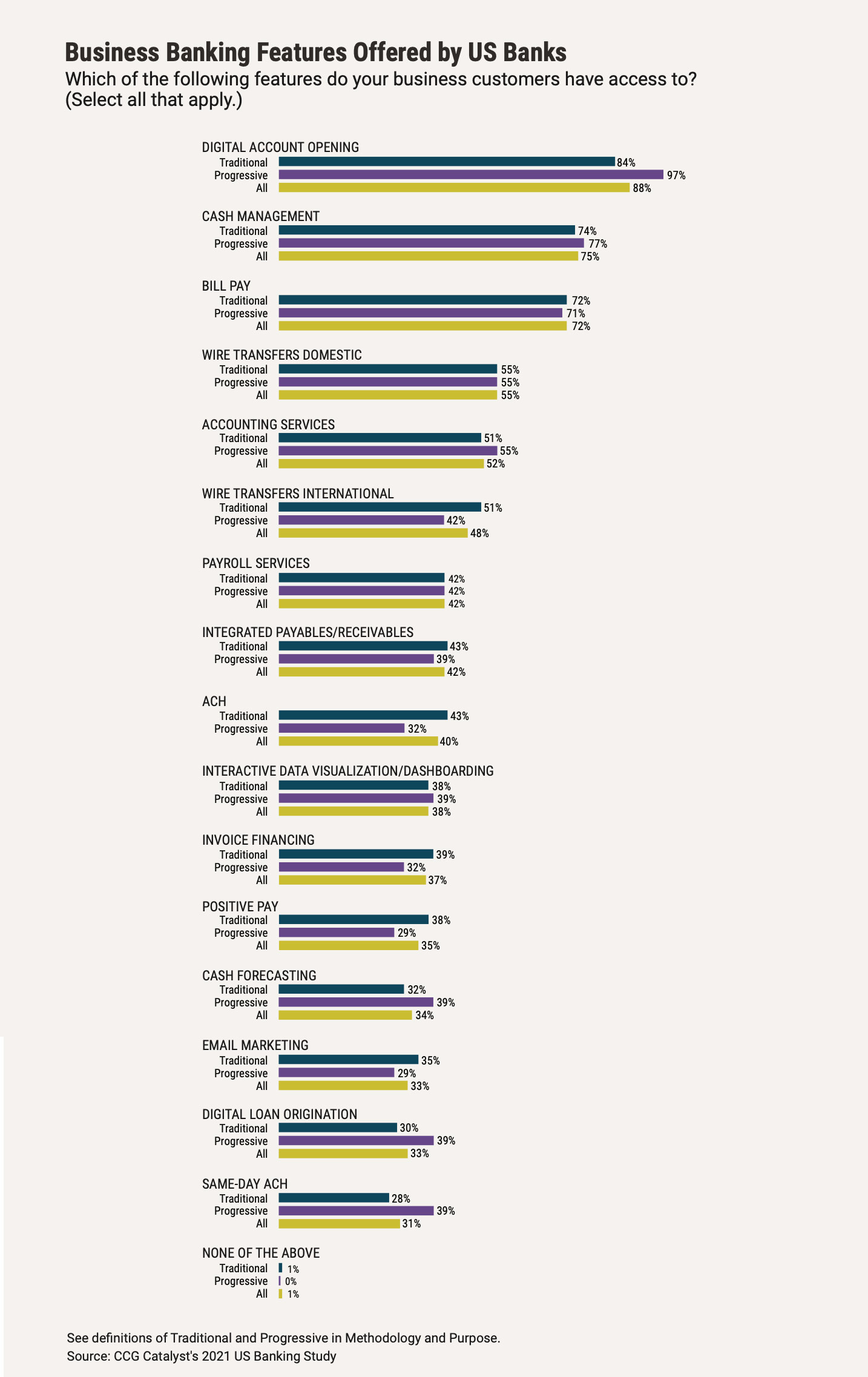

Again, beyond onboarding, we observe progressive institutions embracing more advanced features. For instance, 39% of progressives now offer digital loan origination to their business customers, compared with 30% of traditionalists. Progressive institutions are also further ahead in areas that relate to budgeting like cash forecasting, as well as on same-day ACH. Traditionalists, meanwhile, are more likely to offer typical business banking features, such as invoice financing and traditional ACH.

In particular, the greater focus among progressive institutions on areas like digital loan origination should set off alarm bells with traditionalists, as that’s likely to become the next major battleground after digital onboarding — a whopping 70% of respondents surveyed last year by Bank Director reported implementing or upgrading technology to support the Paycheck Protection Program (PPP), 5 which set aside $659 billion in government funding to provide relief to small businesses in the form of forgivable loans. 6 These efforts enabled many institutions to offer business loans digitally for the first time 7 and will likely spur increased adoption of this service, driving customer expectations as the option becomes more prevalent.

Over time, things like OAO and digital loan origination will no doubt become baseline for commercial bankers. So, it’s important to think through how to continue to improve the customer journey. That’s especially true for those serving the small- to medium-sized business (SMB) market, where offerings for a long time have failed to satisfy. Half of small businesses surveyed by Aite Group for Alkami in 2019 said they would either probably switch, or at least consider switching financial providers, in the next two years as institutions failed to meet their needs, 8 for example. For those still taking a more traditional approach, looking at where progressives are headed on services like cash forecasting could be helpful in charting a path forward. These are the kinds of value-added services that businesses are looking for — according to data from 11:FS, the most important jobs for SMBs managing their business are tracking and managing cash flow and making intelligent decisions based on data. 9 These focus areas offer a window into the future for commercial bankers working to plan ahead.

Segmentation, Targeting, and Product Development

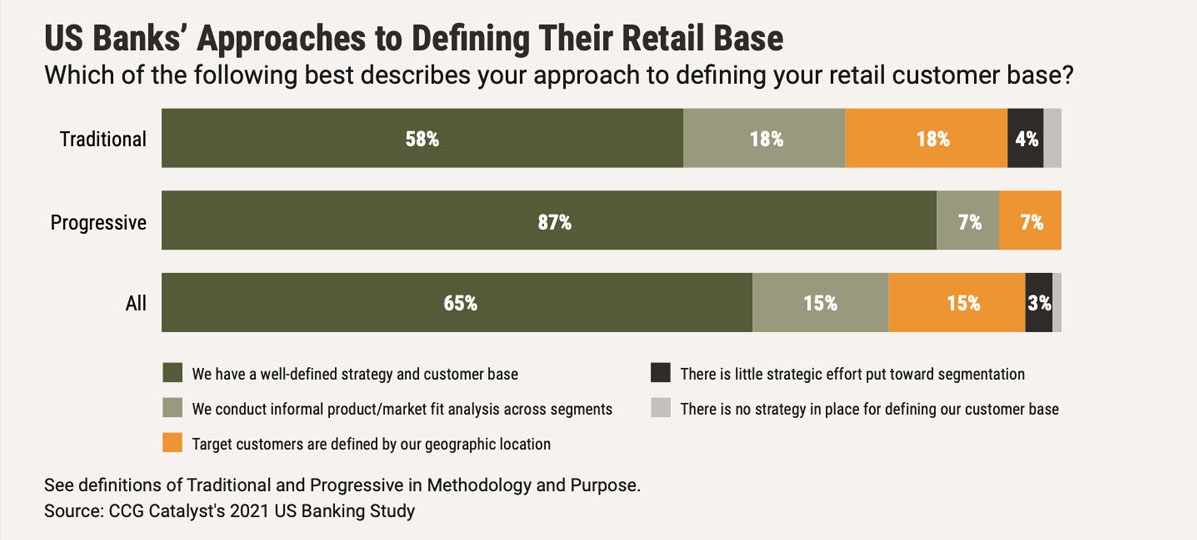

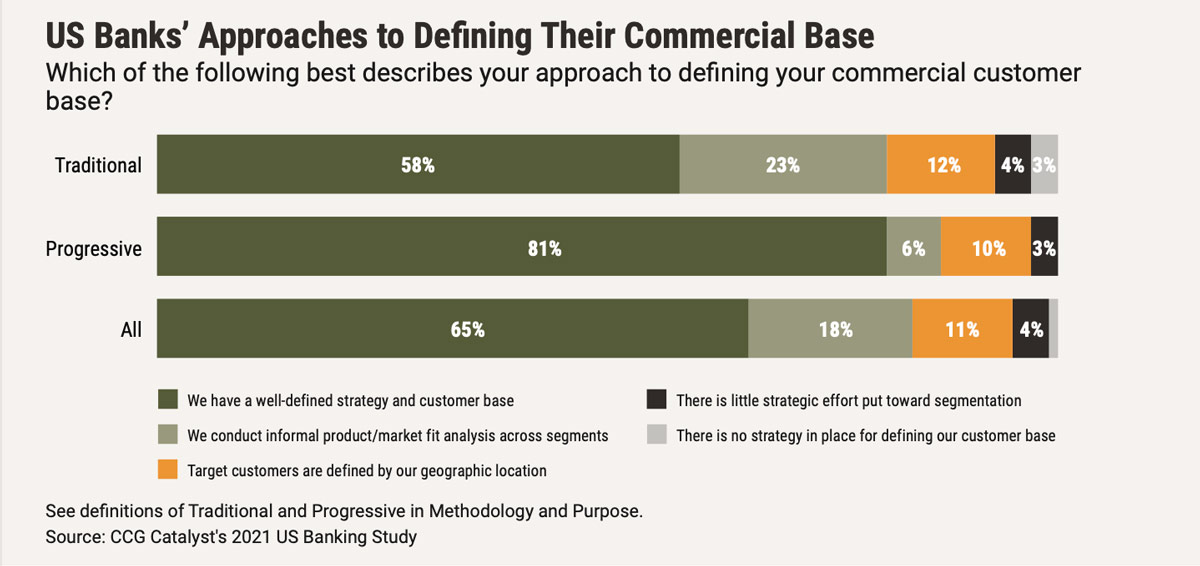

Going after the right customers in the right way is key, especially in a highly competitive environment. Doing this well requires thoughtful segmentation and targeting in a digital world, as geographic bounds are no longer a constraint and key communities and customer groups may be dispersed. Unfortunately, strategizing this way appears to be more of a cutting-edge practice. Among our progressive respondents, a whopping 87% have a well-defined strategy and customer base for their retail operations and 81% said the same for their commercial business. However, traditional players lag far behind at 58% on both fronts, while a handful report having no strategy at all.

Additionally, there are differences in the way institutions define their target customers. On the retail side, for example, progressive institutions were more likely to use less common factors, such as property ownership or occupation, when deciding who to target. Failing to pull in such factors could mean traditionalists are missing an opportunity to better define who their customers are today, and potentially reach more segments that would be attractive to the bank in the future.

Taking a proactive approach to defining and targeting customers is extremely important given that, today, heavy competition is coming from fintechs and other providers that are leveraging technology to target niche communities and pull core deposits away from other institutions. Daylight, for example, focuses on serving the LGBTQ+ community, while First Boulevard is built for Black Americans. These value propositions cut across location-based communities and represent the kind of very specific targeting we expect will be commonplace in the future.

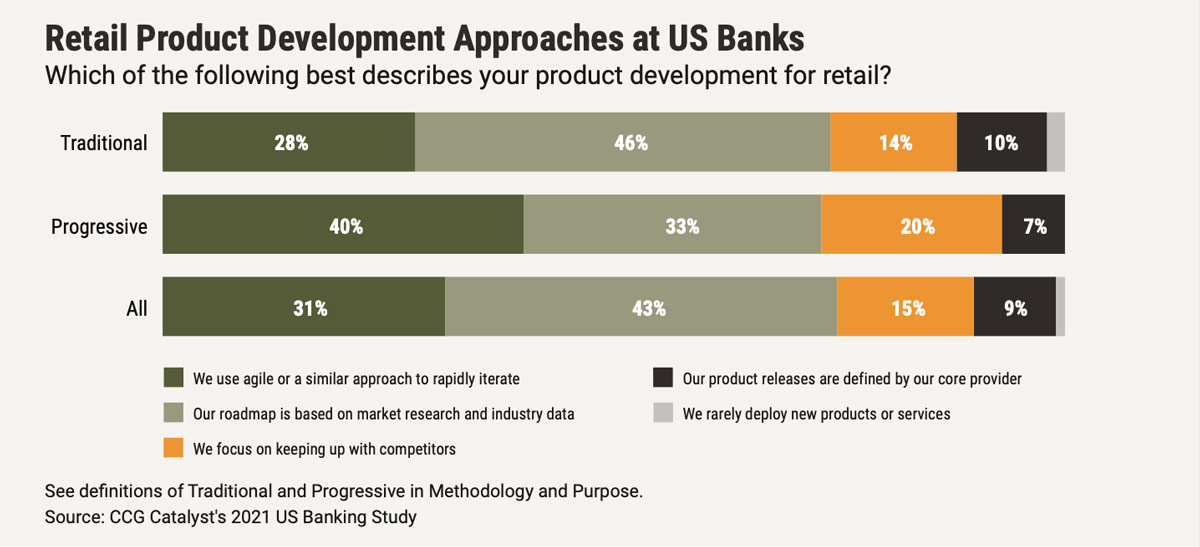

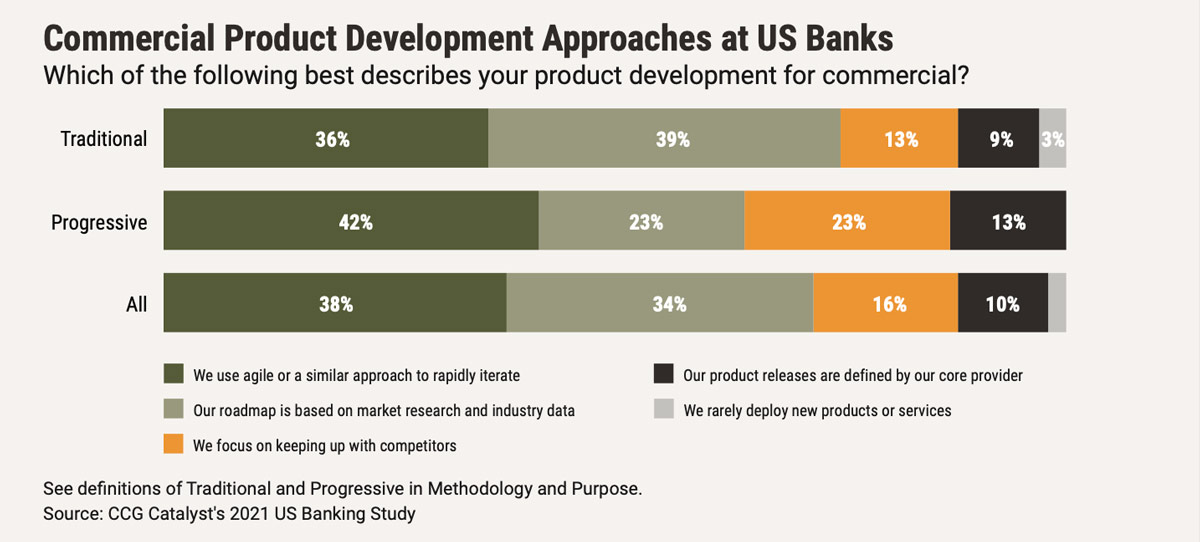

Now, when it comes to developing products that suit these customers, the picture overall is a bit different. Less than half of both groups employ an agile product development strategy across retail and commercial, though progressives do slightly better. This is a bit concerning given changing customer expectations around highly tailored products and services.

For context, agile refers to a product development methodology that encourages frequent iteration, usually in the form of “sprints,” to incorporate customer feedback quickly and drive new products and updates to market faster. It’s used heavily among technology-first companies to keep up with customer needs and encourage continual improvement. Additionally, agile methodologies can create cost efficiencies — data compiled by TCS shows that such approaches can lower product development costs by as much as 40%, while dramatically reducing time to introduce new features. 10

Overall, progressive institutions are doing a good job when it comes to clearly defining who their customers are; much better than their traditional peers. But it seems that many banks across groups have yet to nail how to serve them. Segmentation is just one piece of the puzzle; without the ability to reach those customers in the right way, with the right services, it’s not going to derive true value. This is one area where everyone needs to catch up, as fintech providers are known for doing this extremely well. And that’s a threat to everybody. Once you’ve defined your customer base, survey them, get to know them. Then, tie your product roadmap tightly to their specific needs and be ready to adjust as those needs change.

Technology & Innovation

If there’s anywhere banking institutions need to understand the gaps between themselves and their peers, it’s on technology and innovation. It’s this category that underpins much of the disruption we are seeing in the market and the rapid advancement toward fully digital services and capabilities overall. Interestingly, despite clear differences in their priorities for the future, very few respondents to our survey were willing to report feeling unprepared from a technological standpoint for the next five years — just 13% overall reporting being a bit behind, with the breakdown for traditional versus progressive institutions at 14% and 9%, respectively. This suggests that some executives may feel more prepared than they are.

To understand how well these institutions are doing specifically and where they are putting their efforts, we asked respondents to rank a number of areas based on their bank’s preparedness to tackle each in the next five years as well as the expected importance of each to their business. We then plotted these areas for each group using their average rank in the results.

The rankings on preparedness across groups is relatively similar, with a few notable exceptions. Traditionalists feel more confident in their ability to deliver on the desktop/online experience, while progressives are more confident on mobile. This reinforces the view that these two groups are split on their emphasis of specific digital channels. Progressive institutions also feel a bit more prepared on artificial intelligence (AI) and data analytics, while traditionalists have greater confidence in their ability to implement biometrics and API/microservices infrastructure.

There are greater differences when we look at how each of these groups ranks these areas on their importance. For example, traditionalists put desktop/online experience in their top five areas of importance for the next five years, while progressives do not. Progressives also place more importance on API/microservices infrastructure, despite reporting feeling less prepared in this area. This is could be because progressive institutions view APIs/microservices as a much larger undertaking than their traditional peers. API enablement can mean many things — banks have been using APIs internally for decades, for example. But the ability to leverage APIs to integrate with third parties and deliver best of breed services to customers is a very different beast.

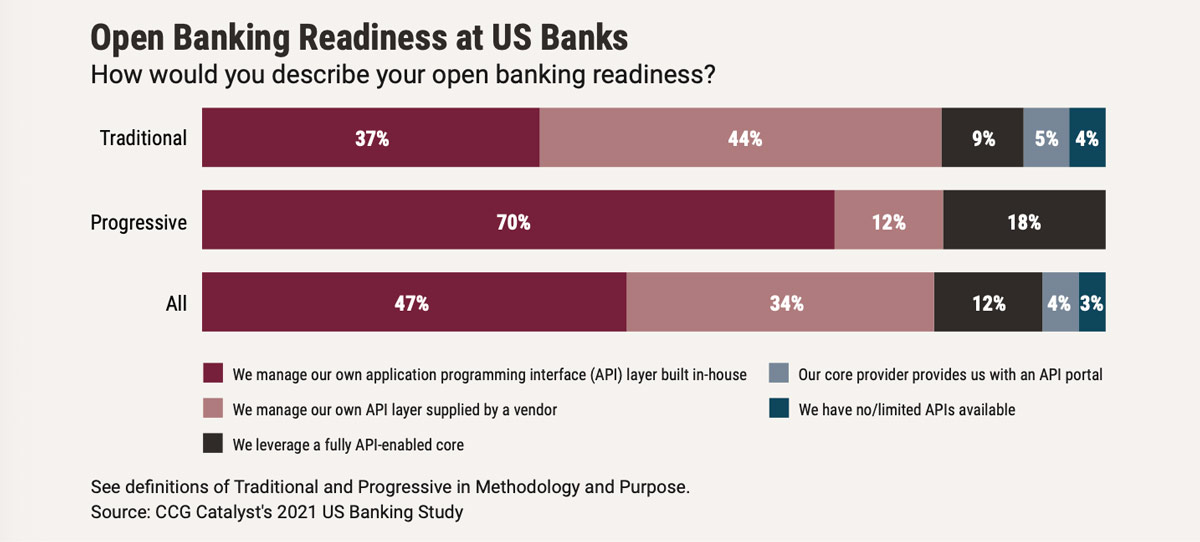

Perhaps more than anything else, the ability to compete in the future will rely on flexible infrastructure that can integrate with third parties. As noted in our recent report, Open Banking | Is the U.S. Ready?, 92% of global banks surveyed by Finastra in 2020 were looking to leverage APIs to enable open banking capabilities in the next 12 months, up from just 69% in 2019. 11 Our data suggests progressive institutions are ahead here. For instance, progressive banks are much more likely to manage their own API layer in-house rather than relying on a vendor to provide them with the APIs they need to integrate with fintechs and other third parties. This is a critical difference because true differentiation comes from freedom of choice. Such a strategy is much more costly and takes more time, which could be why these institutions feel they still have a way to go.

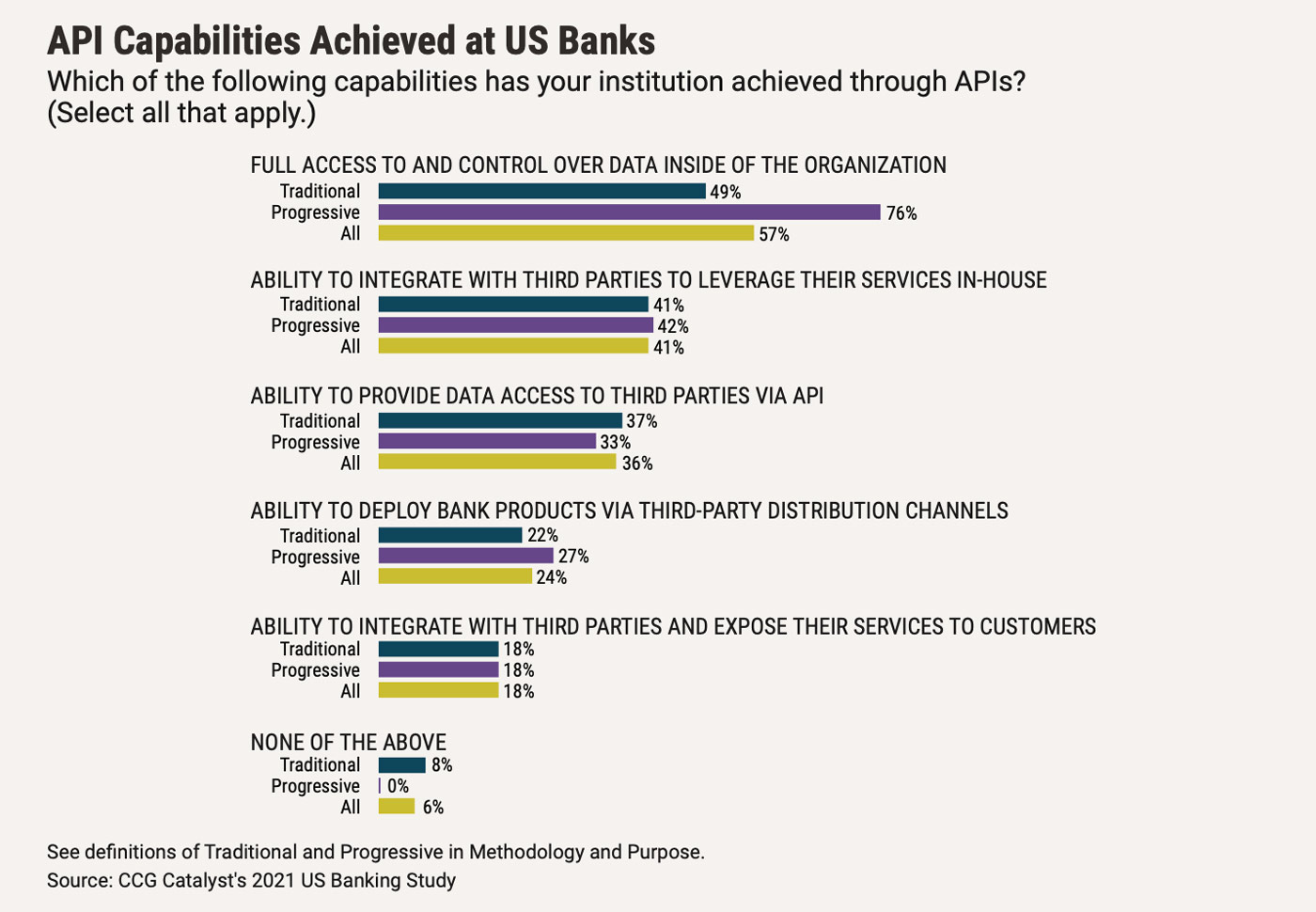

When asked about their API capabilities today, 76% of progressive respondents reported achieving full access to and control over data inside of their organization, compared with just 49% of traditional institutions. This is a major step toward a future where bank data will power many different applications and services from a variety of third-party providers. Progressives are right, though, to believe there is still a lot of work to be done before this becomes a reality — less than half of all institutions in our survey have achieved more advanced API capabilities like integrating with third parties to leverage their technology or expose their services to customers. For those that have not even considered these capabilities as part of their strategy, it may be time to revisit what API-enabled infrastructure means for your bank.

It appears that, even though most respondents feel prepared for the future, some are indeed behind their peers. What’s more, those in the progressive category seem to have a greater understanding of where they still have work to do, especially when it comes to key areas like driving toward flexible, API-based operations. If nowhere else, those with a more traditional view should take note here. It’s one thing to be a bit behind the curve because of budget or resources, or even security concerns, but it’s quite another to be focusing on and defining key areas differently from your competition.

Final Thoughts

Understanding where your peers are not only on their abilities but on their thinking can go a long way in helping to chart a path for the future. For those who may be a bit behind, the lessons here should lend a hand as you look to move forward.

However, that doesn’t mean every traditionally minded institution needs to get on the progressive bandwagon. The data in this report is meant to show how different institutions are thinking about the future and identify areas more forward-thinking participants are focused on. Those areas may or may not be applicable to your bank. The objective is to look at the data and take from it lessons that can inform your perspective and strategy into the future.

©CCG Catalyst 2025 – All Rights Reserved

No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording or any information storage and retrieval system, without prior permission in writing from the publisher.

Read The Banking Battleground 2022: Finding the Opportunities

Read The Banking Battleground 2023: Pulling Back and Pushing Ahead

Download a PDF of this article